Yum! Brands has shown little upside over the past six months. It has held steady at $135 per share, posting a small 1% loss. The stock also fell short of the S&P 500 index’s 14.8% return during that time.

Is now a good time to buy YUM’s stock?

Find out in our full research report, it's free.Why Is Yum! Brands a Good Business?

Spun off as an independent company from PepsiCo, Yum! Brands (NYSE:YUM) is a multinational corporation that owns KFC, Pizza Hut, Taco Bell, and The Habit Burger Grill.

1. Economies of Scale Give It Negotiating Leverage with Suppliers

Yum! Brands is larger than most restaurant chains and benefits from economies of scale, enabling it to gain more leverage on fixed costs than its smaller competitors. However, its scale can be a double-edged sword because there are only a finite number places to build new restaurants, making it harder to find incremental growth.

2. Restaurant Growth Signals an Offensive Strategy

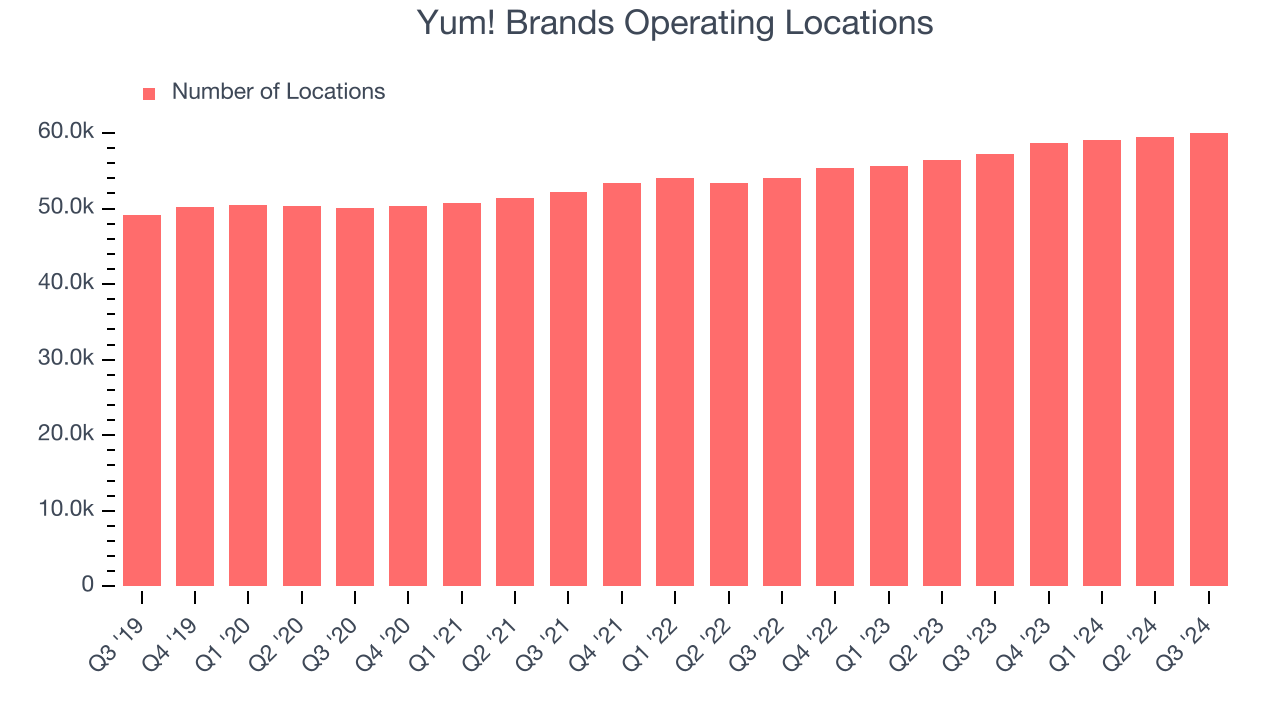

A restaurant chain’s total number of dining locations influences how much it can sell and how quickly revenue can grow.

Yum! Brands sported 60,045 locations in the latest quarter. Over the last two years, it has opened new restaurants at a rapid clip and averaged 5.1% annual growth, among the fastest in the restaurant sector. Additionally, one dynamic making expansion more seamless is the company’s franchise model, where franchisees are primarily responsible for opening new restaurants while Yum! Brands provides support.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where the concept has few or no locations.

3. Stellar ROIC Showcases Lucrative Growth Opportunities

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it raised (debt and equity).

Yum! Brands’s five-year average ROIC was 69.5%, placing it among the best restaurant companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

Final Judgment

These are just a few reasons Yum! Brands is a rock-solid business worth owning in your portfolio. With its shares lagging the market recently, the stock trades at 21.9x forward price-to-earnings, or $135 per share. Is now the right time to initiate a position?

See our full research report, it's free.Stocks We Like More Than Yum! Brands

Now, with the elections behind us, rates dropping and inflation cooling off, many analysts are expecting a breakout market to the end of the year — and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our 9 Best Market-Beating Stocks. These are a curated subset of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% five-year return) as well as under-the-radar businesses like Comfort Systems (+783%) and United Rentals (+550%). Find your next big winner with StockStory today, it’s free.