VANCOUVER, BC / ACCESSWIRE / February 16, 2023 / Blackwolf Copper and Gold ("Blackwolf", or the "Company") (TSXV:BWCG), (OTC PINK:BWCGF) is pleased to announce an updated Mineral Resource Estimation ("MRE") for its Niblack property in southeastern Alaska. The 100% owned Niblack project, located on Prince of Wales Island in southeast Alaska, hosts high-grade Cu-Au-Ag-Zn VMS-style mineralization within a series of felsic volcanic flows and breccias, typically as stringer, semi-massive to massive chalcopyrite and sphalerite-rich replacement-style mineralization, commonly with pyrite. Multiple deposits of both exhalative and replacement-style mineralization occur within a folded prospective horizon of volcanic rocks. Highlights of the updated MRE include:

Highlights:

- Indicated Mineral Resource of 5.85 million tonnes at 0.94% Copper, 1.83 g/t Gold, 1.73% Zinc, and 29 g/t Silver and an Inferred Mineral Resource of 0.21 million tonnes at 0.93% Copper, 1.52 g/t Gold, 1.38% Zinc, and 18 g/t Silver from the Lookout and Trio deposits using a US$100/tonne cut-off.

- A higher-grade zone comprised of multiple, subparallel, interconnected lenses of sulfide mineralization on the Lookout deposit comprised of 3.790 million tonnes at 1.06% Copper, 2.19 g/t Gold, 2.07% Zinc, and 35 g/t Silver in an Indicated category using a US$130/tonne cut-off.

- Both Lookout and Trio are open along strike and up/down-dip of the Mineral Resource with significant additional exploration potential across the property.

- Other areas of mineralization on the Property such as Niblack Mine area and Dama Zones require additional drilling and data validation are required prior to an initial Mineral Resource Estimation and are therefore not included in this MRE.

"Our updated mineral resource estimation includes subsequent rounds of drilling as compared to the previous 2011 mineral resource estimate as well as cost parameter guidance from current underground operations, in accordance with the new CIM guidelines. The wide nature of mineralization, particularly at the Lookout Zone is potentially amenable to underground bulk mining methods such as longhole stoping," said Rob McLeod, President and CEO of Blackwolf Copper and Gold. "Mineralization at multiple zones is wide open for expansion along strike and down dip and our revised geological interpretation has opened up new areas for discovery on the Property. Niblack's proximity to tidewater with a production-size underground ramp, site infrastructure including a water treatment facility, positions Niblack as one of the most advanced, largest and highest-grade polymetallic deposits in the Pacific Northwest."

Mineral Resource Estimate

This MRE represents the first resource evaluation of the Niblack property by the Company since the previous estimate conducted by the Company (formerly Heatherdale Resources Ltd.) and Niblack Mine Development Inc. in 2011. The updated MRE was completed to incorporate three additional rounds of drilling on the Property, to evaluate the potential of including additional resources from other target areas on the Property and to reflect current economic parameters.

The MRE was conducted by Arseneau Consulting Services ("ACS") and is reported within the guidelines of the Canadian Securities Administration National Instrument 43-101 ("NI 43-101"). ACS carried out database verification, grade shell geometry, and variography; utilizing a resource drill hole database with a total of 57,891 meters of sampling from 197 drill holes. Mineral resources were estimated in a single three-dimensional block model using Geovia Gems version 6.8.4 software. Precious and base metal grades within the mineralized domains were estimated in three successive passes by ordinary kriging for the Lookout deposit and by inverse distance squared interpolation for the Trio deposit. Search parameters were generally set to match the correlogram parameters but also designed to capture sufficient data to estimate a grade in the blocks. All assays were composited to 2.0 m and capped at the 97 or 98 percentiles before estimation.

The Indicated and Inferred Mineral Resources were classified according to the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") definition Standards for Mineral Resources and Mineral Reserves by Dr. Gilles Arseneau, P.Geo., of ACS, a "qualified person" as defined by NI 43-101. The Company intends to publish an updated technical report within 45 days of this news release which will include the mineral resource estimate. The report will be available at that time on SEDAR and the Company's website.

