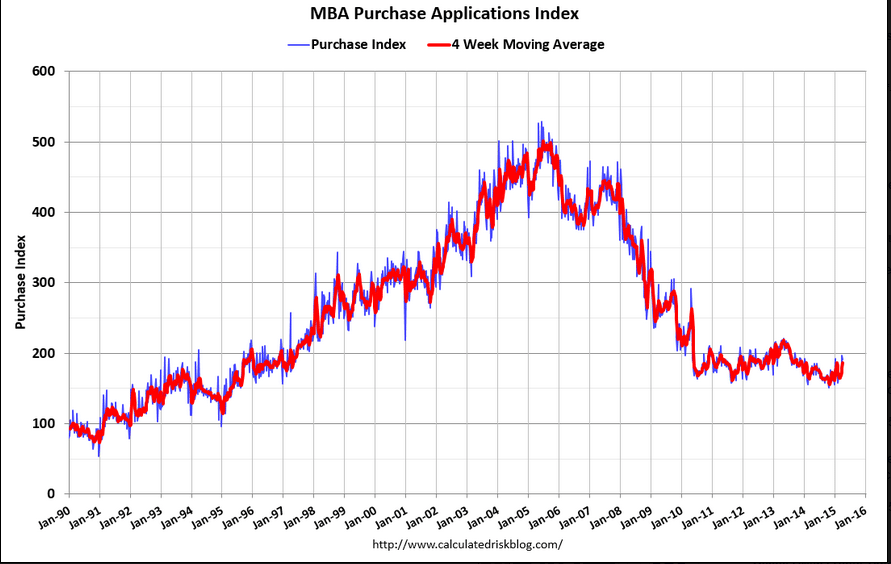

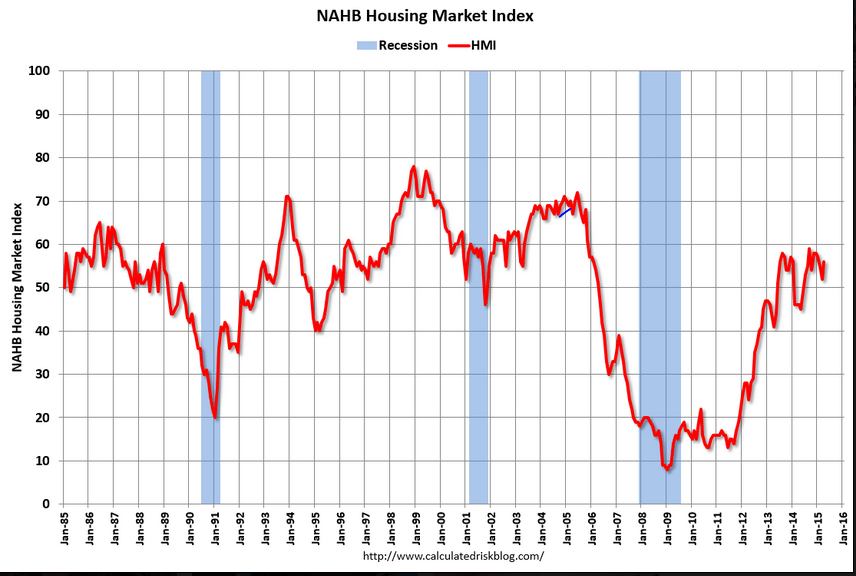

Turned south again, unfortunately. Remains seriously depressed.

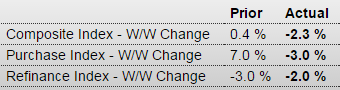

MBA Mortgage Applications

Highlights

After three straight weeks of impressive gains, the purchase index slipped back 3.0 percent in the April 10 week. Year-on-year, the index is still up a solid 7.0 percent in a reading that points to strength for the spring housing market.

