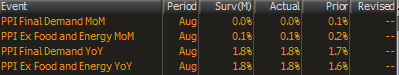

Remember all that ‘hyper inflation’ talk surrounding 0 rates and QE?

No sign of it here. Or anywhere else I’ve looked:

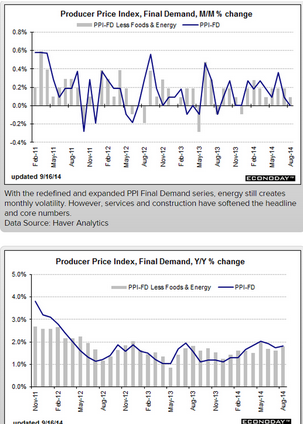

Nor do you hear any more talk about ‘credit acceleration’ since its post winter growth fizzled:

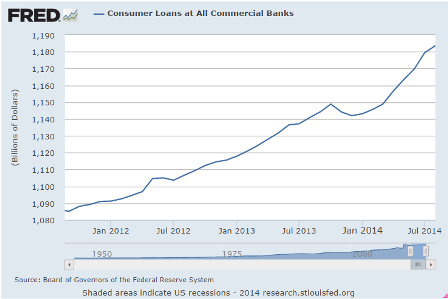

And wage growth (NOT adjusted for inflation) remains next to nothing:

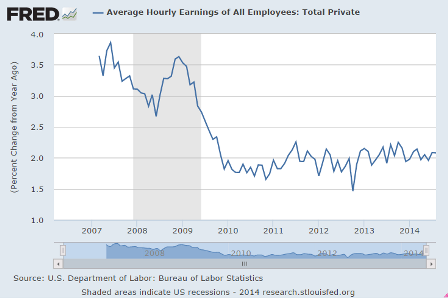

And you only hear about these ‘minor’ reports on retail sales when they go up…

ICSC-Goldman Store Sales

Highlights

Store sales fell back sharply in the September 13 week, down a same-store 2.6 percent from the prior week for a year-on-year rate of plus 3.0 percent vs 4.0 percent in the prior week. But the declines appear to be isolated to the latest week, based on the text of the report which calls the results healthy.

Redbook

Seems the data continues to support my narrative- the deficit is too small given ‘credit conditions’ all of which contributes to a ‘macro constraint’ on the US economy. And the rest of the world is doing same, putting a macro constraint on the global economy.

Furthermore, seems the exporters are in control everywhere, pushing their narrative designed to increase global ‘competitiveness’ by keeping real wages low via low domestic demand and high unemployment.