How interesting the markets have been.

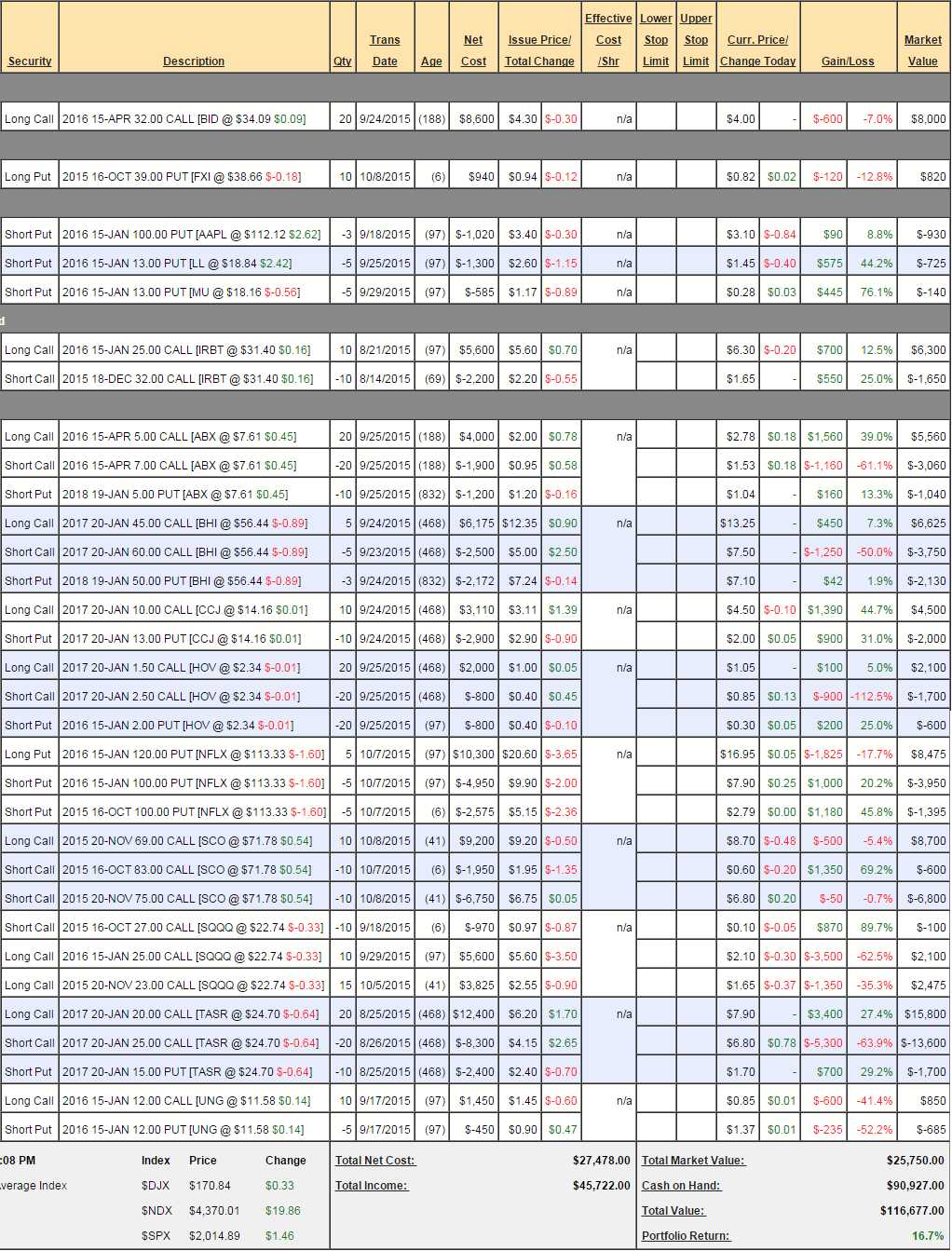

In our August Top Trade Review, I mentioned we were starting a new product, which began as the 5% Portfolio and was renamed the Options Opportunity Portfolio, which has been a huge success, now up 16.7% at the close if the second month:

These are, for the most part, short-term trades but we've been layering in some longer-term trade ideas – using our profits to invest in trades that will generate steady monthly gains over time, rather than only focusing on "quickies".

Our Top Trade Ideas, generally, tend to be longer-term trades and we don't have a portfolio that tracks them specifically. They are generally selected trades from the ones that we are adding to PSW's Short-Term Portfolio or Long-Term Portfolio and tend to be of the "set and forget" variety, while our OOP trades reqire a bit more active management.

While 30 of our first 45 (66%) Top Trade ideas were winners, 4 of our 15 losers were LL trade ideas – all of which are now coming back as LL pops back to $20! Hopefully it can break over $20 and we can put all that silliness behind us.

Getting two out of three trades right is plenty to move the investing ball towards the goal line. Combine that with sensible portfolio management techniques (diversification, managing losses, hedging) and you'll beat the S&P by a mile with no sweat. Generally, with our Top Trades, we're simply picking stocks we feel are underpriced and we're using our various options techniques to give ourselves even better discounts and hedged entries but these are patience plays – that do take time to get going, though we did call for a cash-out of our winners in July, so August was kind of a fresh start.

Without further ado, here's the next month of trades for review – some are still good for new entries:

On Aug 4th we saw a news article that Windstream (WIN) won a contract for $450M to build out wireless services for the VA. As WIN was a company we had played in the past, this was a…