What a crock! Though we were more or less flat yesterday, check out the huge discrepency in declining vs advancing stocks across the board. It's a stealth sell-off, the kind we often have before a major market plunge. This is what leads frustrated investors to wonder " How come the market is up but all my stocks are down? " It's a trick run by the Fund managers, who prop up momentum stocks and key index stocks to hide the fact that they are dumping the rest of their portfolios. This keeps retail traders complacent until it's far too late for them to get out safely . We're already trading at Holiday volume levels and, as you can see from Dave Fry's SPY chart, it's the same old TradeBot pattern day after day with volume selling followed by a low volume move up and more selling into the close – all stealthy ways the Banksters and Fund Managers use to get out of the markets. As noted by Financial Sense : Manipulation is an unfortunate fact of the financial market. Stocks and commodities have always been subject to manipulation, whether by individuals, pools, central banks or even governments. If you are unable to come to terms with this reality then it’s best to avoid participating in the market altogether. But if you’re able to come to grips with this then there is money to be made once you’re able to spot the tell-tale signs of manipulation, a skill which becomes better with experience. That's what we teach our Members to do here at PSW, spot the manipulation and profit from it! We don't care IF the game is rigged, as long as we are able to understand HOW the game is rigged and play along with the winning side. I balance my own moral books by pointing out the manipulation and calling for our regulators to put a stop to it and you would think that would risk our successful strategies but, in all these years, it never changes and, if anything, it gets worse, not better each year . Of course, we…

What a crock!

What a crock!

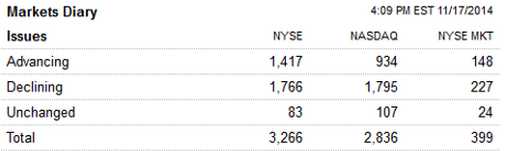

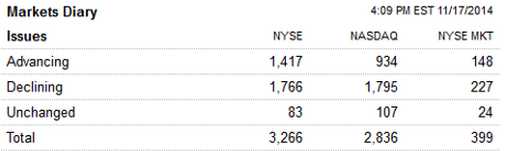

Though we were more or less flat yesterday, check out the huge discrepency in declining vs advancing stocks across the board. It's a stealth sell-off, the kind we often have before a major market plunge. This is what leads frustrated investors to wonder "How come the market is up but all my stocks are down?" It's a trick run by the Fund managers, who prop up momentum stocks and key index stocks to hide the fact that they are dumping the rest of their portfolios. This keeps retail traders complacent until it's far too late for them to get out safely.

We're already trading at Holiday volume levels and, as you can see from Dave Fry's SPY chart, it's the same old TradeBot pattern day after day with volume selling followed by a low volume move up and more selling into the close – all stealthy ways the Banksters and Fund Managers use to get out of the markets. As noted by Financial Sense:

We're already trading at Holiday volume levels and, as you can see from Dave Fry's SPY chart, it's the same old TradeBot pattern day after day with volume selling followed by a low volume move up and more selling into the close – all stealthy ways the Banksters and Fund Managers use to get out of the markets. As noted by Financial Sense:

Manipulation is an unfortunate fact of the financial market. Stocks and commodities have always been subject to manipulation, whether by individuals, pools, central banks or even governments. If you are unable to come to terms with this reality then it’s best to avoid participating in the market altogether. But if you’re able to come to grips with this then there is money to be made once you’re able to spot the tell-tale signs of manipulation, a skill which becomes better with experience.

That's what we teach our Members to do here at PSW, spot the manipulation and profit from it! We don't care IF the game is rigged, as long as we are able to understand HOW the game is rigged and play along with the winning side.

That's what we teach our Members to do here at PSW, spot the manipulation and profit from it! We don't care IF the game is rigged, as long as we are able to understand HOW the game is rigged and play along with the winning side.

I balance my own moral books by pointing out the manipulation and calling for our regulators to put a stop to it and you would think that would risk our successful strategies but, in all these years, it never changes and, if anything, it gets worse, not better each year.

Of course, we…

What a crock!

What a crock!  We're already trading at Holiday volume levels and, as you can see from Dave Fry's SPY chart, it's the same old TradeBot pattern day after day with volume selling followed by a low volume move up and more selling into the close – all stealthy ways the Banksters and Fund Managers use to get out of the markets. As noted by Financial Sense:

We're already trading at Holiday volume levels and, as you can see from Dave Fry's SPY chart, it's the same old TradeBot pattern day after day with volume selling followed by a low volume move up and more selling into the close – all stealthy ways the Banksters and Fund Managers use to get out of the markets. As noted by Financial Sense:  That's what we teach our Members to do here at PSW, spot the manipulation and profit from it! We don't care IF the game is rigged, as long as we are able to understand HOW the game is rigged and play along with the winning side.

That's what we teach our Members to do here at PSW, spot the manipulation and profit from it! We don't care IF the game is rigged, as long as we are able to understand HOW the game is rigged and play along with the winning side.