FLASH- Fed to taper another $10 billion

Maybe they are concerned about all the interest income they are removing from the economy?

;)

General comments:

For GDP to grow at 3% all the pieces have to ‘average’ 3% growth

And if anything is growing at a slower pace than last year, something else has to grow at a faster pace or GDP growth slows.

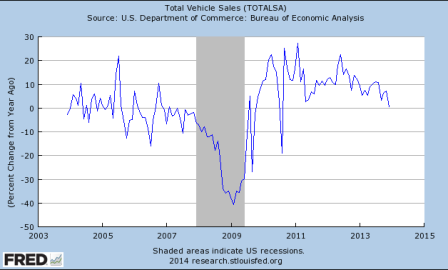

So the growth rate of car sales has slowed and is expected to slow further this year:

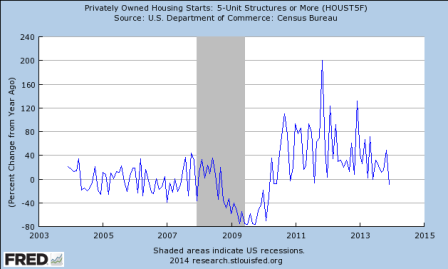

How about housing?

Pending home sales year over year change:

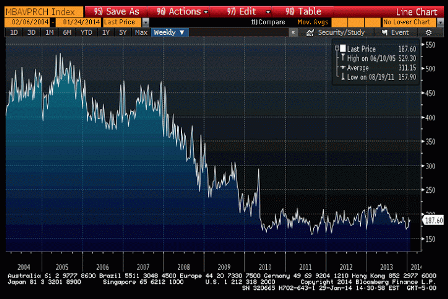

New mortgage applications to purchase homes:

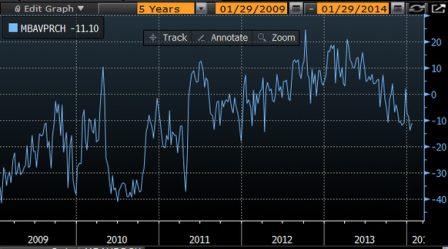

Purchase apps year over year:

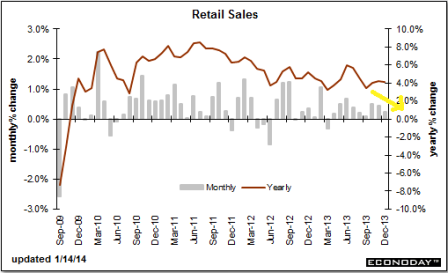

Retail sales growth has been generally slowing and has yet to show signs of increasing:

How about orders for durable goods?

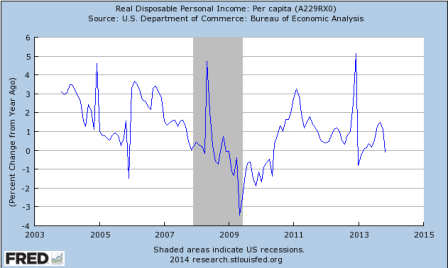

Is the income growth there to support higher levels of spending?

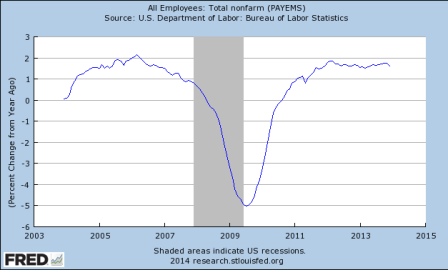

Is the growth rate of employment increasing?

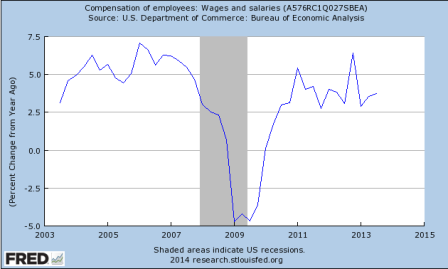

Compensation?

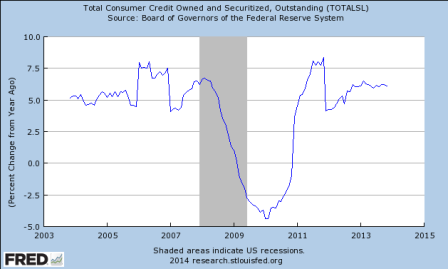

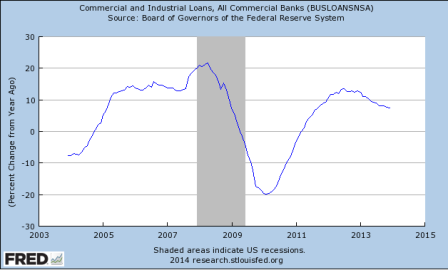

Maybe consumers are somehow borrowing to spend at a higher rate?

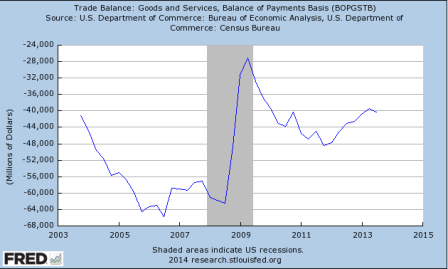

How about the foreign sector?

Well, it was helping, but we need the rate of change to increase to have more of an impact than last year. And with GDP around $17 trillion, last year’s rate of increase has to be exceed by about $7 billion/mo to add an additional .5 to GDP. And the substantial currency depreciation of the EM’s isn’t going to help any.

Just saying, something big needs to start growing a lot just to keep GDP growth positive?

So what happened to growth?

Private sector spending (including non residents) in excess of income may no longer be keeping up with the reduction in the federal govt’s spending in excess of its income (deficit spending spending)?

Maybe the federal deficit is too low for current credit and financial conditions?

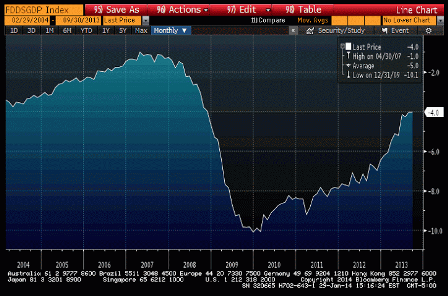

Deficit as a % of GDP through Sept 13. It’s even lower currently: