Real estate investing isn't only for millionaires — retail investors can get a shot at investing in major commercial real estate endeavors by investing in REITs. Specialty REITs help investors refine their investment preferences by capitalizing on tenant returns tied to specific industries.

Real estate investing isn't only for millionaires — retail investors can get a shot at investing in major commercial real estate endeavors by investing in REITs. Specialty REITs help investors refine their investment preferences by capitalizing on tenant returns tied to specific industries.

Office REITs are those associated with office and commercial spaces in major metropolitan areas. Investing in a major city office REIT can help you gain exposure to hot real estate markets like San Francisco and New York City without putting down millions for a down payment.

Are you considering investing in office REITs? Read on to learn more about this unique type of specialty REIT, how office REITs work and a few of the top investment options in this sector.

What is an Office REIT?

Before discussing office REITs, you must understand what a REIT is and what makes it unique. Real estate investment trusts (REITs) are specialized companies that own and operate real estate ventures for profit. These companies usually purchase residential or commercial spaces, rent them out to tenants and use a portion of rental income to maintain and manage the property.

REIT stocks can be attractive to investors because to qualify as a REIT, a real estate company must meet specific requirements set forth by the Securities Exchange Commission (SEC). One of these requirements is that REITs must pay out at least 90% of their taxable income in the form of dividends. This means that the right REIT can create a reliable and consistent stream of passive income for investors. While you should look at more than dividend yield when comparing REITs, on average, dividend payments from REITs are higher than non-REIT companies.

As the name suggests, office REIT stocks are stocks associated with REITs that primarily invest in office spaces and corporate buildings without specialized industrial or warehouse capabilities. The top office REITs own properties in prime locations within major metropolitan areas, central business districts or other high-demand commercial areas. These locations attract high-quality tenants and often command premium rental rates, leading to increased dividend payments to investors when properly managed.

5 Office REITs to Buy Now

5 Office REITs to Buy Now

Now that you understand the basics of an office REIT and how it works, you can compare publicly traded office space REITs. The following are five top most-watched office REITs right now.

Orion Office REIT

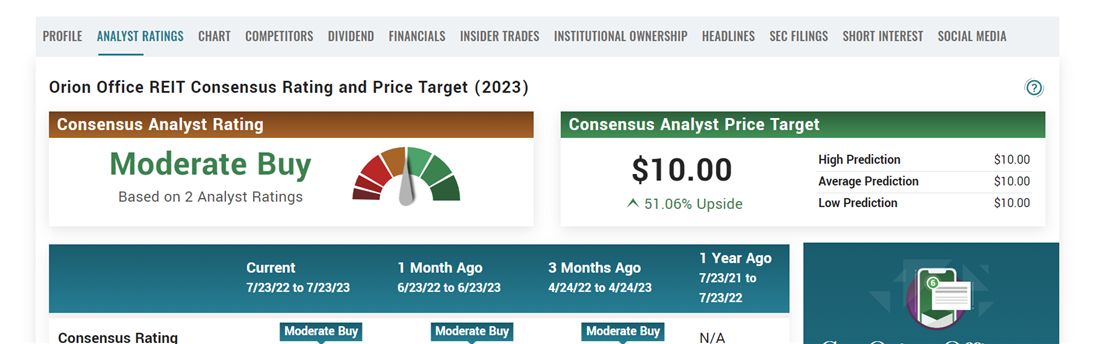

Orion Office REIT (NYSE: ONL) is a highly diversified office REIT that invests in mission-critical and corporate headquarters across the United States. One of the features that sets Orion apart from competitors is its commitment to holding a diverse range of properties; the company's current holdings include 81 wholly-owned properties and six unconsolidated joint venture properties. No single tenant makes up more than 12.1% of Orion's residency, contributing to a more stable portfolio of tenants. Orion Office REIT maintains a market capitalization of $375 million and showcases a dividend yield of 6% as of July 2023.

Image: With a "moderate buy" rating and a 50% upside on its current price target, ONL can be an appealing entry point for REIT investors.

Vornado Realty Trust

If you're searching for a blue-chip real estate investment, the longstanding name Vornado Realty Trust (NYSE: VNO) could be a strong choice. Vornado is one of the largest office landlords in the United States, with a diverse portfolio of commercial real estate assets, including office buildings, retail properties and other mixed-use developments. Its market capitalization of more than $3.9 billion also makes it one of the biggest office building REITs.

Image: With a total market capitalization of almost $4 billion, Vornado Realty Trust is one of the largest office REITs in the country.

Image: With a total market capitalization of almost $4 billion, Vornado Realty Trust is one of the largest office REITs in the country.

Vornado owns and operates a substantial portfolio of office properties, primarily concentrated in major urban markets such as New York City and the D.C. metropolitan area. It is particularly known for its extensive holdings in Manhattan, including the iconic 1290 Avenue of the Americas building. While Vornado's core business focuses on office properties, it also owns retail assets, such as shopping centers, street retail and some residential properties.

