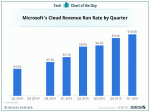

In yesterday's earnings report, Microsoft noted that the company was at a $10 billion annualized "run rate" for its cloud businesses. That's only a $600 million gain, or 6%, from the last quarter.

That may seem like a problem at first glance, given that Microsoft is betting so heavily on cloud customers to make up for slowing software sales. But in fact Microsoft's cloud run rate grows in fits and starts, and is timed with its traditional enterprise sales cycle. Typically, large organizations sign and renew their big licensing deals with Microsoft in the December quarter (the end of many companies' fiscal year) and June quarter (the end of Microsoft's fiscal year, where managers are under the greatest pressure to close deals before the year ends). So, as this chart from Statista shows, the September 2015 quarter also showed slow growth, but it picked up at the end of the year.

If the number stays low next quarter, though, that could signal a problem.

That said, "run rate" is a pretty loose measurement — it's supposed to measure the amount of money Microsoft is collecting from cloud contracts right now, if the value of those contracts are extrapolated out to twelve months. But it depends on things like the duration you're measuring and the nature of the contracts signed.

NOW WATCH: How to find out your Uber passenger rating

See Also:

- Microsoft stock belly-flops on earnings miss, tax hit, and weak guidance

- A huge shift in the Android market is hurting Microsoft

- Intel to slash 12,000 jobs and take a $1.2 billion charge, stock drops

SEE ALSO: What Google has been spending on its 'moonshot' projects