All Indicated and Inferred Resources were categorized as meeting "reasonable prospects for economic extraction" by underground methods utilizing a stope optimizer and 5m x 5m x 5m block model at a US$100 dollar equivalent value cut-off. The Mineral Resource Statement and assumptions and economic parameters used to calculate the resource are presented in Tables 1 and 4 below:

Table 1: Updated Niblack Mineral Resource Statement, February 14, 2022

Area |

Classification |

Cut-off (US$) |

Tonnes (000) |

Cu (%) |

Cu Mlb |

Zn (%) |

Zn Mlb |

Au (g/t) |

Au oz |

Ag (g/t) |

Ag oz |

Lookout |

Indicated | 100 |

5,391 |

0.92 |

108.9 |

1.72 |

204.9 |

1.88 |

326,600 |

30 |

5,168,200 |

| Inferred | 159 |

0.93 |

3.3 |

1.31 |

4.6 |

1.63 |

8,300 |

18 |

93,300 |

||

Trio |

Indicated | 100 |

460 |

1.16 |

11.8 |

1.75 |

17.7 |

1.30 |

19,200 |

20 |

293,800 |

| Inferred | 55 |

0.91 |

1.1 |

1.61 |

1.9 |

1.20 |

2,100 |

18 |

31,700 |

||

Total |

Indicated | 100 |

5,851 |

0.94 |

120.7 |

1.73 |

222.6 |

1.83 |

345,800 |

29 |

5,462,000 |

| Inferred | 214 |

0.93 |

4.4 |

1.38 |

6.5 |

1.52 |

10,400 |

18 |

125,000 |

- Mineral Resources are not Mineral Reserves and have not demonstrated economic viability.

- The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

- The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

- The Mineral Resources were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves. Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

- Numbers may not add up due to rounding.

- Metal prices are derived from the London Energy & Metals Consensus Forecast. Recoveries are derived from preliminary metallurgical testwork on Niblack and operating costs are derived from benchmarking against similar deposits in Alaska and Canada, assuming primarily longhole stope mining methods. See Table 2 for details.

Table 2: Parameters used to derive the "reasonable prospect of eventual economic extraction" for Underground Mining Conditions

| Parameter* | Value |

Unit |

| Copper Price | 3.50 |

US$ per pound |

| Copper Recovery | 94.30 |

percent |

| Zinc Price | 1.10 |

US$ per pound |

| Zinc Recovery | 90.20 |

percent |

| Gold Price | 1,650 |

US$ per Oz |

| Gold Recovery | 72.00 |

percent |

| Silver Price | 20.00 |

US$ per Oz |

| Silver Recovery | 76.00 |

percent |

| Mining Costs | 48.00 |

US$ per tonne mined |

| Milling Costs | 28.00 |

US$ per tonne of feed |

| G & A Costs | 24.00 |

US$ per tonne of feed |

| Mining Rate | 1,500 |

Tones per day |

| Total Costs | 100.00 |

US$ |

| Cut-off (total value) | 100.00 |

US$ |

Note*: Metal prices are derived from the London Energy & Metals Consensus Forecast. Recoveries are derived from preliminary metallurgical tests and are assumed to be 100% payable. Operating costs are derived from benchmarking against similar deposits in Alaska and assuming longhole stoping mining methods.

Table 3: Sensitivity Analysis of the Indicated Mineral Resource at Various Cut-off Grades

Cut-off (US$) |

Tonnes (000) |

Cu (%) |

Zn (%) |

Au (g/t) |

Ag (g/t) |

160 |

2,890 |

1.23 |

2.45 |

2.43 |

40 |

150 |

3,253 |

1.18 |

2.32 |

2.33 |

38 |

140 |

3,634 |

1.13 |

2.20 |

2.24 |

36 |

130 |

4,081 |

1.09 |

2.07 |

2.15 |

34 |

120 |

4,603 |

1.04 |

1.96 |

2.04 |

32 |

110 |

5,190 |

0.98 |

1.84 |

1.94 |

31 |

100(1) |

5,851 |

0.94 |

1.73 |

1.83 |

29 |

90 |

6,554 |

0.89 |

1.62 |

1.74 |

27 |

80 |

7,332 |

0.84 |

1.53 |

1.64 |

26 |

70 |

8,189 |

0.80 |

1.43 |

1.54 |

24 |

60 |

9,183 |

0.75 |

1.33 |

1.44 |

22 |

50 |

10,278 |

0.70 |

1.24 |

1.34 |

21 |

Note 1: Base Case

Table 4: Sensitivity Analysis of Inferred Mineral Resource at Various Cut-off Grades

