Construction and heavy machinery maker Caterpillar (NYSE: CAT) stock has been weathering the bear market down (-17%) on the year. Despite the slowing demand in China, supply chain disruptions, inflationary pressure, and slowdown in the housing market, the Company is still bullish on strength in the second half of the year. Order backlog rose by $2 billion in its second quarter 2022. As the world’s largest manufacturer of construction machinery, the Company is often used as a key indicator for the economy as more construction spend implies growth while contraction in spending signals a weakening economy. Rising interest rates can dampen construction activity especially in the homebuilding market, which Caterpillar and peers like Deere & Company (NYSE: DE), and Terex Corporation (NYSE: TEX) need to maintain growth. As a cyclical company, Caterpillar has peaks and valleys that coincide with economic expansion and contractions. However, the U.S. Infrastructure and Jobs Act may enable Caterpillar to have a longer runway even in a recession as projects are expected to ramp up in late 2022 into 2023. It’s second quarter earnings reflected the contraction in the commercial sector as new retail business suffered a (-12%) or $429 million decline. The revenue miss in the second quarter was blamed on continued supply chain constraints (like the semiconductor shortage) as demand remained healthy in most end markets. The Company expected both volume and price realization to improve in the second half of the year. Caterpillar remains bullish expecting a second half recovery blaming any shortfalls on component shortages stemming from supply chain disruption.

Signs of Slowdown

On Aug. 2, 2022, Caterpillar released its fiscal second-quarter 2022 results for the quarter ending June 2022. The Company reported an earnings-per-share (EPS) profits of $3.18 beating analyst estimates for a profit of $3.02, by $0.16. Revenues rose 10.5% year-over-year (YoY) to $14.25 billion, missing analyst estimates for $14.39 billion. Cat Financial grew revenues 3% to $668 million. The revenue increase was due to $20 million of favorable impact from higher financing rates and an $18 million favorable impact from returned and repossessed equipment, offset by $15 million in negative impact from lower average earning assets. New retail business volume fell by (-12%) or $429 million to $3.1 billion.

