This will be interesting.

This will be interesting.

After saying they would for the last 10 days, driving oil from $47.50 on 9/11 to $51 (7.4%) on Wednesday (now $50.45), OPEC has now decided they will "wait and see" what happens between now and their March meeting. As U.S. shale oil continues to thrive and seasonal demand wanes, the surplus that has weighed on markets for three years could return. If OPEC doesn’t extend the supply curbs, the market will return to oversupply again, forecasts from the International Energy Agency indicate.

Our average on the Oil (/CL) Futures shorts is $50.48 on 10 contracts and we're waiting fo the great unwind, which probably won't happen today as the weekend is here but these contracts run until 10/20 and there are 1.267Bn FAKE!!! orders over at the NYMEX in the front four months – so we're pretty confident there will be a catastrophic sell-off at some point.

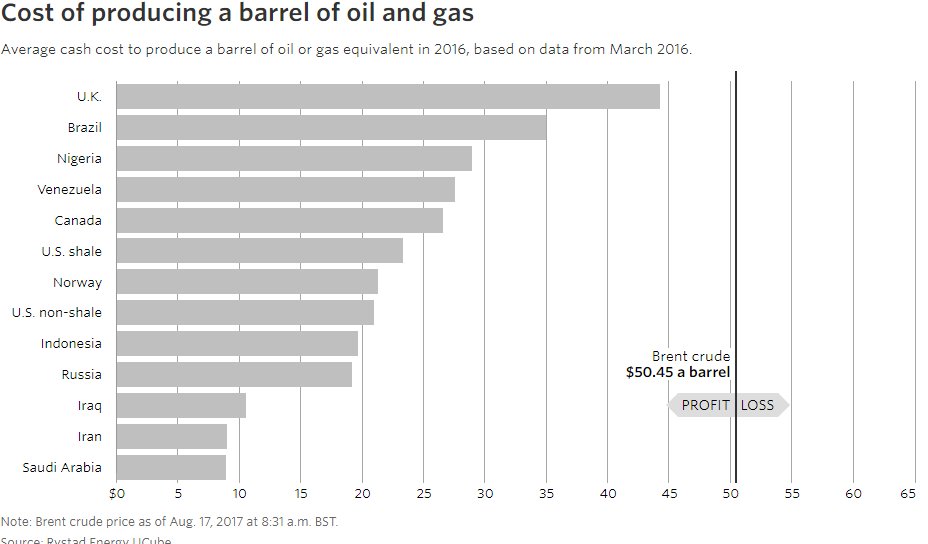

We're confidend shorting at $50-$51 because that's the point at which everyone makes money producing oil. Even the high-cost UK (where all oil is deep-water) makes 10% selling $50 oil so the incentives to pump all they can at these prices becomes quite high and the prices tend to become self-correcting.

We're confidend shorting at $50-$51 because that's the point at which everyone makes money producing oil. Even the high-cost UK (where all oil is deep-water) makes 10% selling $50 oil so the incentives to pump all they can at these prices becomes quite high and the prices tend to become self-correcting.

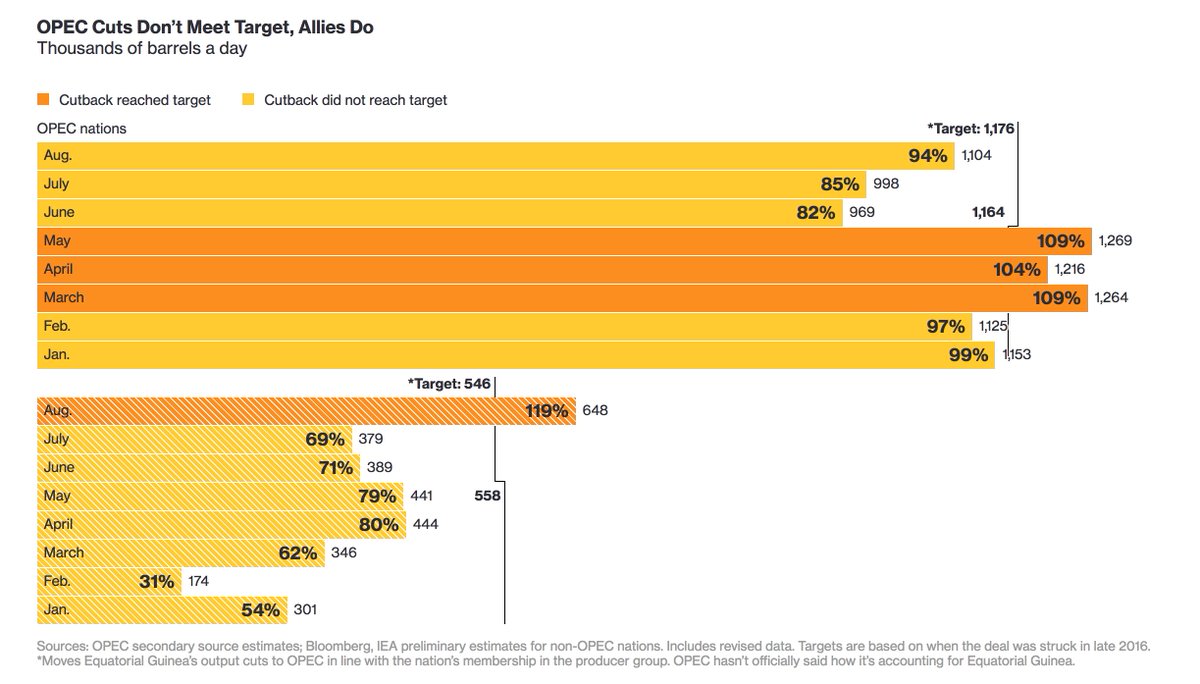

As you can see on the chart, Saudi Arabia has a very unfair advantage over their OPEC buddies with a $9 average production cost so it hurts them a lot less to cut production because their margins are so massive for each barrel sold. They wanted to get the other OPEC producers to agree to cuts but many of those countries are having trouble making their budgets and, as you can see from the first chart – have already been cheating all summer.

When so many people are cheating you either have to call them out for their cheating and get them to stop (the goal of today's meeting) or you have to end the game (the outcome of today's meeting). Now the chips shall fall where they may – along with oil prices – and we expect to at least see $49 again for a $1,500 per contract gain. We'll follow up next week and see how things go. If…