If you’re a car owner, there’s a good chance you’ve been to a Driven Brands Holdings Inc. (NASDAQ:DRVN) shop.

As North America’s largest automotive services provider, the Charlotte-based company services 70 million vehicles each year at its more than 4,800 service centers. From routine oil changes and maintenance to paint jobs and collision work, Driven is a bumper-to-bumper pit stop for consumer and commercial customers. Meineke, Maaco, Carstar and Take 5 are among its expanding lineup of auto service banners.

Six months ago, Driven Brands was in need of some major repairs of its own. Its stock crashed 41% after management reported lighter-than-expected second quarter profits. Wall Street anticipated earnings per share (EPS) of $0.31 and the company fell $0.09 short. Demand weakness and integration delays in the car wash and windshield repair businesses prompted a 25% full-year adjusted EPS cut. Despite exceeding Q2 revenue estimates, Driven sold off in 27x normal daily volume.

Did shareholders exit the highway too soon? Perhaps so.

Since dipping as low as $10.60 in November 2023, DRVN is up nearly 30%. While the broader rally in U.S. equities deserves some of the credit, so too does an improving financial picture.

Driven Brands’ third quarter results were better aligned with analyst forecasts. Revenue grew 12% year-over-year to $581 million. The revenue mix was 42% maintenance, 25% car wash, 22% paint, collision, & glass, and 10% platform services — a nice, diversified blend of all things auto service. Adjusted EPS ($0.20) was down versus the prior year period but ahead of consensus.

Considering the soft consumer demand backdrop and intensified U.S. car wash competition, the Q3 report helped restore some faith. And considering Driven Brands had beaten Street EPS estimates for nine straight quarters before the August 2023 wreck, the market probably overreacted to the one-off Q2 miss.

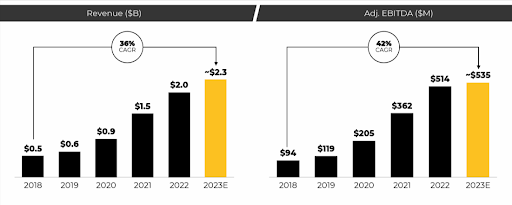

Heading into its February 21st fourth quarter earnings call, Driven Brands appears to be back on course. Management's projection for 2023 revenue of $2.3 billion marks a sixth consecutive year of top-line growth. That's not bad for an old-school auto shop business that hauled in just $100 million a decade ago.

Aging car trend is good for business

Driven Brands’ 33% annualized revenue growth rate since 2012 stems from a variety of factors. For starters, its location count has more than tripled. At the same time, each service center is cranking out higher revenue. Excluding the 2020 pandemic year, same-store sales have grown for 14 straight years. From an investment perspective, this is an attractive trait by itself — but there’s more to the story.

As a comprehensive car care provider, Driven Brands is very much a needs-based business. Consumers and commercial fleet operators are in constant need of required maintenance. Put off oil changes and repairs and they run the risk of higher bills down the road. This makes their vehicles a steady source of demand throughout the economic cycle. So while DRVN is grouped with the industrial sector, the essential nature of its services makes it more of a defensive play — a de facto consumer staple.

Looking down the road, Driven’s growth will likely be fueled by a pair of industry catalysts:

- American cars are showing their age. In 2023, the average age of cars on U.S. roads was 12.3 years. Consumers are holding onto their cars more than ever before because of tight supply conditions and high auto loan rates. According to a projection from Hedges & Company, the average U.S. vehicle age will jump to 12.9 years by 2025.

- New car prices are crazy. Although prices have come down a bit from peak summer 2023 levels, the average new vehicle sells for approximately $49,000 these days. Combined with high financing rates, this has made a new set of wheels unaffordable to many consumers.

Putting these two forces together, a lot of American households will be hanging on to their old clunkers for the foreseeable future. As the limits of used vehicles get stretched, demand for aftermarket parts and services should trend higher. Bad news for car owners. Good news for Driven Brands.

As part of its Dream Big 2026 Plan, the company is targeting 14% annual revenue growth over the next three years to reach $3.4 billion. With momentum in the Take 5 oil change business expected to last, maintenance is expected to account for half of the growth. It is a forecast that may be grossly understated because it factors in limited U.S. car wash growth and, more importantly, zero inorganic growth.

Rollup strategy has lots of mileage left

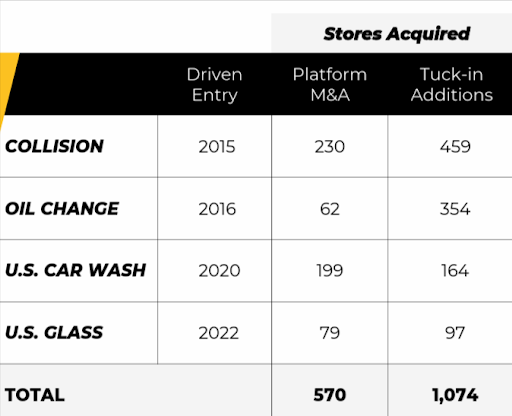

Inorganic growth, or merger and acquisition (M&A) activity, has been a big reason Driven Brands has blossomed into a market leader. Nearly one-fourth of its store count came from acquisitions.

In 2016, it acquired a Take 5 quick lube business that has evolved into a winner. In December 2023, Take 5 opened its 1,000th location in Fort Pierce, Florida. Four years later, it took over the Take 5 car wash business. This has yet to find its stride in a competitive space but has a strong brand name.

In 2022, it bought out AutoGlassNow which has grown to include 240 brick-and-mortar stores and 850 mobile service units. Although management has said it will pause its M&A ambitions to focus on opening new stores and increasing same-store sales, this may be hard to resist given the vast opportunities.

An estimated 80% of the growing $350 billion auto aftermarket space is independent shops. This makes it a highly fragmented and unsophisticated market that, given the current macro tailwinds, is ripe for consolidation.

Despite being the top dog, Driven Brands controls less than 5% of the market. If management opts not to pounce on this opportunity over the next three years, it could prove foolish and allow competitors to narrow its lead.

Driven Brands is expected to have passed the 5,000 store level in the fourth quarter of 2023. More than 70% of those are franchised. There’s value to achieving in-house growth, but kicking buyouts to the curb may crimp store count growth.

A return to profit growth is ahead

Three years removed from its initial public offering (IPO), Driven Brands is trading more than 60% below its $35.56 peak. For a company whose financials have surpassed consensus expectations at the time of the IPO, this seems to be a disconnect. Back in 2020, analysts forecast that 2023 revenue and adjusted EBITDA would be $1.5 billion and $344 million, respectively. Revenue is on pace to be $2.3 billion and adjusted EBITDA $535 million.

After a downturn in profitability in 2023, Wall Street is anticipating that Driven Brands will get an earnings tune-up in 2024. The latest EPS consensus of $1.13 implies 11% growth. At $13.34 per share, this means DRVN has a forward price-to-earnings (P/E) ratio of around 12x. Of the 13 diversified support services providers that are expected to turn a profit this year, Driven Brands has the second lowest P/E. At 11x, only Matthews International (MATW) is cheaper. Fellow auto industry players Copart (34x) and Openlane (21x) are significantly more expensive.

DRVN does not pay a dividend but does offer additional shareholder value in the form of a stock buyback program. A little less than half of the current $50 million authorization remained at the end of the third quarter of 2023. Given the depressed valuation since, it wouldn’t be surprising if management reveals that the rest of the buybacks were activated during Q4. If so, an announcement of a new repurchase program could be the spark plug DRVN needs to take the current recovery to another gear.

Bullish chart patterns emerge

Over the last couple of weeks, a couple of bullish technical patterns have popped up on DRVN’s daily chart. On January 18th, a continuation wedge formed. This suggests that after a temporary interruption, an uptrend that began in November 2023 will resume. On Thursday, a diamond bottom pattern formed, signaling a breakout and potential reversal after a two-week consolidation period.

For a chart that has flashed few bullish signals since the August 2023 plunge, these are encouraging developments. If DRVN can convincingly break through its 250-day resistance at $14.25, the $15.08 level will be the next key test.

Bottom Line

Driven Brands is an up and coming auto services company that is equally balanced between retail and commercial customers in addition to being well-diversified by service type. Despite stringing together an impressive earnings beat history, its mid-cap stock is trading well below its January 2021 IPO level and appears undervalued. As the aging American car theme plays out and industry consolidation progresses, DRVN should be in the pole position to rev higher.