2,500!

The S&P 500 took back a critical level this morning in the Futures as we're back over the 2,500 line and holding that would be a good sign to close out 2019 – despite the epic disaster that we've already endured in Q4 as we fell from 2,950 to 2,360 so 600 (ish) points down invives 120-point bounces (20% of the drop) and 2,489 was the weak bounce line we expected last week but we're not going to be very impressed until we're back over the strong bounce line at 2,600, along with the other strong bounce lines on the other indexes:

- Dow 27,000 to 21,600 is 5,400 points so 1,080-point bounces to 22,680 (weak) and 23,760 (strong)

- S&P 2,950 to 2,360 is 590 points so 120-point bounces to 2,480 (weak) and 2,600 (strong)

- Nasdaq 7,700 to 6,160 is 1,540 points so 300-point bounces to 6,460 (weak) and 6,760 (strong)

- NYSE 13,200 to 10,560 is 2,640 points so 528-point bounces to 11,058 (weak) and 11,586 (strong)

- Russell 1,750 to 1,400 is 350 points so 70-point bounces to 1,470 (weak) and 1,540 (strong)

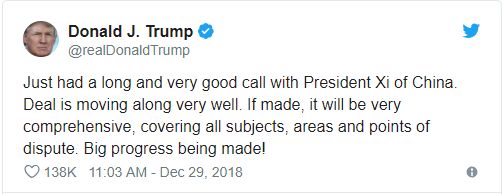

Despite the surge in the Futures, we haven't gained a single green box since Friday morning's Report and today is going to be a light trading day and tomorow the markets are closed so we can't take anything very seriously today. Not only that, but the market is mainly up this morning based on something Donald Trump said over the weekend, as he tweeted:

Despite the surge in the Futures, we haven't gained a single green box since Friday morning's Report and today is going to be a light trading day and tomorow the markets are closed so we can't take anything very seriously today. Not only that, but the market is mainly up this morning based on something Donald Trump said over the weekend, as he tweeted:

It's amazing to me that the market takes anything Trump says seriously as the man lies twice as often as he tells the truth (not hyperbole – a statistical fact as 70% of his public statements over the past two years have been lies) so betting against what he says is the higher-percentage play. Nonetheless, the market jumped on the news and now we'll have to sit back and see if it sticks but it's very easy to move the indexes between the resistance levels – breaking those levels is another story entirely.

I have not read anything from the Chinese side that confirms any great progress being made – this is much more likely a desperate attempt by Trump to calm the markets and avoid breaking the 1931 record for worst December in stock market history. We all know the President likes to keep score and he used to love talking about his score in the markets – about 20% ago….

IN PROGRESS