VANCOUVER, BC / ACCESSWIRE / December 19, 2022 / Fabled Copper Corp. ("Fabled Copper" or the "Company") (CSE:FABL)(FSE:XZ7) is pleased to announce that it has entered into letter of intent dated December 16, 2022 (the "LOI") to acquire the "TJ Property" (the "Property") located in the Skeena mining division of British Columbia, from an arm's length vendor, ARR Mineral Exploration Inc. (the "Vendor").

TJ Property

The TJ Property is located in the southern tip of what is referred to as the "Golden Triangle", due east of Stuart, BC and 95 kms northeast of Hazelton, BC and consists of 6 contiguous mineral tenures covering an area of 3,176 hectares.

Multiple exploration programs carried out between1984 and 2006 have generated a large multi-element soil geochemical anomaly over an area of approximately 5.4 x 2.8 km delineating a gold, silver and base metal target along with numerous (>30) property wide float and bedrock samples ranging from 1.9 g/t Au, 5.0 g/t Ag to 37 g/t Au, 273 g/t Ag over an area 3 km X 4 km in extent. The target area is forested with a thin veneer of glacial till (<2 metres) and < 1% bedrock exposure.

In 2007 a drilling and trenching program confirmed the existence of an intrusive. It is postulated that this is the heat source powering the mineralizing system on the property.

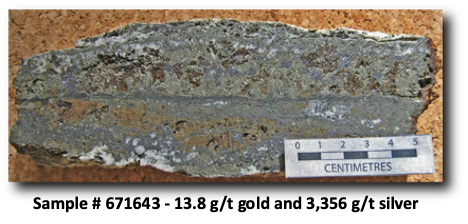

The 2008 program indicated that the controlling structures are the 340 degree and 030/050 degree faults while mineralization occurs in both the sedimentary rocks and the granitic intrusive. The composition and style of mineralization indicates multiple pulses of gold, silver and base metal mineralization with at least two phases of intrusive activity (monzonite and quartz porphyry) being identified. Near the end of the 2008 exploration season high grade gold and silver mineralization with appreciable concentrations of base metals and pathfinder minerals was located in the Discovery Trench area. See Photo 1,2 below.

Photos 1 and 2 - Discovery Trench Sample. Note "banding" of the sulphides indicating multiple pules of mineralization.

Terms of the LOI

Under the terms of the LOI, Fabled will have the option (the "Option") to acquire the TJ Property (the "Acquisition") conditional upon the Company securing additional financing and all required regulatory approvals, and upon the execution of a Definitive Agreement between Fabled and the Vendor.

In order to exercise the Option and acquire the TJ Property Fabled will, pursuant to the Definitive Agreement if entered into, require pay to the Vendor:

- $20,000 in cash to the Vendor on the date of execution of the Definitive Agreement (the "Effective Date");

- $50,000 in cash to the Vendor to twelve (12) months after the Effective Date; and

- a final payment twenty four (24) months after the date of execution of the Definitive Agreement, in common shares of Fabled, having a cash value equal to the value of the Property at such date, as determined by a third party valuator to be chosen by mutual agreement of the parties, at a price per common share equal to the 20 day Weighted Average Volume Price of the Company's common shares as traded on the Canadian Securities Exchange or any other stock exchange that the Optionee may be listed on at such time.

In addition the Company must incur not less than $100,000 in exploration expenses on the Property prior to the date that is twenty four (24) months from the Effective Date and ensure that the Property remains in good standing.

Fabled will also grant the Vendor, or their nominee, a 2% NSR royalty over the Property that may be purchased by Fabled at any time for an additional $2,000,000.

Until the above conditions are met there is no assurance that the Acquisition will be completed as contemplated above or at all.

Proposed Consolidation

In addition the Company announces that it has mailed meeting materials in connection with a special meeting of shareholders of the Company to be held on January 10, 2022 (the "Meeting'') to consider a resolution approving a consolidation (the "Consolidation Proposal") of the Company's outstanding common shares (the "Common Shares") on the basis of up to one (1) post consolidation Common Share for every ten (10) pre-consolidation Common Shares.

In the opinion of management, the current share structure of the Company may make it more difficult for the Company to attract business opportunities or the additional equity financing required to maintain the Company or to allow for the funding of its ongoing operations and business. Management is of the opinion that a consolidation of the Common Shares may increase its flexibility and present additional opportunities with respect to potential business transactions, including equity financings, if determined by the board of directors of the Company (the "Board") to be necessary.

