PORTLAND, Ore. - April 11, 2019 - (Newswire.com)

The following is an open letter from Thad Fisco, owner of Portland Kettle Works & Labrewatory, on the state of the craft beer industry. The intent of this letter is to encourage discussion on how the industry should define craft beer, goals we should be driving towards, and the actions to be taken to achieve these goals. We welcome your comments whether you agree with the opinions expressed in this letter or not.

Late last year my team and I had a chance meeting with two Brewers Association (BA) executives in a brewery. This is not the start of a bad joke -- it is how I learned about a serious problem with the BA and the huge opportunity I see in the craft brewing industry.

After a couple of beers and some serious conversation, we understood that the BA is not focused on the +80 percent of beer drinkers that don’t drink craft beer, and that protecting craft beer’s 12.7 percent of independent market share from AB-InBev is their primary goal. According to these BA folks, Anheuser-Busch is absolutely determined to put independent craft breweries out of business.

We believe this vision is flawed and out of sync with reality. It is based in empty rhetoric and fear that harms rather than helps independent craft breweries and keeps good ideas from finding the light of day. Below we describe why this is true, and we start by getting quite blunt about what craft beer is and who is making it.

What is craft beer? We all know it’s not fizzy, yellow water. Instead, it’s the “Premium Beer” that we all love as beer drinkers, regardless of who makes it. A “craft brewer” is someone or some firm that is engaged in producing it. This is not the BA’s “definition” which seems to change subject to political or economic necessity. Our inclusive definition of craft beer provides a view of the industry landscape from a broad and open perspective, and here is what we see:

Anheuser-Busch, Heineken, Constellation Brands, MillerCoors, Mahou San Miguel, Kirin, Asahi and the other big players are fully invested and very engaged in the business of craft beer. Collectively they have likely invested over $2 billion into the business of premium beer. That investment will continue. They are also in competition with the mounting number of worldwide independent craft breweries, and they are strong competitors in a space that they have traditionally owned. The competition is healthy and helps to drive innovation and quality throughout the industry.

The evidence shows that the big brewers are not out to destroy craft beer, craft beer drinkers, or craft breweries. Last year Anheuser-Busch became the nation’s largest dollar volume craft beer producer surpassing both Boston Beer and Sierra Nevada in craft-derived revenue.The systematic plan that Anheuser-Busch has implemented in buying independent craft breweries between 2011 and 2017 is likely over. Adding to their portfolio through the acquisition of SABMiller makes Anheuser-Busch the undisputed king of craft. Yet the craft beer community is needlessly being led into battle against AB InBev who is actually helping the industry make headway toward what we need most: growing the premium craft beer market share. Should we follow the BA, engaging in industry in-fighting and craft maxing out at 18-20 percent market share, or should we instead push craft forward toward 50 percent market share of the beer market?

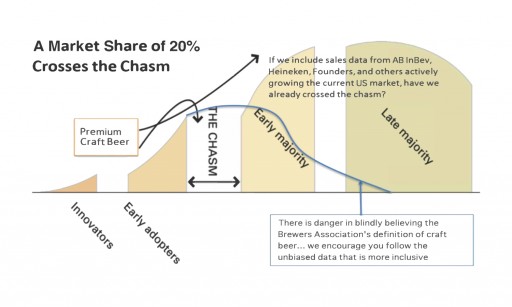

Portland Kettle Works isn’t the only company that thinks the Brewers Association has painted themselves into a corner. The members of Crafting A Strategy (CAS), a global online community of beer business entrepreneurs of which PKW is a member, recently spoke out against how the ever-changing and narrow definition of “craft” from the Brewers Association is misleading and potentially dangerous. In an October 2018 blog, CAS President Sam Holloway and V.P. Mark Meckler noted that AB InBev, Heineken, and Mahou San Miguel were using their vast resources and marketing expertise to convert the 85 percent of non-craft drinkers in the USA into craft drinkers. These breweries are working hard to bring in more craft beer drinkers, but their contributions to the overall premium craft beer market share are not counted in the BA definition. CAS suggests that we are closer to a 20 percent craft market share and this is a tipping point where we can quickly accelerate market share toward as much as 50 percent by 2025. CAS’s logic, borrowed from innovation diffusion logics, is depicted in the figure above. Whereas the BA’s definition of craft suggests we are maxed out, CAS and PKW believe we are on the cusp of widespread market growth if we are wise enough to keep our eyes, and our strategy, looking forward.

Growth in business is a measure of success. Stagnation and shrinking market share eventually lead to failure. If craft beer does not grow as a market segment we, meaning craft brewers including AB InBev, put ourselves under siege as we fight over a non-growing business with increasing competition. It is therefore incredibly dangerous to narrowly under-define the craft beer sector. The stakes are high. While the BA is engaged in protectionism, AB InBev is experimenting and redefining the market in an effort to remove barriers to entry for the 80 percent of non-craft beer drinkers. Independent brewers have a lot to learn from their efforts to grow demand in an increasingly competitive business.

Using BA statistics, 3,743 new breweries opened between 2014 and 2017 which translates to a 116 percent growth rate. During that same period, market share for craft beer, as defined by the BA, grew just 4.9 percent. This is equivalent to 30 percent growth per year in brewery openings against 1.3 percent growth in market share. This is a serious problem, but only because of definitions inadvertently designed to depress the business of craft beer.

Portland Kettle Works makes continuous efforts to define trends that affect our business. While the most recent annual numbers are just now becoming available, they are almost certainly supporting recent historic trends. Here are some recent findings:

- Using publicly available records from the BA, we estimate that from 2014 to 2017 approximately 1.5 million barrels of craft beer were removed from the craft market sector as big breweries bought small breweries

- At the end of 2017, the breweries previously defined as “craft” controlled roughly 4.9 percent of the overall market share

- When this 4.9 percent is added to 12.7 percent “craft” beer share, the more widely defined craft/premium sector becomes 17.6 percent of the overall market

- AB InBev and the other large breweries that have invested in premium beer offerings are helping raise all boats

It would not be at all surprising to find that craft beer, as defined in this article, is now in 2019 controlling over 25 and possibly as much as 30 percent of market share. This number feels better. However, it needs to continue growing.

At a recent brainstorming session, our team along with Crafting A Strategy examined what success should look like in the future. Framed in terms of market share, we decided that 50 percent for craft/premium is a worthy goal. In this moment, the Brewers Association has chosen to lead us into a battle, armed with a well-intentioned campaign of “independence.” We absolutely stand with the BA’s effort to promote the importance of American entrepreneurial innovation, grit, and an undying determination to succeed. Given time and enough money, the independence campaign may well move the needle a bit as a small minority of the public that cares to identify and buy our beers over those of large breweries becomes educated. However, in our opinion, this is a misuse of BA resources. This effort will not grow the craft/premium market share one bit. We will remain besieged. Growing craft market share should be our collective and undisputed priority.

About 196 million barrels of beer were produced in the US in 2017. According to the BA definition and statistics, craft beer accounted for about 25 million barrels of that production (12.7 percent). Adding the premium sector increases that craft/premium piece of pie to 34.5 million barrels in 2017 (17.6 percent). This means, at 49 million barrels, craft/premium owns 25 percent, and at 98 million barrels, it is half of the market. How can that not be good for independent craft brewers, even if Anheuser-Busch and other big breweries help to get us there?

This is a future that we can look forward to. A robust environment with a huge, inclusive base of enthusiasts, willing and eager to enjoy high quality, flavorful beers from thousands of innovative independent breweries across the US and, if trends continue, tens of thousands worldwide. A lot of collaborative and rewarding work lies ahead. Rewarding work beats the blues any day.

Cheers,

Thad Fisco

Owner, Portland Kettle Works & Labrewatory

We welcome your comments via our blog

Press Release Service by Newswire.com

Original Source: Craft Beer is NOT Depressed But the Brewers Association May Be