( click to enlarge )

( click to enlarge )FORM Holdings Corp. (NASDAQ:FH) Could be ready to bounce again! The insiders are very bullish about the stock with very heavy buying last week with total of almost 110.000 shares. The last time they bought so much stock was in September of 2016 and the stock rose more than 100% in just few trading sessions, so let's see if the history will repeat itself. From a technical standpoint, the price action broke this channel upward, giving a strong buy signal. Now that the stock is above the upper line of the channel more buyers should be coming.

( click to enlarge )

( click to enlarge )MannKind Corporation (NASDAQ:MNKD) stock was very strong trading 2x normal daily volume. MNKD had big buyers in it all day and looks ready to make another move tomorrow. I am keeping the stock on the list for the next few days and I expect to see the stock pop up to $1.8 again. The next major resistance level for the stock is located at $1.56. A close above this level would be very bullish.

( click to enlarge )

( click to enlarge )Applied Optoelectronics Inc (NASDAQ:AAOI) brokeout from a sideways consolidation with large volume. I'll be watching the stock again on Tuesday for a follow through. Resistance is $71.34, which was today’s high.

( click to enlarge )

( click to enlarge )BlackBerry Ltd (NASDAQ:BBRY) Shorts continue to get squeezed in this name and the rally has more legs to go. For the first time in many years, the closed above the declining weekly EMA200, which is a strong bullish indicator. Next major resistance lies around the 12.50.

( click to enlarge )

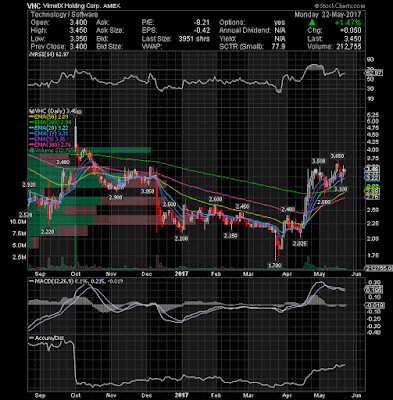

( click to enlarge )VirnetX Holding Corporation (NYSEMKT:VHC) is still consolidating above the major EMAs, so i look for further gains towards the 3.6/3.65 resistance area. Uptrend remains intact above the 3.10 level.

( click to enlarge )

( click to enlarge )ContraVir Pharmaceuticals Inc (NASDAQ:CTRV) is looking perfect right now, with momentum building to the upside and a Possible breakout coming very soon. Make sure you keep watching CTRV, based on the chart it could be a huge winner (the Accumulation/Distribution line still high and trending sideways). First target 90c

( click to enlarge )

( click to enlarge )Acacia Communications, Inc. (NASDAQ:ACIA) still looks poised to break higher. A move above 49.65 would confirm the breakout, with an initial target of 51.12 and secondary target of 55

If you want to contact me for advertising opportunities on blog or twitter, then get in touch via email

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC