Hooray!

Whatever happened to "hooray" – apparently people used to chant it all the time. We should bring that back. Apparently we're bringing back NAFTA as Canada signs on over the weekend and that is rocketing the markets much, much higher than when we used to have NAFTA, which Trump called a terrible trade deal and now we have a new NAFTA, which is the same as the old NAFTA but now it's called the US-Mexico-Canada Agreement because Trump hates anything that had to do with Democrats and because Republicans are about as creative with naming things as a demented parrot.

The fact that USMCA was already the US Minority Contractors Association and now Trump has subsumed the name and ruined their Google ranking, plunging the association into web obscurity is just a bonus for those who want to make America white great again. The bill is a little better for US dairy farmers but, in typical GOP doublespeak BS, the 2.6M vehicle restriction is miles above (40%) what we currently import – that's not a restriction – it's an invitation for growth!

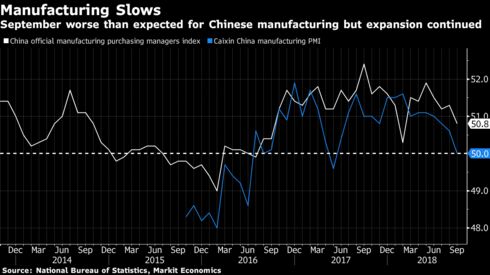

Meanwhile, China is not fixed but because we made deals with Canada and Mexico, people hope we can work something out with China as well. China's PMI dropped to 50.8 in September – that's barely expanding and the lowest since 2016 and missed the 51.2 expected by leading economorons by a wide margin. New Orders fell to 48, which is contracting – also for the first time since 2016.

Meanwhile, China is not fixed but because we made deals with Canada and Mexico, people hope we can work something out with China as well. China's PMI dropped to 50.8 in September – that's barely expanding and the lowest since 2016 and missed the 51.2 expected by leading economorons by a wide margin. New Orders fell to 48, which is contracting – also for the first time since 2016.

“The further slowdown in China’s official manufacturing PMI in September reflects the intensifying impact of the U.S.-China trade war on China’s manufacturing export sector,” said Rajiv Biswas, APAC chief economist at IHS Markit in Singapore. “The near-term outlook for the Chinese manufacturing export sector remains weak, albeit the Chinese government may apply some further stimulus measures to support growth.”

That worsening follows on from a slowdown in industrial profit growth in August. Private companies fared worse than state-owned enterprises, but discrepancies in that data suggest that the picture for Chinese manufacturers may be worse than officially-reported growth rates show. The official PMI report also indicates rising unemployment in the manufacturing sector. Analysts also expect China’s central bank will continue…