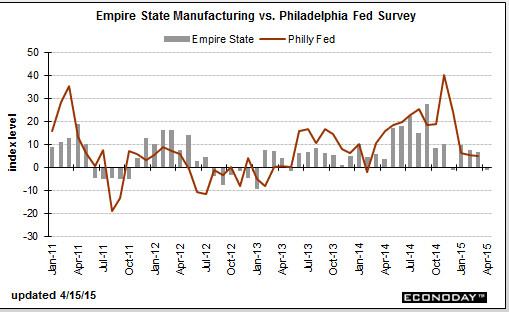

More bad news:

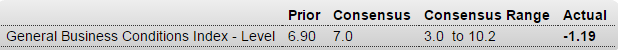

Empire State Mfg Survey

Highlights

There’s no evidence yet that the manufacturing sector is building up steam early into the spring quarter. The Empire State index points to month-to-month contraction for April, at minus 1.19 for only the second negative reading in the last 23 months. The other negative reading was in December which was just about the beginning of this indicator’s slowdown.

New orders are contracting noticeably, at minus 6.00 for the second straight contraction. Weakness in exports, tied to the strong dollar and soft global demand, is a major factor behind the dip in orders. Unfilled orders, at minus 11.70, are in sharp contraction for a second straight month.

But the drop in orders has yet to pull down shipments which, at least for now, are still in the plus column and well into the plus column, at 15.23. Employment is also well into the plus column at 9.57 on top of March’s standout strength of 18.56.

Still, shipments and employment are certain to turn lower if orders don’t pick up. But, in an optimistic note, that’s exactly what the sample sees as a sizable 52 percent expect general conditions to improve in the next six months.

All in all, today’s report is soft reflecting weakness in global demand, weakness underscored by yesterday’s data out of China where GDP is at a 6-year low. Watch for the US industrial production and the latest hard data on manufacturing at 9:15 a.m. ET.

Another bad one:

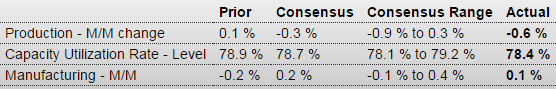

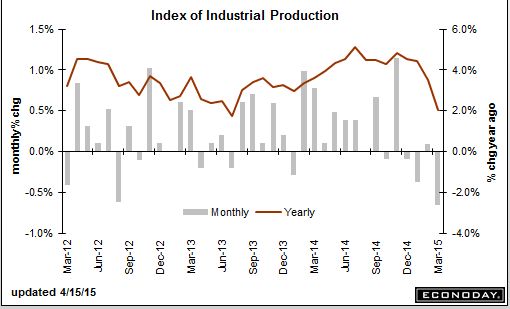

Industrial Production

Highlights

The manufacturing sector remains sluggish. Industrial production for March fell 0.6 percent after a February rise of 0.1 percent. The March drop was largely due to utilities although manufacturing was soft. Market expectations were for a 0.3 percent fall for overall production in March.

Manufacturing edged up 0.1 percent in March after dipping 0.2 percent the month before. Analysts projected a 0.2 percent increase.

Mining dropped 0.7 percent in March after a 1.6 percent decrease the prior month. Utilities plunged 5.9 percent after surging 5.7 percent in February.

The production of durable goods moved up 0.2 percent, on the strength of a rebound in the production of motor vehicles and parts. The output of primary metals declined 3.2 percent to register the largest loss among durable goods industries. The production of nondurable goods moved up 0.1 percent; decreases in the indexes for paper, for chemicals, and for plastics and rubber products mostly offset gains by the other major nondurables industries. The production of other manufacturing industries (publishing and logging) fell 0.4 percent. The decrease of 0.7 percent for mining reflected a drop of 17 1/2 percent in the index for oil and gas well drilling and servicing that was partly offset by gains in crude oil and natural gas extraction and by a bounce back in coal mining.

Overall capacity utilization declined to 78.4 percent from 79.0 percent in February.

Not terrible but still low historically:

The post mtg purchase apps, NY manuf survey, industrial production, home builders index appeared first on The Center of the Universe.