Wholesale Trade![]()

Highlights

Wholesale inventories rose a sharp 0.8 percent in May, a much larger-than-expected gain but still in line, though just barely, with sales in the wholesale sector which rose 0.3 percent to keep the stock-to-sales ratio unchanged at a respectably lean 1.29. Inventories relative to sales fell for autos and paper products. Builds were posted in furniture, farm-products, and apparel.

Indications on second-quarter inventories have been favorable, showing balanced growth despite the overhang of the first quarter. Today’s larger-than-expected build may bump up second-quarter GDP estimates slightly.

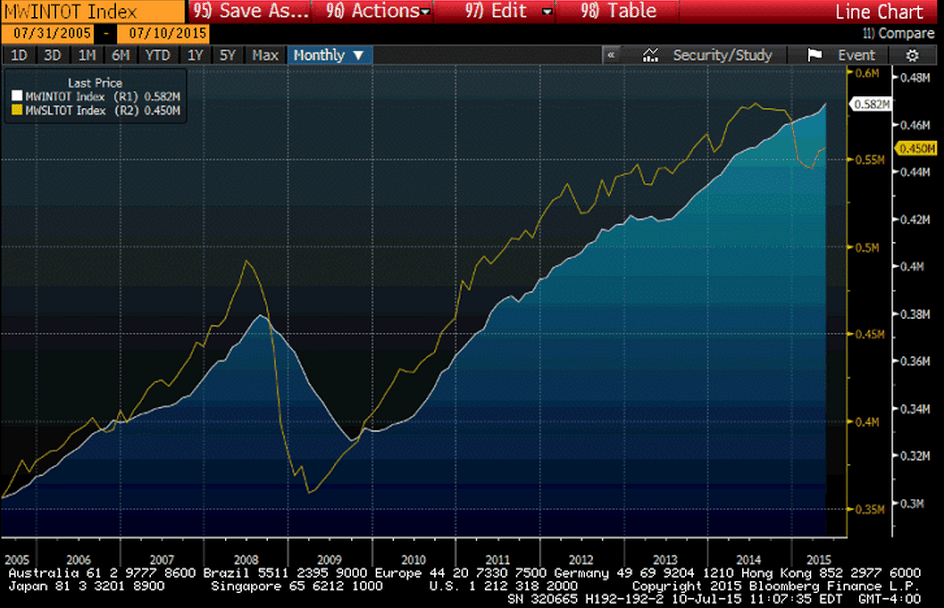

In the first chart the yellow line is whole sales, which collapsed when oil prices fell enough eliminate capital expenditures that were chasing higher priced oil. The blue line is inventories, which have continued to rise even after sales fell. The textbook narrative where sales lead inventories, with inventories falling after sales fall and production is reduced, is most likely what’s going on here, as evidence that we may already be in recession continues to increase:

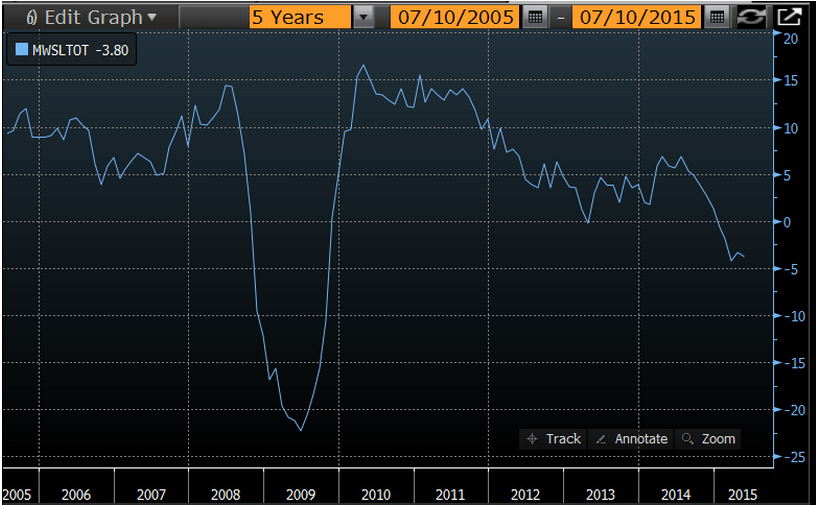

Sales Y/Y:

The post Wholesale trade appeared first on The Center of the Universe.