Wheeee – what a ride!

Wheeee – what a ride!

As we expected, the anticipation of the Fed doing something wonderful led to a big rally in the morning and the fact that the Fed didn't actually do anything at all wasn't enough to stop the party train once it left the station. My comment in yesterday morning's post (which you can subscribe to HERE) was:

At the moment, we are expecting the Fed to keep things going and we're long on the indexes again at 17,100 (/YM), 1,975 (/ES), 4,100 (/NQ) and 1,135 (/TF) but with tight stops below and, if any two are below the line then none of them should be played.

This morning, we are flipping short at 17,500 on /YM (up $2,500 per contract from yesterday's call), 2,035 on /ES (up $3,000 per contract), 4,220 on /NQ (up $2,400 per contract) and 1,185 on /TF (up $5,000 per contract). We think the run is officially overdone at this point and we also added some Jan TZA calls back to our Short-Term Portfolio to hopefully catch another nice move down into Christmas.

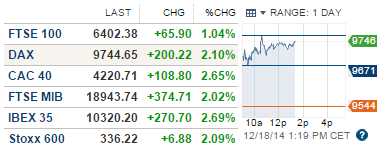

Europe is up 2% and more on the Continent this morning as Putin gave a speech in which he assured his people that the country's economic troubles would pass in no more than two years. How that's considered rally fuel is beyond me but it's Christmas – people want the markets to go up – so they do. On the whole, it's all going according to plan. As I said to our Members into yesterday's close in our Live Chat Room:

Europe is up 2% and more on the Continent this morning as Putin gave a speech in which he assured his people that the country's economic troubles would pass in no more than two years. How that's considered rally fuel is beyond me but it's Christmas – people want the markets to go up – so they do. On the whole, it's all going according to plan. As I said to our Members into yesterday's close in our Live Chat Room:

They want to spin Yellen's comments as bullish as possible to get Asia and Europe to buy so we may be higher at the open (from Futures) but then I expect a sell-off from there.

So we're just following the plan and I drew up the lines from our 5% Rule™ on the Nasdaq to illustrate our expectations.

So we're just following the plan and I drew up the lines from our 5% Rule™ on the Nasdaq to illustrate our expectations.

We should see that 4,700 line tested and there we expect it to fail at which point the 140-pont run that got…