A bit of a move up this week, but still not much happening

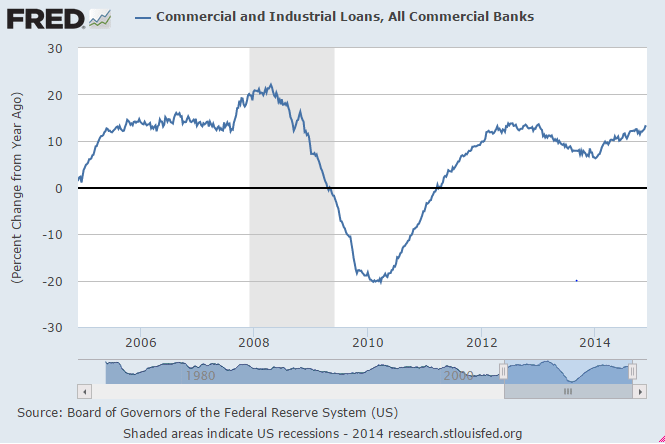

So all the talk is about a rate hike next year. And not much talk about what that’s supposed to do. The mainstream presumes, for example, that a rate hike will somehow moderate ‘inflation’ through the lending channel. That is, higher rates will discourage borrowing and thereby moderate borrowing to spend. Setting aside the point about the effect of increased income to savers/investors, etc, and to their narrow point, exactly which ‘borrowing to spend’ needs ‘cooling off’?

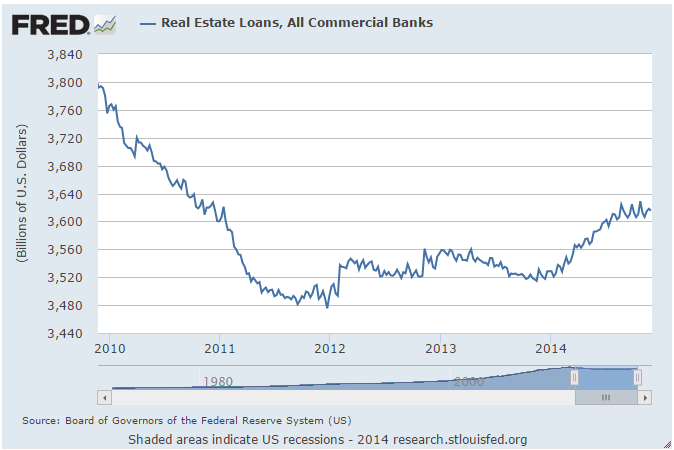

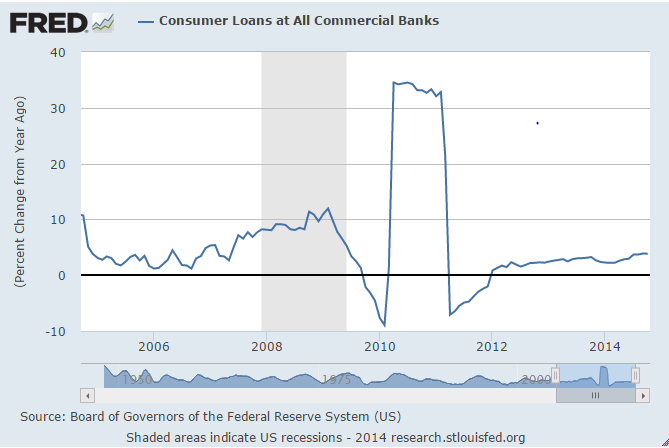

Housing has near flat lined at historic lows, and even the growth rate of the one ‘bright spot’- cars- has been slowing. And from the above charts it doesn’t look to me like there’s any ‘excess credit growth’ problem they’d want to cool down via a rate hike anywhere in sight?

Not that they won’t do it anyway, just on general principles that the interest rate they set ‘should’ be higher than the ‘rate of inflation’, ‘or else’ something ‘bad’ will happen…