$134 BILLION!

$134 BILLION!

That's what Jeff Bezos is worth this morning as Amazon (AMZN) crushed earnings last night with $51Bn in sales for Q1, up 43% ($16Bn) from Q1 last year. And Q1 is usually AMZN's slowest quarter so we're taking about possibly a $300Bn year, which would make Amazon approximately 1/10th of all US Retail Sales and growing at 43% means we are 7 years away (do the math) from AMZN putting every other retailer out of business.

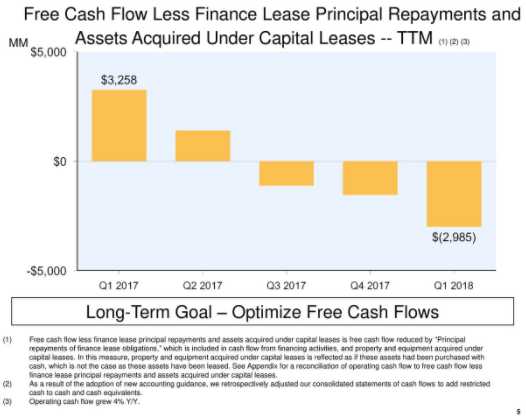

Operating income was $1.927Bn, which seems good but not when you consider $3Bn of that $2Bn in profit came from cloud services and the rest of the business lost $1Bn. In fact, inclusive free cash flow was NEGATIVE $3Bn but let's not cloud the Amazon celebration with ugly facts like those.

I didn't make this up – it's their own slide! Still, $4Bn of that $3Bn "loss" came from leasing payments (cloud computers are expensive) and they are kind of an asset – until the next generation of computers comes out in 18 months. One thing Amazon will be doing to close the ga is raising the fees on 100M Prime Members by $20, which will drop another $2Bn to the bottom line but it won't help much if they are burning $3Bn a quarter.

I didn't make this up – it's their own slide! Still, $4Bn of that $3Bn "loss" came from leasing payments (cloud computers are expensive) and they are kind of an asset – until the next generation of computers comes out in 18 months. One thing Amazon will be doing to close the ga is raising the fees on 100M Prime Members by $20, which will drop another $2Bn to the bottom line but it won't help much if they are burning $3Bn a quarter.

Speaking of slides, that's what the Retail ETF (XRT) and the rest of retailers are likely to do if Amazon's gains turn out to be Retail's losses. I just ordered $60 worth of Nespresso pods this morning on Amazon despite the fact I was right in a grocery store yesterday. Amazon is very good at getting you into the habit of buying things once you let them know what your preference is and now they are delivering things to the trunk of your car if you want!

We don't have a lot of Retailers in our portfolios and we went over the ones we do like in yesterday's Live Trading Webinar (replay available here). I imagine we'll see some real bargains popping up over the next couple of weeks and we're still in the middle of the end for Toys R Us and Sears though Toys R Us is more like the end of the end now.

IN PROGRESS