Cut-off (US$) |

Tonnes (000) |

Cu (%) |

Zn (%) |

Au (g/t) |

Ag (g/t) |

160 |

85 |

1.21 |

2.01 |

2.13 |

23 |

150 |

96 |

1.15 |

1.96 |

2.09 |

22 |

140 |

114 |

1.10 |

1.84 |

1.98 |

21 |

130 |

136 |

1.05 |

1.71 |

1.87 |

20 |

120 |

154 |

1.02 |

1.62 |

1.77 |

19 |

110 |

179 |

0.98 |

1.52 |

1.65 |

19 |

100(1) |

214 |

0.93 |

1.38 |

1.52 |

18 |

90 |

284 |

0.85 |

1.23 |

1.32 |

16 |

80 |

354 |

0.78 |

1.14 |

1.20 |

15 |

70 |

452 |

0.70 |

1.08 |

1.06 |

14 |

60 |

636 |

0.59 |

1.03 |

0.89 |

12 |

50 |

868 |

0.51 |

0.94 |

0.77 |

11 |

Note 1 - Base Case

The "reasonable prospects for economic extraction" requirement generally implies that the quantity and grade estimates meet certain economic thresholds and that the mineral resources are reported at an appropriate cut-off grade taking into account extraction scenarios and processing recoveries. To meet this requirement, the QP considers that the majority of the Lookout and Trio deposits are amenable for underground mining by longhole stoping with minor cut and fill methods similar to the Greens Creek VMS deposit in Alaska (SLR, 2022).

To determine the quantities of material offering "reasonable prospects for economic extraction" by underground methods, the QP used a mining stope optimizer and reasonable mining assumptions to evaluate the proportions of the block model (Indicated and Inferred blocks) that could be "reasonably expected" to be mined by underground methods.

The optimization parameters were selected based on experience and benchmarking against similar projects. The reader is cautioned that the results from the stope optimization are used solely for the purpose of testing the "reasonable prospects for eventual economic extraction" by underground methods and do not represent an attempt to estimate mineral reserves. There are no mineral reserves on the Niblack Project. The results are used as a guide to assist in the preparation of a mineral resource statement and to select an appropriate mineral resource reporting cut-off grade.

The Qualified Persons considers that all the blocks above cut-off forming a minimum stope shape of 15 by 10 by 5 m easily accessible from the main deposit satisfy the "reasonable prospects for eventual economic extraction" and can be reported as a mineral resource (Figure 1).

Comparison to 2011 Mineral Resource Estimation and Key Factors

The updated Mineral Resource estimate for Niblack contains increased Mineral Resource Indicated Tonnes and fewer Inferred Mineral Resource Tonnes compared with the 2011 Mineral Resource estimate(1). Indicated resources increased from 5.638 million tonnes (2011) to 5.851 million tonnes (2022). Significantly fewer Mineral Resources were estimated in the Inferred Category, 0.214 million tonnes in this MRE versus 3.393 million tonnes in the 2011 Mineral Resource estimate.

Key factors impacting the current resource estimate include:

- Increasing the reporting cutoff to US$100 per tonne from US$50 per tonne resulted in a net loss of tonnes in the resource.

- Consensus forecast metal prices used for the current resource estimate increased the overall tonnes in the model, but these were at lower grades and did not meet the current reporting cutoff to be included in the resource estimate.

- Additional drilling, updated geological modelling, and refined variography and geostatistics resulted in an increase in overall tonnes in the model and the conversion of Inferred to Indicated blocks.

