Ted Cruz won Iowa.

Ted Cruz won Iowa.

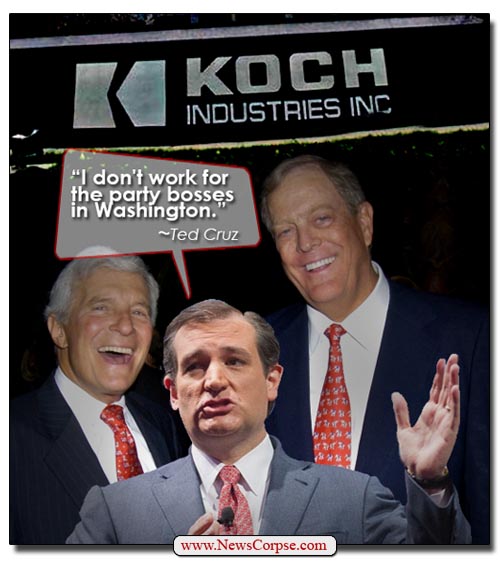

That is the scariest thing I have to say this morning. The Koch-powered Conservative is the GOP's leading Climate denier and, if he becomes President of the United States, you can pretty much guarantee he'll put a stop to the agreements we made in Paris last year to work with the rest of the World to help stop Global Warming – especially as it's projected to be a $12Tn effort over 25 years on our part.

Of course, many (almost all) scientists would argue that a failure to do this will lead to the extinction of the Human Race but that's considered a win for Cruz's Father's ministry "Purifying Fire International" who are anxious to finally get to the end of days they've all been praying for. Don't take my word for it – listen to his Dad.

Anyway, enough about Cruz, hopefully this is a one-off and the World will not end because Americans make the worst possible choice come November. Meanwhile, it may in fact be the end of days for oil, as it's back to $30 after an aborted (sorry Ted) run at $35 just last week. Low oil prices hit BP so hard that profits are down 90% from last year and, unadjusted, BP is taking a $6.5Bn loss but officially a 2015 net profit of $196M, down from $2.2Bn last year. In good news for oil prices, however, the World's 4th largest oil company is cutting production in 2016.

So, despite oil being down 2.5%, we think $30 will hold and you can refer back to our UCO/USO bullish spread (see last week's post) and we're also liking Natural Gas (NG Futures) again as we dip back to $2.08. We are not, however, playing the front-month March contract (/NGH6) but the /NGK6 May contract, which is trading a bit higher at $2.16 this morning.

Our logic on Natural Gas (and UNG is the ETF you can play at $7.50, which is our Trade of the Year for 2016 - beating IBM at the last minute!). In our Live Trading Webinar on 12/16, we had called a play on the April Natural…