Boston Properties

Another major name in U.S. real estate, Boston Properties (NYSE: BXP), also focuses on high-quality office buildings in major urban markets, catering to top-tier tenants with higher corporate budgets. The company's properties are usually located in major metropolitan areas, such as Boston, New York City, Washington D.C., San Francisco and Los Angeles.

In addition to the standard model of purchasing buildings and charging rent like other office REIT stocks, Boston Properties is also involved in constructing new commercial spaces. These development projects further fuel the company's growth, providing vertical integration for its office space operations. In July 2023, Boston Properties was one of the largest office REITs in the United States, with a total market capitalization of almost $10 billion. It also maintains an attractive yet stable dividend yield of 6.18%.

Alexandria Real Estate Equities

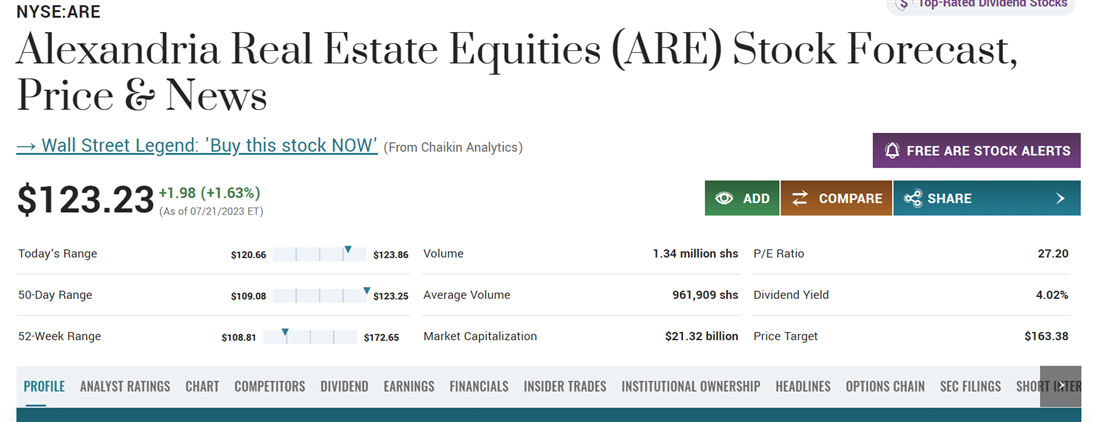

Alexandria Real Estate Equities Inc. (NYSE: ARE) is another major office REIT, with holdings in key metropolitan areas like New York City, Boston and Triangle Park in North Carolina. Alexandria primarily concentrates on properties that cater to the needs of life science and technology companies, with lab and office companies making up most of its major properties. The company's properties are strategically located in major innovation clusters and life science hubs to increase the concentration of high-value, research and development-oriented clientele. With a total market capitalization of $21 billion, Alexandria is also one of the biggest office REITs in the country.

Image: With a total market capitalization of over $20 billion, ARE can be a strong choice for blue-chip real estate investors.

Image: With a total market capitalization of over $20 billion, ARE can be a strong choice for blue-chip real estate investors.

Hudson Pacific Properties

While most other REITs on our list specialize in East Coast properties, you can add West Coast exposure with Hudson Pacific Properties Inc. (NYSE: HPP). Hudson Pacific Properties owns and operates a series of office and studio spaces across the West Coast, with major operations in Los Angeles, San Francisco, Silicon Valley, Seattle and Vancouver.

The company's portfolio consists of well-located, modern and innovative properties with amenities that cater to the needs of its target tenant base. For example, many of the company's operational office spaces include studio spaces that enhance creativity and provide shooting flexibility. It also features a higher dividend yield of almost 9%, which can attract income investors.

How to Invest in Office REITs

Investing in office REITs is similar to investing in other stocks, as many trade on major exchanges. Use the following steps to get started and start investing.

Step 1: Open a brokerage account.

If you don't already have a brokerage account, you'll need to open one before buying and selling shares of stock. A brokerage account is a type of financial account that allows individuals to buy, sell, and hold various investment assets, including REITs and other types of stocks. Brokerage accounts are maintained by brokerage firms, which are companies authorized by the SEC to buy and sell shares of securities on behalf of retail investors.

Some factors you may want to consider before selecting a broker include the exchanges you have access to, account minimums, the type of trading tools you have access to, and more.

Step 2: Research available REITs.

The broker you select will determine which markets you have access to and the type of assets you can hold in your account. After opening your brokerage account, look at the available stocks that correlate with your risk tolerance and investing objectives. Many brokers allow you to narrow down and organize assets by sector, making it easy to directly compare REITs by price, market capitalization and other factors.

Step 3: Place a buy order.

