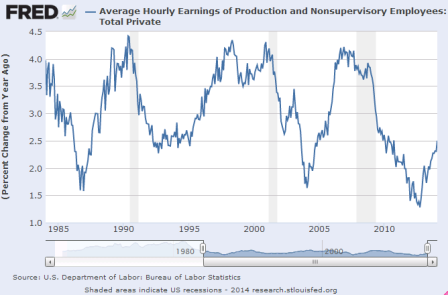

When asked about the growth in hourly wages:

Most measures of wage increases are running at very low levels. Wage inflation closer to 3% or 4% would be expected given some measures, such as productivity growth. But right now it is certainly not flashing. An increase in it might signal some tightening or meaningful increase over time. I would say were not seeing that.

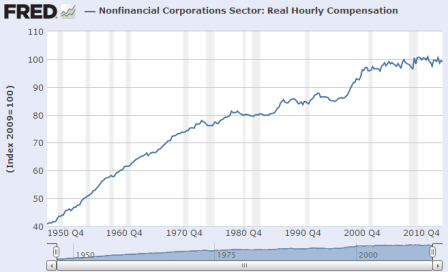

It’s well publicized that real wages have been lagging for maybe 40 years, as profits hit an all time high of about 11% of GDP. So as a point of logic the only way wages can stop the slide is if they grow faster than GDP grows, which leads to the ‘where the productivity growth has been going’ discussion, etc. Furthermore, in today’s economy the distribution is largely and necessarily a result of an impossibly ‘complex’, global, institutional structure rather than ‘free market forces’.

Add to that the Fed only has ‘one lever’ which is interest rates, and they all believe that lowering rates is ‘easing’, and that GDP growth promotes wage grow. So it could be that hourly wage growth of 2% that looks like it’s heading to prior highs of around 4% per se might not be all that strong a factor for quite a while in their reaction function?