Up up and away!

Up up and away!

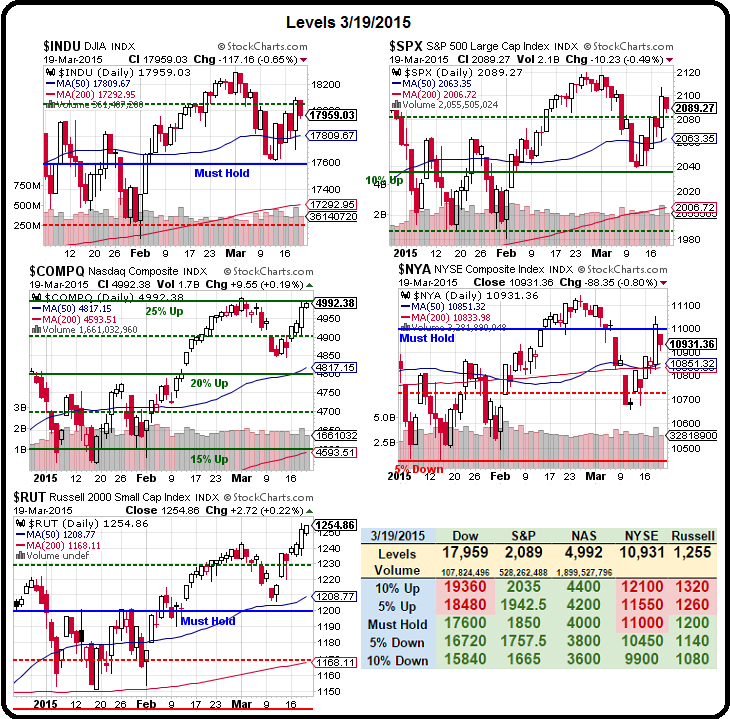

Not only is the Nasdaq popping back over 5,000 today but the Dow is back over 18,000 in the Futures and the Russell is already flying over 1,250 – well past the previous all-time high of 1,243 that was set on the first day of March.

As we've noted earlier in the week, a rising market tide has NOT lifted all ships with 30% of the Dow and 1/4 of the Nasdaq at 52-week LOWS (mostly materials), which is why they had to stuff AAPL into the Dow – so it could at least keep pace with the Nasdaq going forward.

Hey, who are we to complain? This week's rally gave us a nice $4,300 gain on Wednesday's Top Trade Alert and a 5% comeback on our Long-Term Portfolio, which is closing back in on a 30% gain, albeit at the expense of our more bearish Short-Term Portfolio, which has fallen back to up 77.6% but it's 1/5th the size of the LTP, so GO BULLS – I guess…

Hey, who are we to complain? This week's rally gave us a nice $4,300 gain on Wednesday's Top Trade Alert and a 5% comeback on our Long-Term Portfolio, which is closing back in on a 30% gain, albeit at the expense of our more bearish Short-Term Portfolio, which has fallen back to up 77.6% but it's 1/5th the size of the LTP, so GO BULLS – I guess…

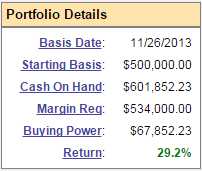

Despite our success, I'm not happy with this rally but I wasn't happy in 1999 or 2007 either and that made me miss out on some nice gains so we're keeping our LTP open (though, as you can see, over 50% in cash) so we don't "miss out" on the madness.

And it is madness – there's no connection between valuations and earnings and, as you can see from this chart, the Macro Outlook is deteriorating rapidly, even in the US. In fact – THE FED JUST SAID SO!!! Unfortunately (for us "rational" investors) bad news is still good news to the markets as it only brings wave after wave of MORE FREE MONEY – so much free money that we are drowning in it.

And it is madness – there's no connection between valuations and earnings and, as you can see from this chart, the Macro Outlook is deteriorating rapidly, even in the US. In fact – THE FED JUST SAID SO!!! Unfortunately (for us "rational" investors) bad news is still good news to the markets as it only brings wave after wave of MORE FREE MONEY – so much free money that we are drowning in it.

What does "drowning in money" mean? Here's some jokes for you -

What does "drowning in money" mean? Here's some jokes for you -

- Money doesn't get no respect these days. Why, there's so much money in the World these days that you've gotta pay the banks to hold it for you!

- There's so much money in