We're still at 11,000 on the Nasdaq . We punched over it a bit yesterday and we're into our second round of shorts on the Nasdaq ( /NQ ) Futures now and you can still catch them crossing the 11,000 line with tight stops above, which is a more conservative way to play. We scaled back in overnight, taking advantage of the spike up to end up with 3 short at 11,048 average so 11,000 is now our stop line to lock in the net $1,000 per contract gains (there were some losses that are offset). The Russell ( /RTY ) is below 1,500 so, as long as that stays below, it's still good to short /NQ and the Dow ( /YM ) failed 26,600 and the S&P ( /ES ) failed 3,300 again and we're probably on the way back to 3,150, which is the Must Hold Line on our Big Chart and also now the 50 dma(ish). Our tracking chart for the S&P is more conservative as we don't think this bull run will last so the Must Hold line on the SPX is still 2,850 and thats' a solid 15% drop from where we are now: Our hedges in the Short-Term Portfolio are holding up well and the portfolio itself is up 373% for the year as the STP loves volatility – and we've had plenty of that. Although it's early in the month, not much is happening today so it's a good time to go over our hedges and see if there's anything we should adjust ( there wasn't last time ). We haven't touched the positions since July 14th (3 weeks) other than adding the short INTC puts but, since then, the Long-Term Portfolio (LTP) has gained $75,000 AND the Short-Term Portfolio (STP) is up $70,000 too – not bad for leaving things alone! CANE – I thought sugar consumption may go up during a pandemic and so far, so good and we're well over our very conservative target. Keep in mind that we sold the Oct $5 puts for 0.75 so our net entry is $4.25 and we make 0.75 (17.6% against risk) if CANE is …

We're still at 11,000 on the Nasdaq.

We're still at 11,000 on the Nasdaq.

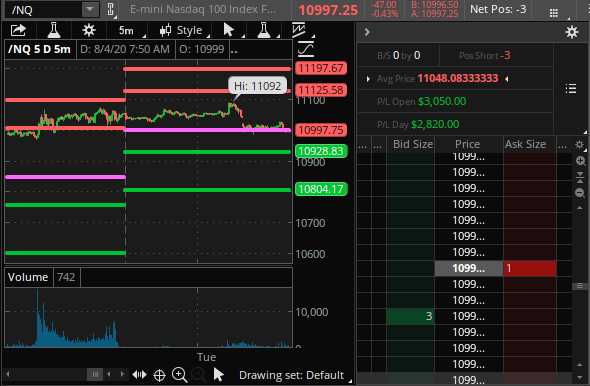

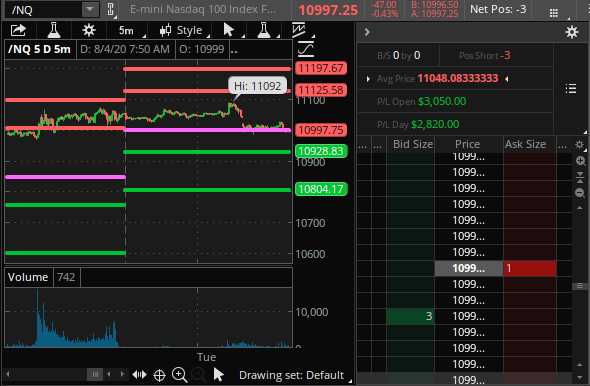

We punched over it a bit yesterday and we're into our second round of shorts on the Nasdaq (/NQ) Futures now and you can still catch them crossing the 11,000 line with tight stops above, which is a more conservative way to play. We scaled back in overnight, taking advantage of the spike up to end up with 3 short at 11,048 average so 11,000 is now our stop line to lock in the net $1,000 per contract gains (there were some losses that are offset).