The most significant of the factors is the change in cut-off grade which removed lower grade, Inferred blocks from the Mineral Resource, leading to increases in the overall grades and increased Indicated Mineral Resources.

- Refer to the NI43-101 compliant Mineral Resource Estimation - Niblack Polymetallic Sulphide Project report dated December 6, 2011. Available on SEDAR.

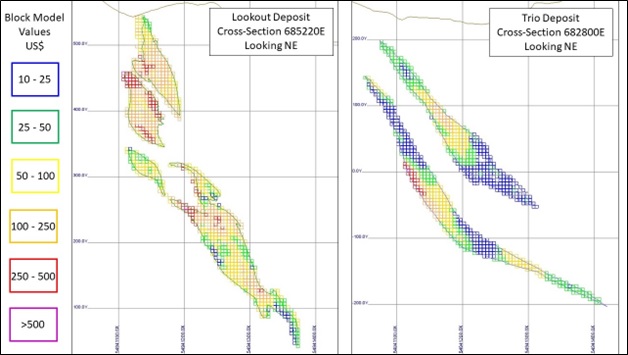

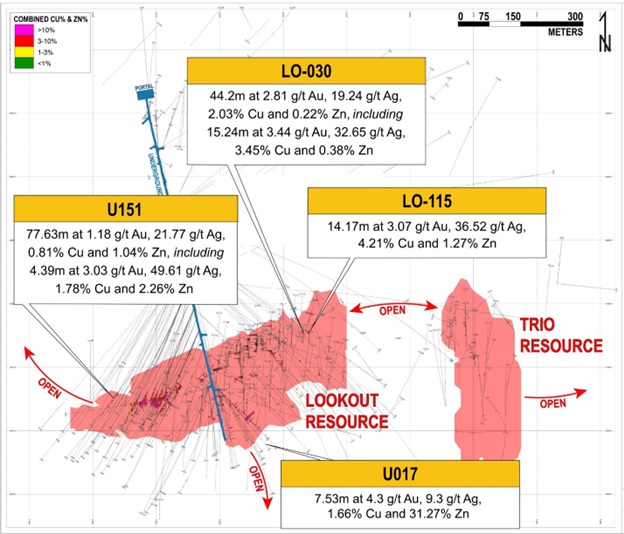

Lookout Deposit

The Lookout deposit hosts the majority of Mineral Resources at Niblack and consists of a northeast striking, south dipping, body of polymetallic mineralization traced over 700 meters along strike and over 500 meters downdip from surface. The higher-grade sulphide mineralization at Lookout occurs in several subparallel, partially interconnecting lenses. These lenses are usually separated by regions of lower-grade mineralization. To a large extent, the higher-grade zones may reflect regions of greater porosity-permeability within the complexly interbedded coarse fragmental rocks and the finer tuffaceous units. In the central portion of the Lookout deposit, stacked lenses cumulatively comprise 80 to 100 m of sulphide mineralization separated by 5 to 10 m intervals of lower grade mineralization. Increased thickness of mineralization can also be attributed to the hinge zones of parasitic folds on the limbs of the major structures, where the mineralized zone is folded back on itself. Overall, these high-grade lenses comprise a significant portion of the Lookout resource and includes Indicated Resources of 3.790 million tonnes at 1.06% Copper, 2.19 g/t Gold, 2.07% Zinc, and 35.2 g/t Silver at a US$130 cut-off. Current modeling demonstrate that Lookout is open in both directions along strike, down dip, and, locally, up-dip/near surface.

Trio Deposit

The Trio deposit is located approximately 200 meters northeast of the Lookout deposit and hosts Indicated Resources of 460 thousand tonnes at 1.16% Copper, 1.3 g/t Gold, 1.75% Zinc, and 20 g/t Silver and Inferred Resources of 55 thousand tonnes at 0.91% Copper, 1.2 g/t Gold, 1.61% Zinc, and 18 g/t Silver. of the Trio Deposit is comprised of two parallel south dipping lenses with massive to semi-massive sulphide mineralization with associated stringer-style mineralization surrounded by lower grade mineralization. The current geological interpretation suggests a moderate southerly dip to these lenses within felsic volcanic rocks, with mineralization following the margins of an intensely stockwork veined, rhyolite flow/dome complex. The outlined dimensions of the Trio deposit are approximately 580 metres by 170 metres, with an average thickness of 30 metres and it is open along strike.

