Well, that about sums it up, right? As I said in yesterday morning's Report: " On the whole, I'd rather if we consolidate here before even popping above 2,700 again as 2,850 was too high. Hopefuly we can hang around 2,650 for a week or two and form a proper base before trying to move higher again – but traders are so impatient.… " Well, it's been a day and people are already freaking out because we haven't flown back to 2,850 and it's going to be a while before they realize 2,850 shouldn't have happened in the first place and it's more likely that this (2,700) is the top of the range, not the bottom – at least through Q2. On our Big Chart, 2,640 is the 20% line on the S&P and, even being generous, THAT should be the middle of a range we move 5% up (2,772) and 5% down (2,508) in, so call it 2,500 to 2,800 with 2,650 the middle line. That's where I think we'll settle once all the dust clears. This morning, however, in our Live Member Chat Room, we are playing for a bounce using the following levels: I also like /TF over 1,500 and /NQ over 6,600 and /NQ is lagging and likely to pop big if we get moving. /YM 24,800 and /ES 2,675 will confirm and tight stops if 2 of the 3 fail to hold those lines! Remember, 25 points (back to 2,700) on the S&P ( /ES ) is good for $1,250 per contract – nothing to sneeze at. The Russell ( /TF ) hit 1,520 yesterday and that's up $1,000 per contract and the Nasdaq hit 6,700 and getting back there pays $2,000 per contract, so it's well worth playing for the bounce and the BOE gave a more hawkish statement this morning and that should keep the Dollar in check and allow our indexes a bit of breathing room today. In the Futures, we tested 2,550 on Tuesday and our 30% line is 2,860 and 2,640 is 20% so, ignoring the spike below, we have a 220-point drop and our 5% Rule™ tells us to expect a 20% weak bounce off that fall (44 points) back to 2,684 and then the strong bounce line…

Well, that about sums it up, right?

Well, that about sums it up, right?

As I said in yesterday morning's Report: "On the whole, I'd rather if we consolidate here before even popping above 2,700 again as 2,850 was too high. Hopefuly we can hang around 2,650 for a week or two and form a proper base before trying to move higher again – but traders are so impatient.…"

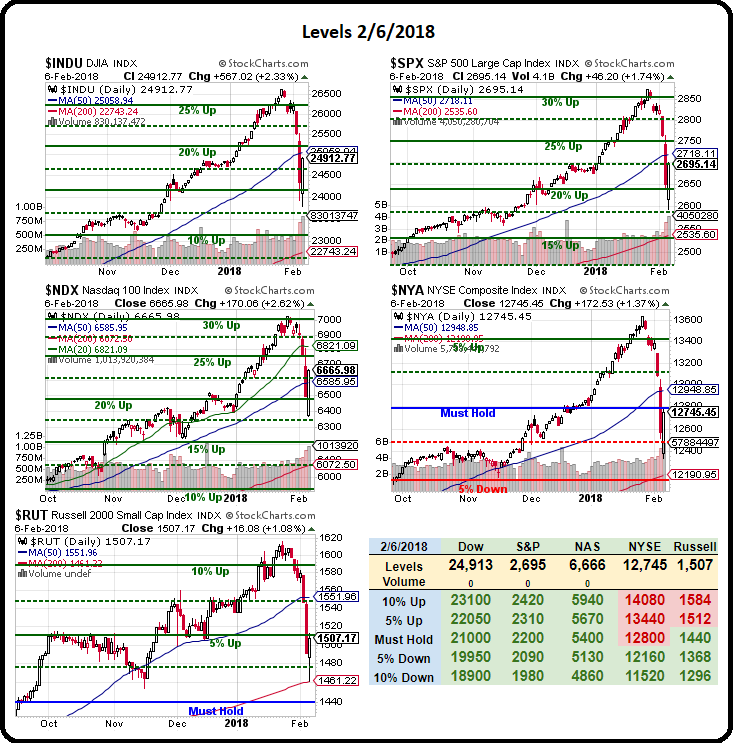

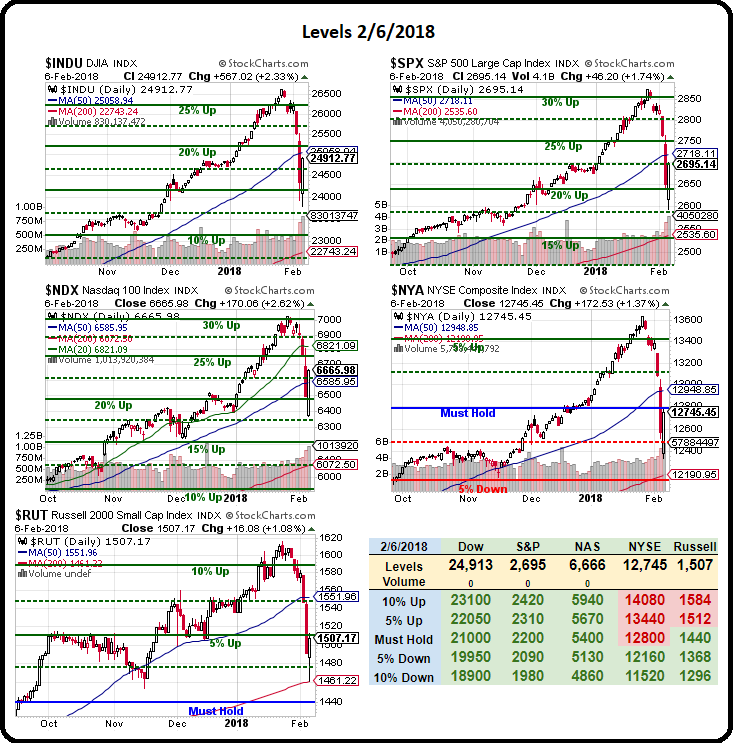

Well, it's been a day and people are already freaking out because we haven't flown back to 2,850 and it's going to be a while before they realize 2,850 shouldn't have happened in the first place and it's more likely that this (2,700) is the top of the range, not the bottom – at least through Q2. On our Big Chart, 2,640 is the 20% line on the S&P and, even being generous, THAT should be the middle of a range we move 5% up (2,772) and 5% down (2,508) in, so call it 2,500 to 2,800 with 2,650 the middle line. That's where I think we'll settle once all the dust clears.

This morning, however, in our Live Member Chat Room, we are playing for a bounce using the following levels:

I also like /TF over 1,500 and /NQ over 6,600 and /NQ is lagging and likely to pop big if we get moving. /YM 24,800 and /ES 2,675 will confirm and tight stops if 2 of the 3 fail to hold those lines!

Remember, 25 points (back to 2,700) on the S&P (/ES) is good for $1,250 per contract – nothing to sneeze at. The Russell (/TF) hit 1,520 yesterday and that's up $1,000 per contract and the Nasdaq hit 6,700 and getting back there pays $2,000 per contract, so it's well worth playing for the bounce and the BOE gave a more hawkish statement this morning and that should keep the Dollar in check and allow our indexes a bit of breathing room today.

In the Futures, we tested 2,550 on Tuesday and our 30% line is 2,860 and 2,640 is 20% so, ignoring the spike below, we have a 220-point drop and our 5% Rule™ tells us to expect a 20% weak bounce off that fall (44 points) back to 2,684 and then the strong bounce line…

Well, that about sums it up, right?

Well, that about sums it up, right?