Natural Gas Stocks 2014: As Russia's clash with Ukraine and the West boils on, pressure is mounting for the federal government to loosen export regulations on U.S. liquefied natural gas.

Currently, the U.S. exports natural gas to only a handful of countries, such as Canada. No U.S. LNG is exported to Europe.

That's mainly because the key factor in gaining the U.S. Department of Energy's blessing to export is whether or not the importing country has a free-trade agreement (FTA) with the United States.

Before this week, a total of six permits for sales to non-FTA nations, like India and Japan, had been issued - five of those permits had been granted in the last 10 months.

But on Monday, the Department of Energy conditionally approved the $7.5 billion Jordan Cove LNG project in Coos Bay, Ore., making it the seventh export terminal to receive a federal permit to export to a non-FTA nation. Final approval for the project is still subject to environmental and regulatory review, the Department of Energy said.

The Jordan Cove terminal will export to Asia, and not to Europe, where lawmaker proponents of LNG exports hope that U.S. LNG would undermine Russia's grip on Europe's natural gas markets.

Russian President Vladimir Putin has threatened multiple times to restrict gas supplies as a weapon in this conflict with Ukraine and the West. This places heightened urgency and importance on the exportation of U.S. LNG as a means to meet increasing world energy demands.

And that's a major bullish sign for natural gas stocks in 2014...

Geopolitical Pressures Boost Need for U.S. LNGU.S. exports of LNG could mitigate any shortages in Europe caused by the Ukraine-Russia conflict.

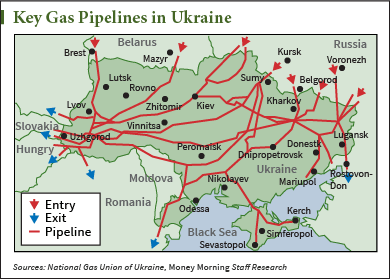

Prior to Monday's conditional approval, the Department of Energy's six approved projects to export LNG to countries without FTAs amounted to a flow-rate volume of 8.5 billion cubic feet per day (ft3/d) of LNG. Compare that to the 6 billion ft3/d that Russia exports to Europe via Ukrainian gas pipelines; Russia provides 30% of Europe's gas using pipelines that cross Ukraine.

"Expanding U.S. LNG exports is an opportunity to combat Russian influence and power, and we have an energy diplomacy responsibility to act quickly," U.S. Rep. Fred Upton, R-MI, chairman of the Natural Resources Committee, said earlier this month. "We will continue to advance legislation and develop new proposals that allow market forces and technology to help expand Eastern Europe's access to affordable energy beyond Russia."

Even though the United States is the world's largest natural gas producer, efforts to export LNG have been drowning in federal rules, financing issues, and construction demands - winning federal approval can take three years or more.

Only one of the six approved projects has final approval from the federal government, and it will not start exporting natural gas until 2019.

That's why the Obama administration's decision on Monday to conditionally approve the Jordan Cove export terminal was met with praise from lawmakers.

"This is welcome news for those opposed to Russia's aggression," Brendan Buck, spokesman for House Speaker John Boehner, R-OH, said Monday. Buck encouraged the administration to approve more projects "if we're going to weaken Russia's dominance in many foreign energy markets."

"There can be no doubt that we have crossed a line into an era when we could be massively exporting America's natural gas, sending the jobs and consumer benefits abroad along with the fuel," Foreign Relations Committee member Sen. Edward Markey, D-MA, said of the approval.

The Jordan Cove facility, owned by Veresen Inc., could export up to 0.8 billion standard cubic feet of natural gas per day over the next 20 years. Natural gas would be transported to the Jordan Cove liquefaction terminal via the 234-mile long Pacific Connector Gas Pipeline. When Veresen applied for the permit in May 2013, it said it would take 42 months to construct the facility, which would put completion in September 2015, following the Department of Energy's approval Monday. The facility will employ around 900 people on average and up to 2,000 in peak periods.

As the United States continues to ease restrictions on natural gas exports, the rising demand and prices in Europe creates a unique window of opportunity for natural gas stocks in 2014...

Natural Gas Stocks 2014: On the RiseThe Ukraine conflict has given LNG companies' stock prices an additional boost on top of their rise in 2014.

"[This is] an example of how geopolitical events sometimes have a major energy component," Money Morning Global Energy Strategist Dr. Kent Moors said in early March. "In the case of what is transpiring in Ukraine, energy may be the main chess board in which political change is worked out."

Cheniere Energy Inc. (NYSE: LNG) - an LNG stock we've been optimistic about for years - is up 27.34% in 2014 and 11.09% so far in March alone, when troubles in Ukraine came to a head.

Owner, operator, and manager of LNG vessels GasLog Ltd (NYSE: GLOG) is an LNG carrier that could be directly impacted by increased LNG exports out of the United States. The company's stock is up 42.01% so far in 2014 and 15.24% in March.

Golar LNG Ltd. (Nasdaq: GLNG) also owns and operates LNG carriers. GLNG stock is up 18.19% in 2014 - and 17.19% in March alone, since the Ukraine conflict began pressuring the energy industry.

Dominion Resources Inc.'s (NYSE: D) portfolio of assets includes a 21,800-mile-long gas distribution pipeline and an underground natural gas storage system with approximately 947 billion cubic feet of storage capacity. Dominion shares are up 9.52% in 2014 and 23.02% from a year ago; the company has enjoyed a steady, fairly constant rise since going public in 1978.

Sempra Energy (NYSE: SRE) has climbed 8.08% in 2014 and 2.69% in March. The holding company owns and operates natural gas distribution utilities, storage facilities, and LNG pipelines and sells and transports natural gas across the United States.

These are only a few of the natural gas stocks on an upward march so far in 2014.

"The market events that I'm predicting will make the New Year a big one for LNG investors," Moors said. "The global energy sector is intensifying, and its importance has never been more striking than it is right now."

Share your thoughts on #Ukraine and #LNG with us on Twitter @moneymorning or Facebook.

History is full of compelling examples of small-cap stocks delivering 1,000% returns, but just as many flop, leaving investors with worthless shares. This risk-management strategy - specifically tailored for small-cap stocks - allows investors to seize massive wins... and still sleep easily.

Tags: Best LNG stocks, Best Natural Gas Stocks, energy investing, energy investments, how to invest in natural gas, LNG, LNG exports, LNG stocks, natural gas companies, natural gas price forecast, natural gas price forecast 2014, Natural Gas Prices, natural gas prices 2014, natural gas prices today, natural gas stock news, natural gas stocks, Natural gas stocks 2014, what are the best LNG stocksThe post Natural Gas Stocks 2014: A Bullish Sign from This LNG Export News appeared first on Money Morning - Only the News You Can Profit From.