The Russell (/RTY) is below 1,500 so, as long as that stays below, it's still good to short /NQ and the Dow (/YM) failed 26,600 and the S&P (/ES) failed 3,300 again and we're probably on the way back to 3,150, which is the Must Hold Line on our Big Chart and also now the 50 dma(ish). Our tracking chart for the S&P is more conservative as we don't think this bull run will last so the Must Hold line on the SPX is still 2,850 and thats' a solid 15% drop from where we are now:

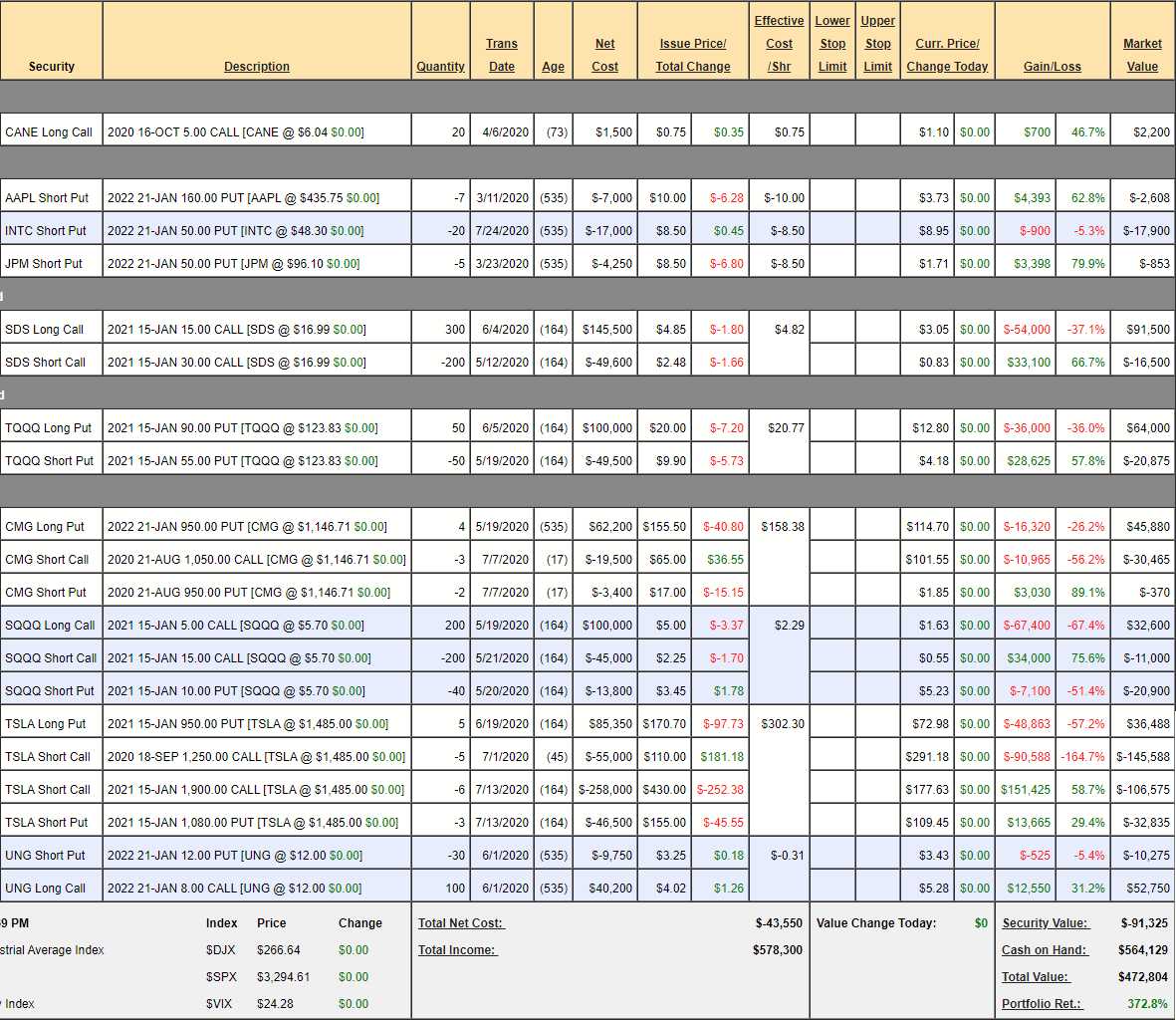

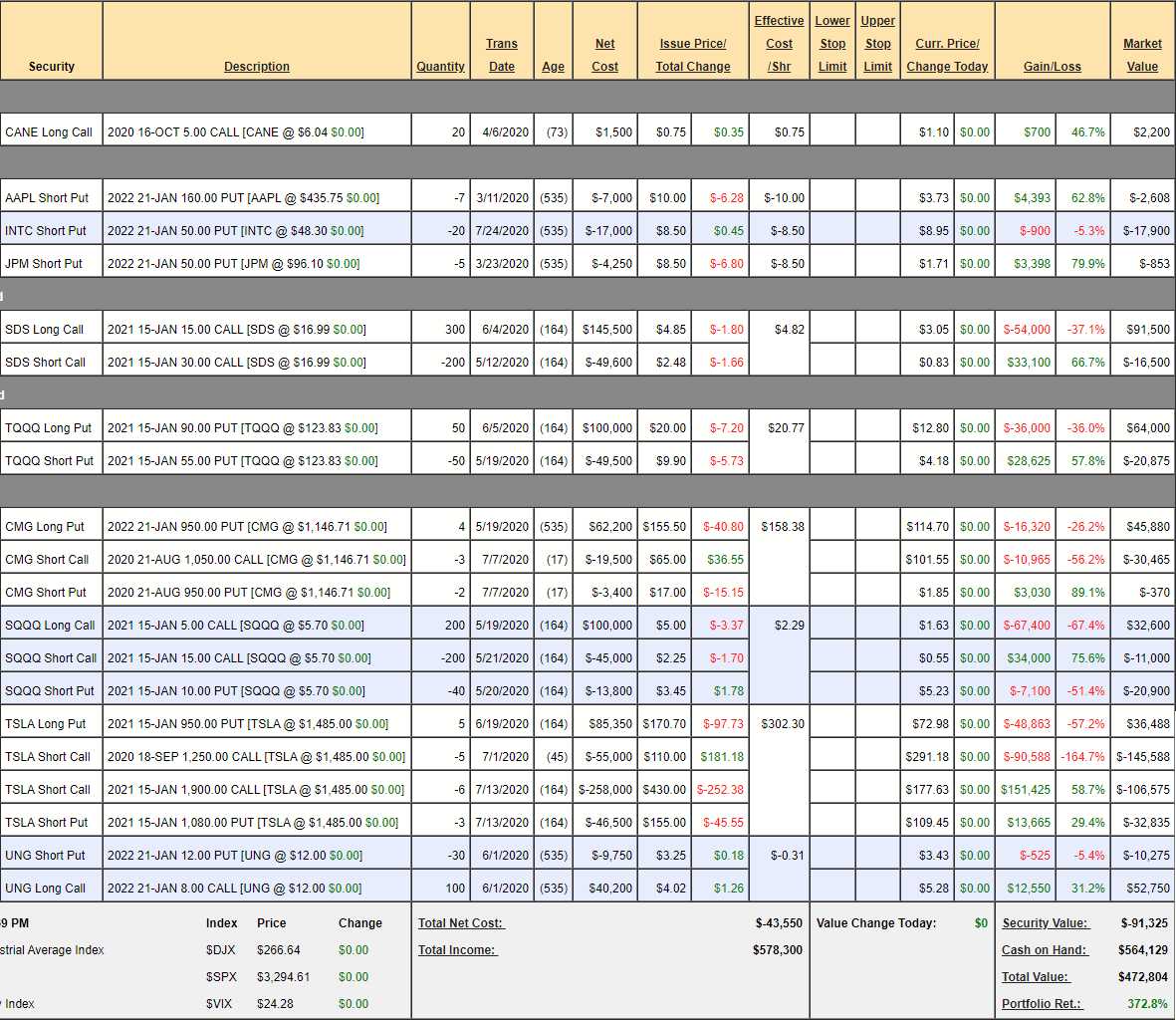

Our hedges in the Short-Term Portfolio are holding up well and the portfolio itself is up 373% for the year as the STP loves volatility – and we've had plenty of that. Although it's early in the month, not much is happening today so it's a good time to go over our hedges and see if there's anything we should adjust (there wasn't last time). We haven't touched the positions since July 14th (3 weeks) other than adding the short INTC puts but, since then, the Long-Term Portfolio (LTP) has gained $75,000 AND the Short-Term Portfolio (STP) is up $70,000 too – not bad for leaving things alone!

- CANE – I thought sugar consumption may go up during a pandemic and so far, so good and we're well over our very conservative target. Keep in mind that we sold the Oct $5 puts for 0.75 so our net entry is $4.25 and we make 0.75 (17.6% against risk) if CANE is

…

We're still at 11,000 on the Nasdaq.

We're still at 11,000 on the Nasdaq.