$2,121,342! Not bad for the 4th anniversary of our primary portfolios. We began this lesson on November 26th of 2013 and allocated $500,000 to our Long-Term Portfolio and $100,000 to our Short-Term Portfolio with the intention of demonstrating our balanced, paired portfolio tactics over time. Now, 4 years later, we're up $1,521,342 (253%) , which is right at the top of our 40% annual compounded gains we can expect from this strategy when it goes very well . You can't double up in a year playing a hedged strategy like this because we're constantly betting against ourselves but by " Being the House – NOT the Gambler ", we are able to CONSISTENTLY make 20-40% returns and, in this non-stop bull market – it's been more like 40%. Well, a bit under 40% as $600,000 at 40% compounded for 3 years would be $2.3M but that's my fault, not the system's – as we got so close to goal back in October that I put the brakes on and shifted to a more neutral stance and, in our last review, we " only " made $14,565 for the month and, since last month, we've " only " made another $12,867 – it's like it's hardly worth getting up in the morning, right? Short-Term Portfolio Review (STP) - Submitted on 2017/11/14 at 12:46 pm : $422,970 is up 323% but that's down 7.7% since our last review on 10/19 . That's mostly because I had forgotten an SCO trade we put in the OOP AND the STP and that's a big loser as oil moved badly against it and it was a November call. Even with oil dropping another $1.25 this morning – not enough to save it. Otherwise, the rest of the positions are doing their job but I do want to adjust our hedges. Keep in mind, most of these adjustments are not urgent, make sure you get a good price above all else. FAS – Expensive leftovers from an old spread …

$2,121,342!

$2,121,342!

Not bad for the 4th anniversary of our primary portfolios. We began this lesson on November 26th of 2013 and allocated $500,000 to our Long-Term Portfolio and $100,000 to our Short-Term Portfolio with the intention of demonstrating our balanced, paired portfolio tactics over time. Now, 4 years later, we're up $1,521,342 (253%), which is right at the top of our 40% annual compounded gains we can expect from this strategy when it goes very well.

You can't double up in a year playing a hedged strategy like this because we're constantly betting against ourselves but by "Being the House – NOT the Gambler", we are able to CONSISTENTLY make 20-40% returns and, in this non-stop bull market – it's been more like 40%. Well, a bit under 40% as $600,000 at 40% compounded for 3 years would be $2.3M but that's my fault, not the system's – as we got so close to goal back in October that I put the brakes on and shifted to a more neutral stance and, in our last review, we "only" made $14,565 for the month and, since last month, we've "only" made another $12,867 – it's like it's hardly worth getting up in the morning, right?

