( click to enlarge )

( click to enlarge )Pacific Ethanol Inc (NASDAQ:PEIX) stock had a great week with a minor drop on Friday. It closed at $11.33 and has a 52-week high of $23.97. I used this pullback to add several positions. The resistance at $12.16 in my opinion is the key to unlocking this technical chart and getting the party started. With a break above this zone, you can see just how thin the technical chart becomes. The next key resistance is not until up at $15.57. Indicators are also strong indicating further upside for the stock. MACD is already above the zero-line and still has plenty of room to move before it retests the highs it put in, back in September. Along with this, just check out the uptrend of the MACD since late January. The RSI is in the power zone and A/D is clearly showing money moving into the stock as more investors start noticing this stock. PEIX could be on the verge of making a stronger move upwards and early entrants, could take advantage of this potential opportunity. Im long.

( click to enlarge )

( click to enlarge )On the hourly time frame, we can see that the stock is making lower highs and lower lows (bearish sign) since February 20 after reaching a high of 70.48. Additionally, it broke the second bear flag that has been formed in this downtrend. Key indicators suggest continuation of negative bias for the stock.

( click to enlarge )

( click to enlarge )Regado Biosciences Inc (NASDAQ:RGDO) closed very strong on Friday, above the January highs. The stock traded 3x normal daily volume, as buyers came rushing in. I like this Bio name and will watch it again on Monday. Resistance is $1.61, which was Friday’s high of the day. Technical daily chart shows bullish sign with RSI in the power zone and MACD on top of signal line. A decisive close above the 1.61 level on heavy volume, and, we could be looking at RGDO testing its next resistance level around the 200-day EMA at 2.18.

( click to enlarge )

( click to enlarge )Marvell Technology Group Ltd. (NASDAQ:MRVL) held up very well in a weak market on Friday, which is a good reason to keep a close eye on the stock. The way the it is trading, leads me to believe the price is going to make a big move up. In addition, the volume has been slowly picking up the last few trading sessions, which is another sign of a buyer in the stock. Keep an eye for a possible breakout over 16.78

( click to enlarge )

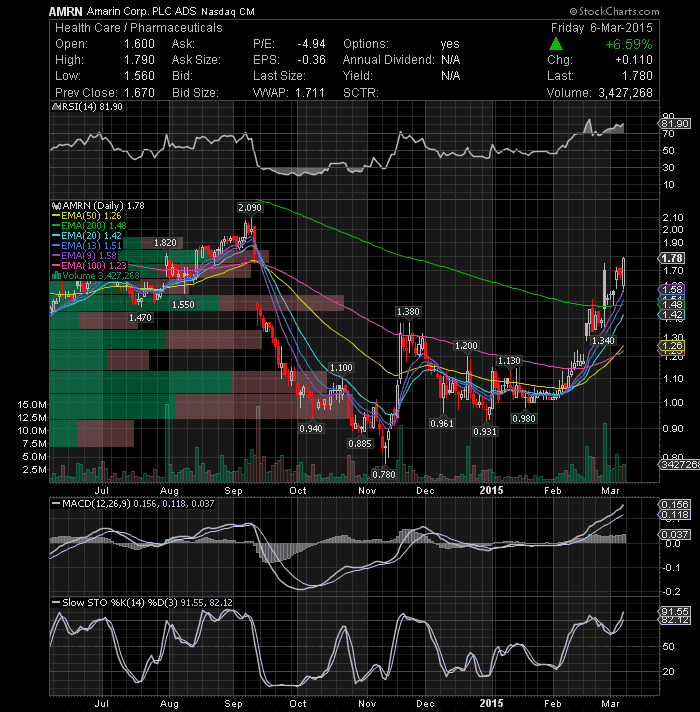

( click to enlarge )Amarin Corporation plc (NASDAQ:AMRN) had a very bullish move last week breaking several resistance lines with large volume and we should see a continuation move next week. The MACD chart is still showing an uptrend with the MACD indicator above its signal line and is indicating further strength. The RSI value is currently above 80% level but the past behavior shows that RSI can easily move to 90. The short-term trend is bullish and a move to the 1.9-2.05 range appears likely. AMRN has definitely changed the trend.

( click to enlarge )

( click to enlarge )Crossroads Systems Inc (NASDAQ:CRDS) declined to a support zone and upside volume is starting to pick up, watch resistance at $3.05. Fresh exposures may be considered on close above this level, with a stop-loss at $2.53

( click to enlarge )

( click to enlarge )ZIOPHARM Oncology Inc. (NASDAQ:ZIOP) This technical chart looks pretty bullish. The stock has been under strong accumulation since the beginning of October and is now working the overbought area. There is a need for profit taking for some consolidation from these high levels. The short-term outlook remains positive as long as the stock stays above the 9 & 13 EMAs.

I would like to remind everybody that Benzinga Pro's news feed is my streaming plataform and could be your best tool to invest better. It delivers real-time financial news straight to your desktop. Benzinga is offering 1 month of its streaming platform for just $1. Hurry as this is a limited offer. CLICK HERE I recommend this tool to all my readers/friends.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC