BALTIMORE, June 26, 2017 /PRNewswire/ --

NEWS

T. Rowe Price Retirement Plan Services, Inc., found that 61% of the employer-sponsored retirement plans for which it provides recordkeeping services offer Roth contributions in their 401(k) plans, up from 50% at the end of 2015. This represents the biggest one-year increase in Roth contribution adoption since the company began tracking the figure in 2007.

This new finding comes from T. Rowe Price's 2016 update of Reference Point, an annual benchmarking report of employer-sponsored retirement plans based on T. Rowe Price's full-service recordkeeping client data. This report provides plan sponsors the ability to review retirement plan trends and plan participant behavior patterns to help them make more informed plan decisions.

Reference Point is one component of T. Rowe Price's comprehensive digital toolkit aimed at helping plan sponsor clients and their advisors manage every aspect of their plan(s). Key findings from this report are summarized by topic below, while the executive summary and full report are available at troweprice.com/referencepoint.

AUTO-SOLUTIONS TRENDS

Adoption of auto-solutions has been on the rise since the Pension Protection Act of 2006, and it continues to be a successful tool for plan sponsors to use within their plans. Of the T. Rowe Price plan participant base:

- The number of plans with a 6% default deferral rate or more has doubled since 2011, with 33% of plans offering this higher rate in 2016. The industry standard for the past 10 years has been 3%.

- The percentage of plans adopting auto-increase of participant contributions and auto-enrollment has significantly grown in the last five years. The percentage of plans adopting auto-increase grew from 63.3% in 2011 to 71.5% in 2016. Similarly, auto-enrollment increased from 39.8% in 2011 to 54.5% in 2016.

- Participation rates continue to be strongly tied to the adoption of auto-enrollment, with participation 42 percentage points higher in plans with auto-enrollment than those without it.

CONTRIBUTION TRENDS

Pretax deferral rates continued to increase in 2016 and now stand at 8%, the highest rate since before the financial crisis. Likely factors contributing to this increase include plan sponsors raising the default deferral rate for their plans and improved market conditions.

INVESTMENT TRENDS

Plan adoption of target date portfolios continued to rise. In 2016, 93% of plans at T. Rowe Price offered target date portfolios. Additionally, 55% of participants invested their entire account balance only in target date products, an increase of nine percentage points since 2013. The increasing popularity of target date products could indicate that participants prefer a more managed approach verses choosing their own allocation, or are sticking with their plan's default option.

LOAN AND DISBURSEMENT TRENDS

Loans are a staple of the retirement plan feature but can derail a participant's future savings if not utilized properly. The percentage of participants with loans at the end of 2016 is down marginally to 23.8%, which is the lowest since the height of the financial crisis in early 2009.

T. Rowe Price also found that as of year-end 2016:

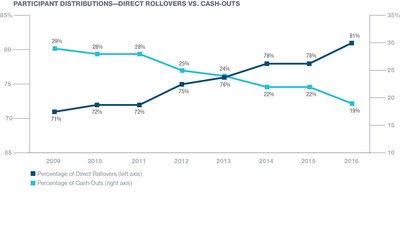

- The ratio of direct rollovers to cash-outs continued to strengthen, with rollovers increasing to 81% in 2016, compared with 71% in 2009, and cash-outs decreasing to 19% in 2016, compared with 29% in 2009.

- Hardship withdrawals declined, with only 1.4% of participants in plans at T. Rowe Price taking such a withdrawal, compared with the 2% industry average.

QUOTE

Aimee DeCamillo, head of T. Rowe Price Retirement Plan Services, Inc.:

"It's encouraging to see that so many of our plan sponsors are continuing to take steps to prepare their plan participants for retirement. An important demonstration of this is the 10 percentage point increase we saw in 2016 in the number of plan sponsors who offer Roth contributions in their 401(k)s. Roth contributions in 401(k)s offer important benefits to participants, including the ability to diversify the tax treatment of retirement income. Providing this option, as well as the education around its benefits, reflects plan sponsors' commitment to the successful retirement outcomes for their participants."

"We are continuing to see a favorable turn in participants' financial behaviors in 2016. The percentage of participants taking out a loan is down slightly and is at its lowest since 2009. We also saw a strengthening ratio of rollovers to cash-outs. We believe that educating participants on their retirement savings plan has had a direct, positive effect on reducing plan leakage and has dissuaded more people from using their savings for nonretirement purposes."

REFERENCE POINT METHODOLOGY

Data are based on the large-market, full-service recordkeeping universe of T. Rowe Price Retirement Plan Services, Inc. retirement plans (401(k) and 457 plans), consisting of 642 plans and over 1.6 million participants.

For plan-level analysis (i.e., averages by industry), a plan-weighted average is shown. This process takes the average from each plan and averages them together. A plan-weighted average assigns plans with a smaller number of participants the same weight as plans with a larger number of participants.

For participant-level analysis (i.e., averages by age and tenure), a participant-weighted average is shown. This process adds up all participants for all plans and takes one overall average. A participant weighted average assigns plans with a smaller number of participants less weight than plans with a larger number of participants.

Data and analysis cover the time periods spanning calendar years ended December 31, 2007, through December 31, 2016.

Auto-increase and auto-enrollment data are based on plans that are eligible to receive this service. Loan availability and usage results are based on active participants with outstanding balances.

ABOUT T. ROWE PRICE RETIREMENT PLAN SERVICES, INC.

T. Rowe Price Retirement Plan Services, Inc. has been a retirement solutions provider for more than 30 years and on December 31, 2016, served more than 1.9 million retirement plan participants across more than 3,500 plans.

ABOUT T. ROWE PRICE

Founded in 1937, Baltimore-based T. Rowe Price Group, Inc. is a global investment management organization with $861.8 billion in assets under management as of March 31, 2017. The organization provides a broad array of mutual funds, subadvisory services, and separate account management for individual and institutional investors, retirement plans, and financial intermediaries. The company also offers sophisticated investment planning and guidance tools. T. Rowe Price's disciplined, risk-aware investment approach focuses on diversification, style consistency, and fundamental research. For more information, visit troweprice.com, Twitter, YouTube, LinkedIn, or Facebook.

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/t-rowe-price-finds-significant-increase-of-plan-sponsors-offering-roth-contributions-in-401k-plans-300479526.html

SOURCE T. Rowe Price Group, Inc.