ShopSavvy, the mobile application best known for its barcode-scanning and price comparison features, is today moving into personalized deals, through a new relationship with Capital One. The app will now show Capital One deals to any of the app’s users, provided they first add their Capital One credit card to ShopSavvy’s mobile wallet. In addition to the discount the deal provides, users will also receive a $20 credit on their Capital One bill when they make their initial purchase using their card within ShopSavvy’s application.

While for ShopSavvy, the move means the app is again growing its feature set to go beyond just price comparisons, for Capital One, it’s more about trying to establish a foothold in the emerging mobile wallet ecosystem.

“The reason it’s interesting to us,” ShopSavvy CEO John Boyd explains, “is that it actually provides content to our customers. When they make a purchase of $40 or more, they’ll be eligible for a $20 statement credit from Capital One. But, then, they’re also eligible for Capital One deals, which is exclusive content to ShopSavvy users, based on what they’re interested in,” he says. “We want users, when they go to ShopSavvy, to feel like they get offers, coupons, and deals that they’re not going to see anywhere else, and we want to make that as easy as possible.”

Boyd says that the tricky thing about managing e-commerce on mobile, is that there’s limited bandwidth and landscape to put content in front of customers. So unlike on the web, where you can show users much more at a glance, what an app like ShopSavvy displays to its users has to be highly personalized and relevant. “We have to be really careful about the choices that we make and the partners that we work with,” Boyd remarks.

The deals Capital One will show users are not based on general popularity trends, but are targeted based on the customer’s own spending patterns and behavior. Capital One’s deals are built on top of ShopSavvy’s add-ons platform, which the company introduced last year in order to distribute offers to end users. In its first year, Boyd says the company had several million in ad sales because its very high CPM. “We’ve never sold any deal less than $500,” he says. He also describes the Capital One integration as one of the most technically complicated to date – which means they’re really hoping the end result pays off in terms of improving product discovery for ShopSavvy users.

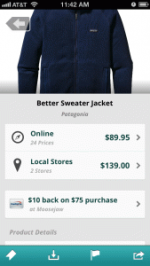

The company has long since moved away from being just a price comparison app, though that remains a popular use case. Unlike Amazon’s Price Check app, for instance, ShopSavvy has historically been neutral about its suggestions, pointing users to both online and local stores where prices may be better. Today, it has 40,000 retailers (online and off) on its platform, and 20 million products. But knowing where to buy is only part of the overall shopping experience. The idea is that ShopSavvy wants to get to a point where, when a user searches for a product, they’re not just getting a recommendation of where to buy, they’re also shown all the relevant offers and deals which may be associated with that product as well.

Over the past year or so, ShopSavvy has also been adding functionality to its mobile application to become more of a fully fledged shopping companion, starting with the launch of its mobile wallet in late 2011 which aims to increase mobile conversions by simplifying checkout. The wallet has now grown to support over 40 retailers, including Best Buy, Barnes & Noble, and Buy.com. The wallet launch was followed by the debut of its marketplace in early 2012, and most recently, an updated interface and design which now includes more photos, videos, product details, and an increase in the deals and offers, as mentioned above, that come through partnerships with retailers, aggregators and other deal sources like the Fancy. It makes sense that ShopSavvy would want to work with the credit card companies themselves, too – and Boyd confirms that they’re now in talks with all the top banks for similar integrations to the one launching today.

More details about the new program with Capital One, including how to get the statement credit, are here.