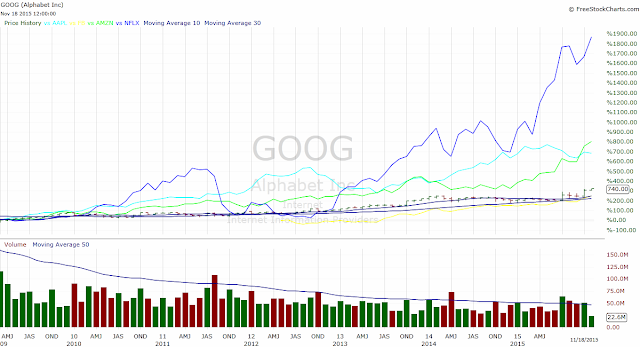

Here's a monthly performance chart of Google (GOOG) vs. widely-owned Apple (AAPL) and the rest of the so-called "FANG" stocks: Facebook (FB), Amazon (AMZN), and Netflix (NFLX). You can click the chart to enlarge it.

GOOG (shown in price bars) is up from the March 2009 start of this bull market. Meanwhile, FB, which only IPO'd in 2012, is up 250%. AAPL (shown in light blue) is up 675%. AMZN (in green) is up 800%, while NFLX (in blue) leads the pack by a wide margin, up 1,860% since 2009.

Now that FANG stocks have replaced the .com bubble's "Four Horsemen" of tech (Microsoft, Intel, Cisco, and Dell), does that mean we just buy this new basket of tech leaders and hold on forever (or at least until retirement age)?

Well, here are a few problems with that approach.

1) The new tech leaders, like the "Four Horsemen" of old, are likely to stumble or be thrown from their perches at some point. Tech is at the leading edge of capitalism, and each company's fortunes can shift rapidly. Today's leading stock is often tomorrow's punch line.

Remember IBM, DEC, Commodore, Yahoo, GeoCities, JDS Uniphase, or Research in Motion?

2) Once a group of stocks is tied to an acronym, as with FANG stocks, it tends to indicate mass acceptance of an investing theme. Once something becomes that popular, you'll know that this is an idea being marketed and heavily sold to the public (and bandwagon hopping fund managers). Increased buying pressure may help fuel the advance of these stocks, but at some point in the not too distant future, who is left to buy them?

Prior leading stock themes/fads included the "Nifty Fifty" of the 1970s, the TMTs and "Four Horsemen" (and later, the "new four horsemen") of the '90s and early 2000s, and the BRICs or emerging market giants of the 2000s. These stocks were all eagerly snapped up in their heyday, but their peak to trough performance left many "buy and hold" stockholders burned.

3) It is a good idea to buy stocks in an uptrend, especially in the earlier stages of an uptrend. We are now in the sixth year of this bull market. Right now, the leading big cap tech names are among a very small group of strong stocks leading the market higher. It's getting narrow and windy near the top of the mountain.

Holding popular stocks through mania peaks and ensuing downtrends, or worse, adding to losses and buying more in an effort to "average down" can be a recipe for disaster.

Subscribe to Finance Trends by email or get new posts via RSS. You can follow our real-time updates on Twitter and StockTwits.