Approval of the Consolidation Proposal will provide with the Board with discretion to determine the actual consolidation ratio within the above stated range and whether to proceed with any consolidation at all. The approval of the Consolidation Proposal does not mean that a consolidation will occur, as the Board will have the discretion not to proceed with a consolidation if it is deemed to be in the best interests of the Company not to do so.

The Company currently has 173,651,734 Common Shares issued and outstanding. Following the completion of a consolidation, the number of Common Shares of the Company issued and outstanding will depend on the consolidation ratio selected by the Board. The following table sets out the approximate number of Common Shares that would be outstanding after the completion of a consolidation at the ratios suggested below, and if such consolidation were to be effected as at the date hereof:

| Selected Proposed Consolidation Ratios(1) |

Approximate Number of Outstanding Common Shares (Post Consolidation)(2) (3) |

1 for 2 |

86,825,867 |

1 for 3 |

57,883,911 |

1 for 5 |

34,730,347 |

1 for 7 |

24,807,391 |

1 for 10 |

17,365,173 |

Notes:

- The ratios above are for illustrative purposes only and are not indicative of the actual ratio that may be adopted by the Board

- The exact number of Common Shares outstanding after the Consolidation will vary based on the elimination of fractional shares, and certainother factors.

- Based on the number of outstanding Common Shares as at the date hereof, being 173,651,734 which is subject to change prior to the date any consolidation is effected.

The Board is recommending that shareholders approve the Consolidation Proposal at the Meeting. The Company is not expected to change its name or trading symbol in conjunction with any consolidation however it may be required to apply for a new ISIN and CUSIP number for any post consolidated Common Shares. The exercise price and number of Common Shares issuable pursuant to the exercise of any outstanding convertible securities, including stock options and warrants, will also be adjusted in accordance with the Board's chosen consolidation ratio if a consolidation is effected pursuant to the Consolidation Proposal, if approved.

Any consolidation that the Board decides to effect is subject to the approval of the Consolidation Proposal at the Meeting and any required regulatory approvals including the approval of the Canadian Securities Exchange.

About Fabled Copper Corp.

Fabled Copper is a junior mining exploration company. Its current focus is to creating value for stakeholders through the exploration and development of its existing copper properties located in northern British Columbia. The Company's property package consists of the Muskwa Project and comprises approximately 16,219 hectares in three non-contiguous blocks and located in the Liard Mining Division in northern British Columbia.

Mr. Peter J. Hawley, President and C.E.O.

Fabled Copper Corp.

Phone: (819) 316-0919

peter@fabledcopper.org

For further information please contact:

The technical information contained in this news release has been approved by Peter J. Hawley, P.Geo. President and C.E.O. of Fabled, who is a Qualified Person as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

The Canadian Securities Exchange does not accept responsibility for the adequacy or accuracy of this release.

Certain statements contained in this news release constitute "forward-looking information" as such term is used in applicable Canadian securities laws. Forward-looking information is based on plans, expectations and estimates of management at the date the information is provided and is subject to certain factors and assumptions, including, that the Company's financial condition, development plans and business plans do not change as a result of unforeseen events and that the Company obtains any required regulatory approvals.

Forward-looking information is subject to a variety of risks and uncertainties and other factors that could cause plans, estimates and actual results to vary materially from those projected in such forward-looking information. Some of the risks and other factors that could cause results to differ materially from those expressed in the forward-looking statements include, but are not limited to: the failure of the shareholders of the Company to approve the Consolidation Proposal, impacts from the coronavirus or other epidemics, general economic conditions in Canada, the United States and globally; industry conditions, including fluctuations in commodity prices; governmental regulation of the mining industry, including environmental regulation; geological, technical and drilling problems; unanticipated operating events; competition for and/or inability to retain drilling rigs and other services; inability to obtain drilling permits; the availability of capital on acceptable terms; the need to obtain required approvals from regulatory authorities; stock market volatility; volatility in market prices for commodities; liabilities inherent in mining operations; changes in tax laws and incentive programs relating to the mining industry; as well as the other risks and uncertainties applicable to the Company as set forth in the Company's continuous disclosure filings filed under the Company's profile at www.sedar.com. The Company undertakes no obligation to update these forward-looking statements, other than as required by applicable law.

SOURCE: Fabled Copper Corp.

View source version on accesswire.com:

https://www.accesswire.com/732318/Fabled-Copper-Enters-into-Letter-of-Intent-to-Acquire-TJ-Property-and-Proposes-Potential-Share-Consolidation