Seems both apps and price growth both peaked around the same time?

MBA Purchase Applications

Highlights

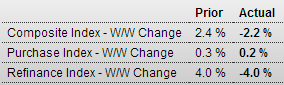

The housing market is flat, evident in the purchase index which is little changed for a second week at plus 0.2 percent in the July 25 week. Year-on-year, the index is down 12.0 percent. Refinancing is also flat, down 4.0 percent in the week. Rates have been very steady, unchanged for the third straight week at 4.33 percent for 30-year conforming mortgages ($417,000 or less).

S&P Case-Shiller HPI

Highlights

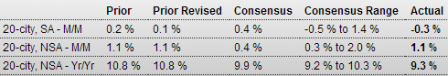

Home-price appreciation is slowing rapidly, actually going into reverse in May at a seasonally adjusted minus 0.3 percent for Case-Shiller’s 20-city index. This is the first negative reading since January 2012.

Year-on-year, both adjusted and unadjusted, home prices are at plus 9.3 percent, down substantially from 10.8 percent and 12.4 percent in the two prior months.

The weakness is very apparent in the 20-city breakdown with 14 cities in the negative column for the month. Atlanta shows the steepest monthly decline, at minus 0.9 percent, followed closely by Chicago and San Francisco.