Dividend stocks are a dime a dozen, so it is important to weed the good from the bad. Among the many ways to filter dividend stocks is following the money, which means the analysts. This is a look at five Top-Rated Dividend Stocks, according to analysts tracked by Marketbeat.com. What does top-rated mean? Marketbeat.com tracks terabytes of data, including analysts' sentiment and dividend statistics and aggregates the data into useable information.

The Top Rated Dividend Stocks screener filters for stocks with at least five analysts covering them and then ranks them by sentiment. The highest possible score is 4.0, which indicates 100% Buy ratings over the past twelve months. The stocks making this list score at least a 3.0 and have a minimum 10% upside potential and 2% yield.

Copa Holdings, S.A. Is a High-Yield Value Analyst Like

Copa Holdings, S.A. (NYSE: CPA) is a small air carrier operating in Latin America. Its business is booming, with passenger and freight demand supporting growth. It scores the highest among dividend-paying stocks with a Marketbeat.com rating of 3.5. Six analysts are covering the stock, and they rate it as a Strong Buy and view it as deeply undervalued.

The consensus target implies more than a 40% upside, while the low end of the range is 25%. Recent highlights include a 17% increase in February capacity compounded by a complimentary increase in passenger miles. The next significant catalyst for the stock price is when it reports results in May. The analysts forecast a slight decline in revenue, which is unlikely given the trends.

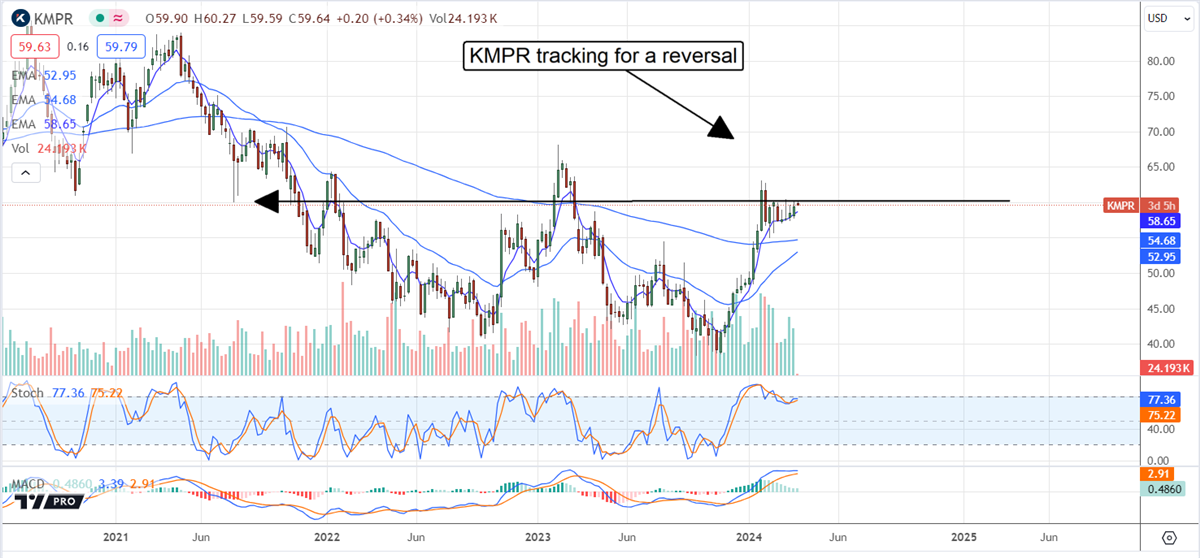

Kemper Corporation Analysts Insure Higher Prices Will Come

Kemper Corporation (NYSE: KMPR) struggled in 2022 and 2023, but those days are over. The latest results show that the pivot back to profitability is gaining traction, and a return to growth is expected next fiscal year. The balance sheet is also in decent shape and suggests the dividend payout will continue. The yield isn’t high at 2.0%, but it is market-beating compared to the S&P 500, and analysts are buying it.

Analysts' revisions have increased the consensus sentiment to Buy over the last twelve months and the price target by 500 basis points. This stock, like COPA, is undervalued, with the market below the analysts’ lowest forecast. The low end of the analysts' range suggests about 1000 basis points of upside, while consensus is closer to 20%. The Marketbeat analyst rating for this stock is 3.17.

Kimbell Royalty Partners Is a Royally Good Yield

Kimbell Royalty Partners (NYSE: KRP) is a limited partnership headquartered in Texas focused on mineral and royalty rights for oil and natural gas properties. The units yield more than 10% at current levels and appear sustainable in 2024. As of the last report, the payout ratio to distributable cash is nearly 75%, with the remaining 25% put toward debt reduction. Analysts rate the stock as Buy, steady over the past year, with a price target of $21. The consensus target is also constant and 35% above the current price action. Like others on this list, the low end suggests a deep value with at least a 20% upside.

Atlas Energy Solutions Builds A Solid Foundation On Sand

Atlas Energy Solutions (NYSE: AESI) is a leading provider of oil-field services delivering sand to frackers. The sand is used to keep the fissures open for oil recovery and is crucial to the process. Atlas is notable for its profits, cash flow, and dividends, which are as solid as a rock. The 2.95% yield is less than 30% of the earnings, with expected revenue growth and margin expansion to come. Analysts rate this stock as a Buy and see it advancing more than 2% at the low end of their range, about 12% at the consensus, which is trending higher.

Upbound Group Has Yield, And the Analysts Support

Upbound Group (NASDAQ: UPBD) is a rent-to-own provider with brands like Rent-a-Center in its portfolio. The company has returned to growth and provides solid cash flow, driving its capital returns. The dividend is worth 4.25%, with shares trading near $35, and the payout is only 38% of earnings. Analysts' activity includes numerous upgrades in the last twelve months, lifting the rating from Hold to Buy and increasing the price target by 35%. Consensus implies a slim 10% of upside but is trending higher and leading the market.