After selecting a stock you want to buy, navigate to the stock or fund's page on your brokerage app. You can find the stock you want to buy by searching for the corresponding ticket. If you haven't already funded your brokerage account, you'll need to link a funding method like a bank account or debit card before you buy. Be sure not to invest more than you can afford to lose in a single company, especially when discussing high-volatility options like REITs.

Step 4: Monitor your investment.

One of the primary attraction points that office REITs offer is their higher dividend distributions. When you buy a share of REIT stock, you're entitled to receive dividends according to the company's payment schedule. You'll see dividends deposited to your brokerage account on the payment date unless you enable dividend reinvestment features.

Pros and Cons of Office REITs

Be sure to consider the pros and cons of investing in an office REIT before risking any investment capital.

Pros

Office REITs can be profitable investments, especially considering dividend income potential.

- Dividend income: Like other REIT types, office REITs pay out most taxable income back to shareholders as dividends. This income potential is a major draw for investors, providing a reliable and consistent passive income stream.

- Enhanced liquidity: In investing, "liquidity" refers to how easy or difficult it is to sell an asset once it's in your control. Most office REITs trade on major exchanges, making it very easy to sell your shares if you need quick cash to cover medical expenses.

- Access to prime locations: Office REITs usually own properties in prime locations and major business districts, which may be challenging for individual investors to access due to high costs.

Cons

Like other types of specialized REITs, office building REITs have risks and limits associated with specific concentrations.

- Tenant risk: The performance of office REITs heavily depends on their tenant base and lease agreements. If major tenants vacate properties or face financial challenges, it can lead to higher vacancy rates and lower rental income. The rise of remote work during the COVID-19 pandemic has made this a particularly pronounced risk for office REIT investors.

- Concentrated risk: Office REITs are specialized investments focused only on office properties. This highly specialized concentration can lead to higher losses if this sector performs poorly.

Should You Invest in Office REITs?

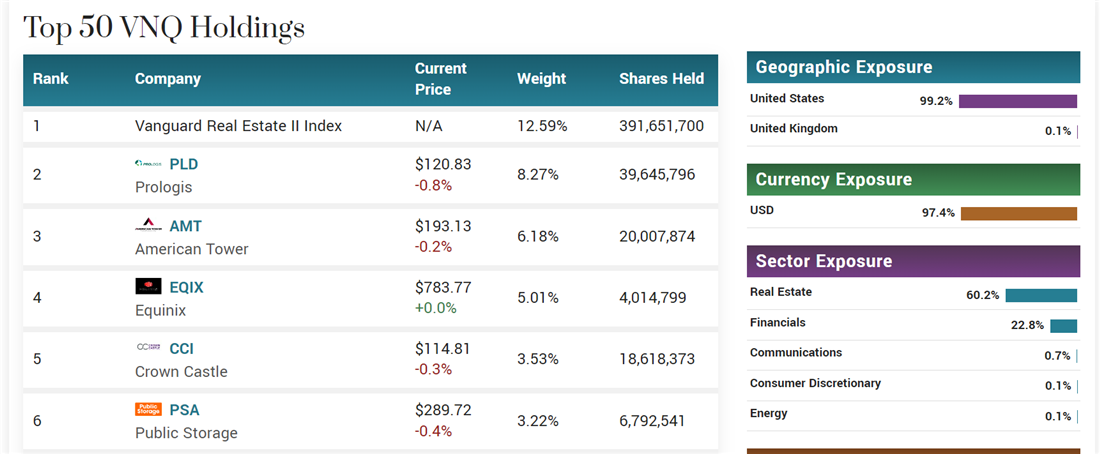

Interested in investing in REITs but don't have the prior knowledge required to select individual stocks? Investing in a REIT ETF can be a better choice in these situations. Like other exchange-traded funds (ETFs), REIT ETFs contain a "basket" of real estate stocks, with some ETFs focusing on a particular sector like commercial office spaces. By buying into the fund, you gain exposure to all stocks included in the fund, instantly diversifying your holdings. This can be a stronger choice for first-time real estate investors.

FAQs

The following are some last-minute questions you might have about REITs.

What are the largest office REITs?

When measured by market capitalization, the largest office REITs in the United States are Alexandria Real Estate Equities, Boston Properties, Gecina, Nippon Building Fund and Dexus. Note that not all of these stocks trade on American exchanges like the New York Stock Exchange, meaning you'll need international market access to buy and sell these shares.

What is the market cap of office REITs?

The term "market cap" is a specific figure calculated by multiplying the number of outstanding stock shares by each share's current price. There is no singular "market cap of office REITs," as each REIT will have its own market capitalization based on current data.

Why invest in office REITs?

Investing in office REITs can provide regular dividend income, making them appealing to income-seeking investors. They offer exposure to a diversified portfolio of office properties in prime locations without the need for direct property management, making them more affordable options for most investors. Office REITs can offer liquidity, professional management and the potential for long-term capital appreciation as the real estate market and rental demand evolve.