Exploration Potential

In addition to potential expansion of the Lookout and Trio deposits, the Niblack project hosts four other known VMS targets (Mammoth, Dama, Lindsy, and the historic Niblack mine site), all with variable amounts of drill testing. Preliminary models were prepared for both the historic Niblack mine site and Dama targets and were reviewed by ACS, however, the drilling density on the targets does not currently meet the requirements for resource estimation. Both the historic Niblack mine site and Dama, which include drill highlights of 7.6 meters of 5.18% Cu, 2.66 g/t Au, 145.1 g/t Ag and 6.53% Zn (Niblack Mine) and 19.2m of 6.4% Cu, 1.37 g/t Au, 53 g/t Ag, and 3.2% Zn (Dama), are considered high priority targets for future drilling campaigns that could potentially add to the resource base. In addition, there is strong potential for new discoveries along the 100 - 200m thick Niblack Felsic horizon that hosts all known VMS mineralization on the Property. The felsic horizon extends an additional 2,500 meters southeast of the Dama target and has only received minor exploration to date.

QUALIFIED PERSON(S):

Jodie Gibson, P.Geo., Vice President Exploration for the Company and Gilles Arseneau, P.Geo., Arseneau Consulting Services, are both Qualified People under NI 43-101, have reviewed and approved the technical content of this release.

ABOUT BLACKWOLF COPPER AND GOLD

Blackwolf's founding vision is to be an industry leader in transparency, inclusion and innovation. Guided by our Vision and through collaboration with local and Indigenous communities and stakeholders, Blackwolf builds shareholder value through our technical expertise in mineral exploration, engineering and permitting. The Company holds a 100% interest in the high-grade Niblack copper-gold-zinc-silver VMS project, located adjacent to tidewater in southeast Alaska as well as five Hyder Area gold-silver and VMS properties in southeast Alaska and northwest British Columbia in the Golden Triangle, including the high-priority wide gold-silver veins at the Cantoo Property. For more information on Blackwolf, please visit the Company's website at www.blackwolfcopperandgold.com.

ON BEHALF OF THE BOARD OF DIRECTORS

"Robert McLeod"

Robert McLeod

President, CEO and Director

For more information, contact:

ROB MCLEOD

604-617-0616 (Mobile)

604-343-2997 (Office)

rm@bwcg.ca

LIAM MORRISON

604-897-9952 (Mobile)

604-343-2997 (Office)

lm@bwcg.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements relate to future events or future performance and reflect the expectations or beliefs of management of the Company regarding future events. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as "intends" or "anticipates", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "should", "would" or "occur". This information and these statements, referred to herein as "forward‐looking statements", are not historical facts, are made as of the date of this news release and include without limitation, statements relating to the resource estimates and potential mineralization on the Niblack Project, the preparation of a technical report which will include the resource estimate, drilling programs, the Company's exploration plans, and the Company's future objectives and plans. Forward‐looking statements involve numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking statements. These risks and uncertainties include, among other things, market volatility; the state of the financial markets for the Company's securities; fluctuations in commodity prices, general economic conditions and changes in the Company's business plans and the risk that the mineral resources may not be as estimated. In making the forward looking statements in this news release, the Company has applied several material assumptions that the Company believes are reasonable, including without limitation, with respect to the mineral resource estimates, the key assumptions and parameters on which such estimates are based and that the Company will continue with its stated business objectives and its ability to raise additional capital to proceed. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws. The Company seeks safe harbor.

For more information on the Company, investors should review the Company's continuous disclosure filings that are available at www.sedar.com.

SOURCE: Blackwolf Copper and Gold Ltd

View source version on accesswire.com:

https://www.accesswire.com/739561/Blackwolf-Updates-NI43-101-Mineral-Resource-Estimate-for-Niblack-Cu-Au-Zn-Ag-Deposit-Alaska