Here’s What the Charts Say

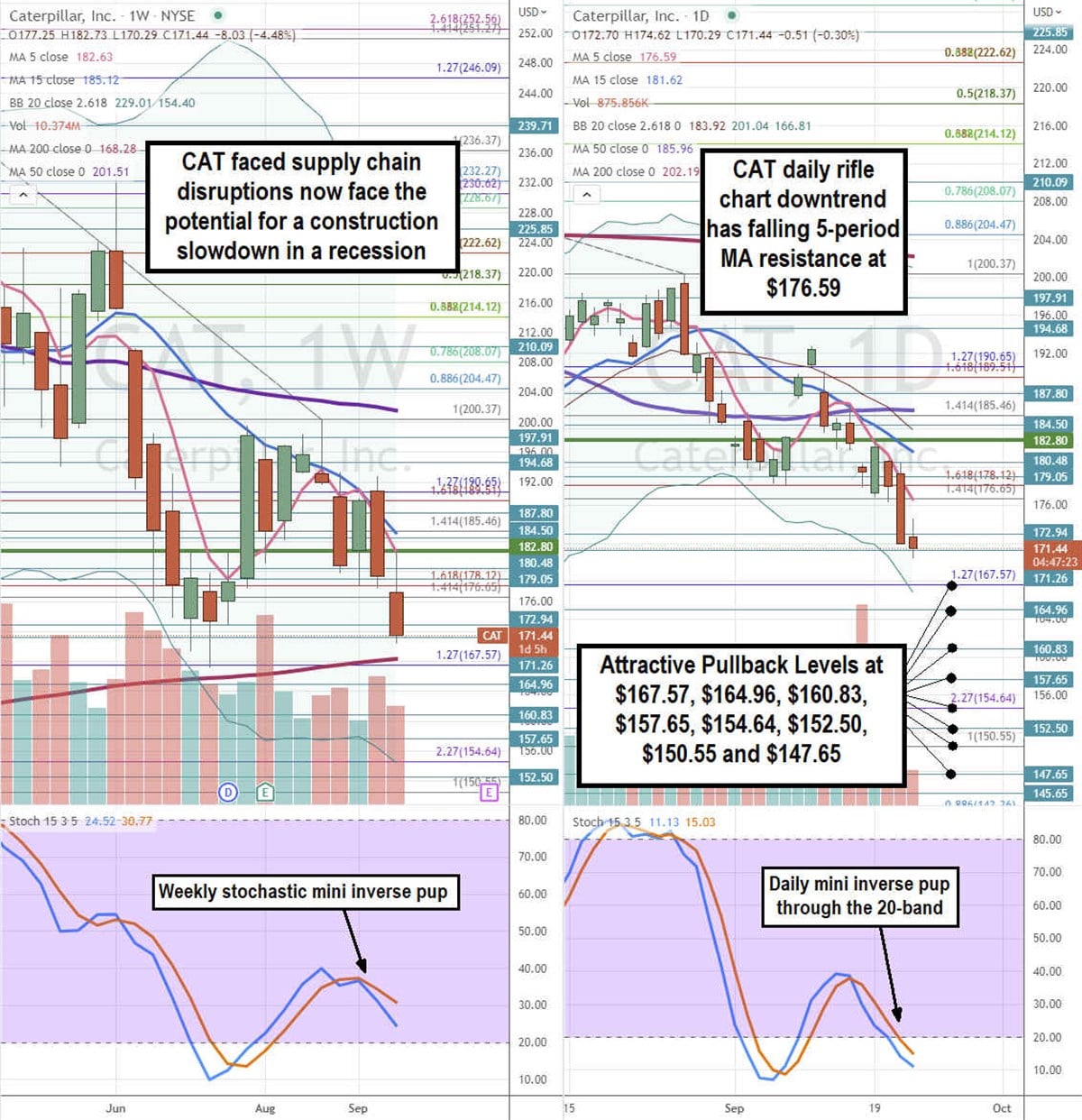

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for CAT stock. The weekly rifle chart coiled off the swing low near the $167.57 Fibonacci (fib) level before peaking at $200.37 and starting its inverse pup breakdown as the weekly 5-period moving average (MA) resistance falls at $82.63 followed by the 15-period MA at $185.12. The weekly 50-period MA resistance is at $201.51 and weekly 200-period MA at $168.28. Shares triggered a stochastic mini inverse pup breakdown after rejecting the $182.80 weekly market structure low (MSL) buy trigger. The weekly stochastic mini inverse pup targets the weekly lower Bollinger Bands (BBs) at $154.40. The daily rifle chart breakdown has a falling 5-period MA resistance at $176.59 followed by the 15-period MA at $181.62. The daily lower BBs sit at $166.81. Attractive pullback levels sit at $167.57 fib, $164.96, $160.83, $157.65, $154.64 fib, $152.50, $150.55 fib, and $147.55 level.

Supply Chain is the Problem, Not Demand

Caterpillar CEO Jim Umpleby commented, “As we close out the first half of 2022, I want to thank our global team for delivering another good quarter with double-digit top line and adjusted profit per share growth despite ongoing supply chain challenges. Our second quarter results reflect healthy demand across most of our end markets.” Supply chain constraints were blamed for missing top line analyst estimates. For example, engine control modules are one of the most significant components being affected due to the semiconductor shortage. CEO Impleby reiterated that demand was strong across end markets for its products and services with notably strong momentum in services. He remains confident that services revenues can double to $28 billion by 2026. Manufacturing costs continued to rise but was offset by price realization. Dealer inventory remains at the low end. Backlog grew by nearly $2 billion in the quarter. North American sales rose by 18% and Latin America saw 27% sales growth. EAME saw a (-3%) sales decrease due to currency impacts. Sales to users declined (-3%) and machines fell by (-4%). These were due to component shortages stemming from the supply chain. Sales to users in Construction Industries fell (-4%) due to supply chain restraints and weakness in China. Operating profit margins fell to 13.6% from 13.9% in the year ago period.

Expectations By Industry

Caterpillar expects non residential construction strength to continue due to construction backlogs. The U.S. Infrastructure and Jobs Act is expected to see ramping of projects. Residential construction is moderating from very strong levels in 2021. The EU has proposed an infrastructure plan, but business activity is slowing down. Latin America continues to show strong growth due to supportive commodity prices. Healthy demand is expected through the end of the year in Construction. In Resources, mining companies are remaining disciplined and expect the continuation of high equipment utilization. Continued growth expected in heavy constructions, quarry and aggregates. Energy and Transportation is showing improving momentum with solar services expected to remain steady. Oil and gas drove new equipment orders in the first half and expects the growth to continue through 2023.