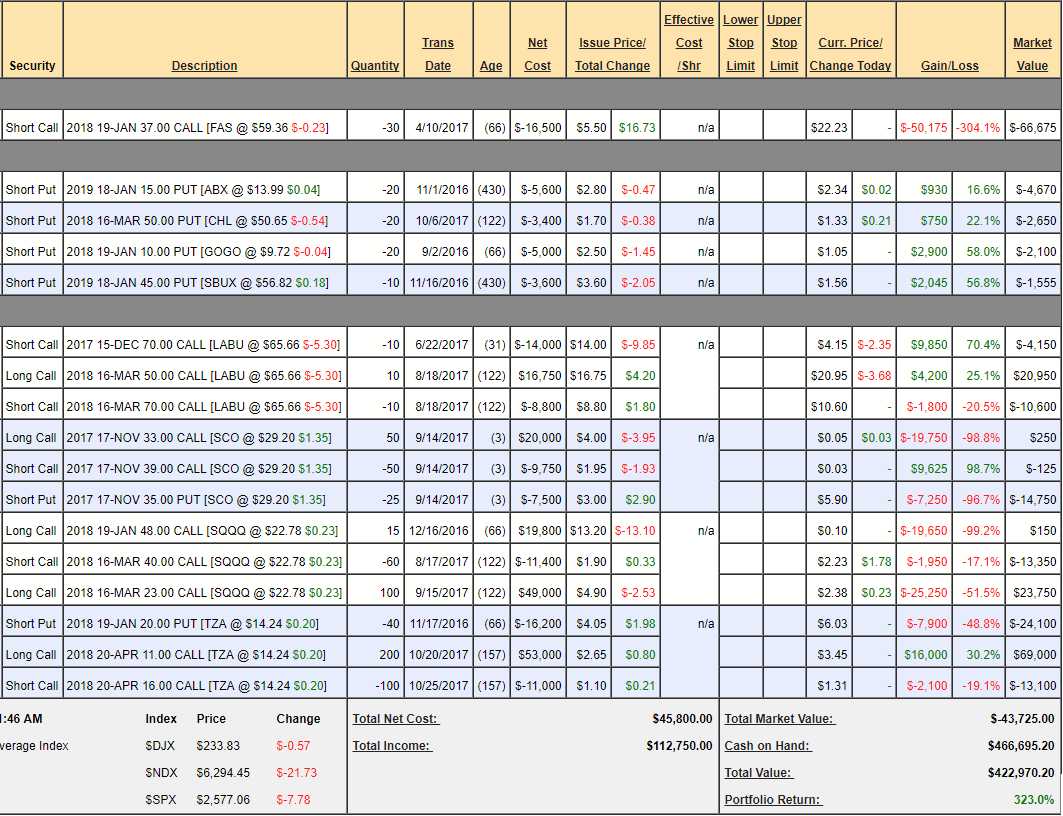

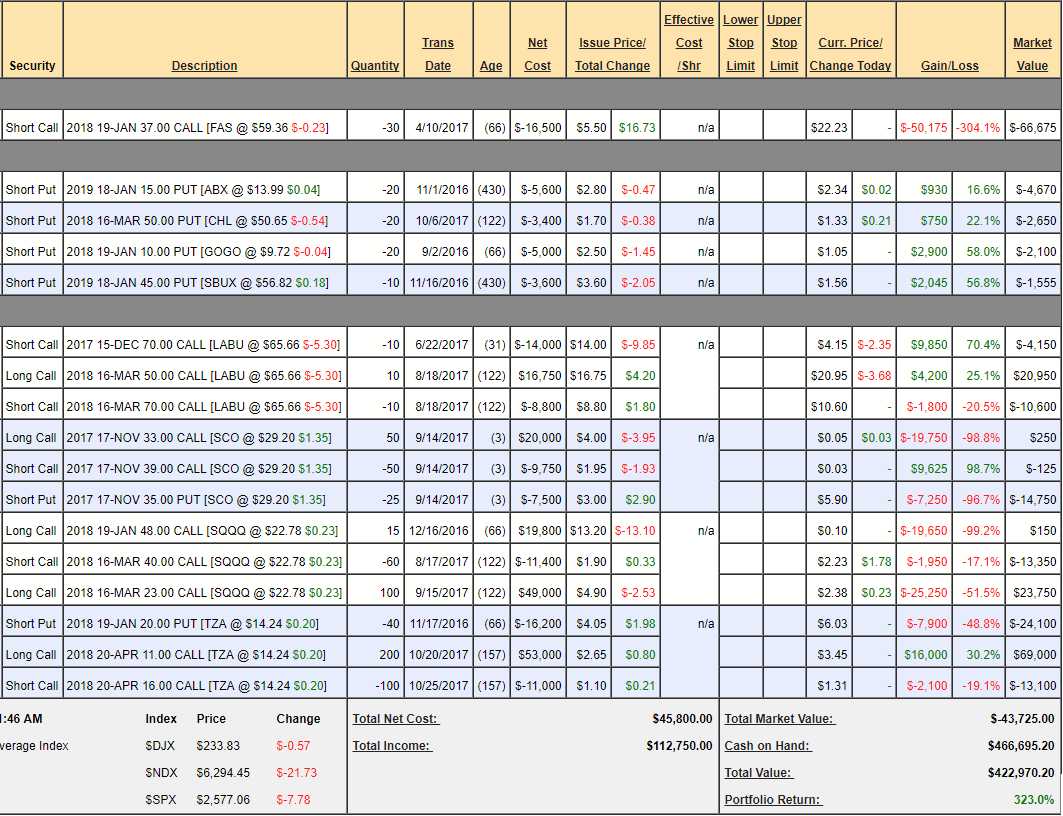

Short-Term Portfolio Review (STP) - Submitted on 2017/11/14 at 12:46 pm: $422,970 is up 323% but that's down 7.7% since our last review on 10/19. That's mostly because I had forgotten an SCO trade we put in the OOP AND the STP and that's a big loser as oil moved badly against it and it was a November call. Even with oil dropping another $1.25 this morning – not enough to save it.

Otherwise, the rest of the positions are doing their job but I do want to adjust our hedges. Keep in mind, most of these adjustments are not urgent, make sure you get a good price above all else.

FAS – Expensive leftovers from an old spread

…

$2,121,342!

$2,121,342!