( click to enlarge )

( click to enlarge )Starting with Facebook Inc (NASDAQ:FB) on the daily charts. The present uptrend in stock price is getting confirmed as the days go on. Right now, I'm in a long trade that I entered around 29. The medium trend is still bullish, as we can see on the chart above. Immediate support remains at 28.75 followed by 27.4 (50-day SMA). Initial resistance at 32.21. A break above that area could trigger further bullish momentum towards $35 area.

( click to enlarge )

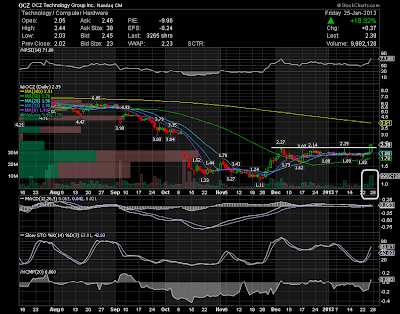

( click to enlarge )OCZ Technology Group Inc. (NASDAQ:OCZ) made a strong move Friday on unusual volume. The stock was strong all day as it closed up 18.32% to $2.39. If the stock can break Friday’s high of $2.44, we should see a continuation move.

( click to enlarge )

( click to enlarge )JPMorgan Chase & Co. (NYSE:JPM) has been in a strong uptrend since November and it does not looks like the trend will change soon. Today, the stock broke out an important resistance at $46,87 with solid volume. The trend is in favour of Bulls and JPM still has room to go higher.

( click to enlarge )

( click to enlarge )NVIDIA Corporation (NASDAQ:NVDA) broke out of a short-term consolidation range on Friday. The high of the day was $12.42, which is resistance for the continuation move. A break of this resistance level could see the stock testing its 200-day SMA at $12.85. Although the stock is still weak as the MACD is below 0, the technical indicator KD now shows positive sign as %K line is now back above %D line. NVDA can be a fast moving stock, so keep it on your radar and be ready for this upside move.

( click to enlarge )

( click to enlarge )Zynga Inc (NASDAQ:ZNGA) is holding up nicely above its 50-day SMA. The technical chart is showing possible buying opportunity as %K line is about to cross on top over %D line. A close above 2.54 would impart positive momentum. The stock is likely to move to the 2.7-2.76 range on the break past the resistance zone.

( click to enlarge )

( click to enlarge )I continue to watch Delta Air Lines, Inc. (NYSE:DAL). The volume is still large so it could potentially break out again at any moment. Breakout watch over 14.2

During the day I tweet many times to my readers. I encourage everybody to subscribe AC Investor Blog twitter and newsletter, so you can receive my trade ideas and stock news in real time.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC