Finally! We keep betting on it and it finally happens but don't get exicted about this teeny, tiny pullback – it will take a lot more than this little action to derail the bull market. I know it's very much in vogue to ignore "facts" and "news" but we're Fundamental Investors – we can't help ourselves and, when the conditions weaken, we bet against the market, no matter how good the charts look. As I noted in Friday's Morning Report: That means our index shorts ( see yesterday's Morning Report ) are back on in the Futures and we do have S&P ( /ES ) 2,850 this morning and Nasdaq ( /NQ ) 7,000 along with Dow (26,425) and Russell ( /TF ) 1,610 but, as with yesterday, we favor shorting the S&P and the Nasdaq as they cross below with very tight stops over the lines. The once-again weak Dollar is supporting the indexes for now but it's not likely to last (China and Japan won't put up with it past this level). We're not shy about going back to the well and this is just another one of those ways the rich get richer in ways the poor don't even have access to (Futures accounts). We discussed our hedges earlier in the week and I would strongly suggest not going into the weekend without any as it may occur to some people that a declining GDP might not support a 12.5% rise in the S&P since the beginning of Q4. We didn't get a good entry signal (crossing below the lines from above) until Monday morning, when I sent out a 5am note to our Members saying : Futures dipping a little bit but nothing exciting so far. I still have 6 short /ES at 2,854 and 4 short /NQ at 6,999.68 and still long 8 /DX at 89.10. …

Finally!

Finally!

We keep betting on it and it finally happens but don't get exicted about this teeny, tiny pullback – it will take a lot more than this little action to derail the bull market. I know it's very much in vogue to ignore "facts" and "news" but we're Fundamental Investors – we can't help ourselves and, when the conditions weaken, we bet against the market, no matter how good the charts look. As I noted in Friday's Morning Report:

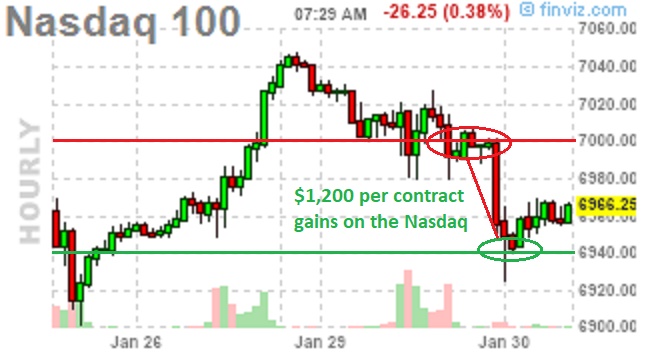

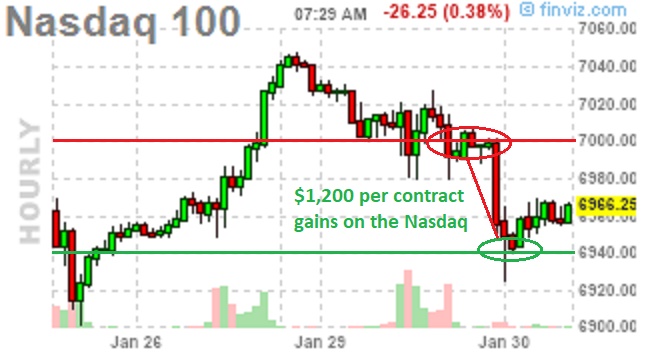

That means our index shorts (see yesterday's Morning Report) are back on in the Futures and we do have S&P (/ES) 2,850 this morning and Nasdaq (/NQ) 7,000 along with Dow (26,425) and Russell (/TF) 1,610 but, as with yesterday, we favor shorting the S&P and the Nasdaq as they cross below with very tight stops over the lines. The once-again weak Dollar is supporting the indexes for now but it's not likely to last (China and Japan won't put up with it past this level).

We're not shy about going back to the well and this is just another one of those ways the rich get richer in ways the poor don't even have access to (Futures accounts). We discussed our hedges earlier in the week and I would strongly suggest not going into the weekend without any as it may occur to some people that a declining GDP might not support a 12.5% rise in the S&P since the beginning of Q4.

We didn't get a good entry signal (crossing below the lines from above) until Monday morning, when I sent out a 5am note to our Members saying:

Futures dipping a little bit but nothing exciting so far. I still have 6 short /ES at 2,854 and 4 short /NQ at 6,999.68 and still long 8 /DX at 89.10.

…

Finally!

Finally!