Headquartered in Dublin, Ireland, Accenture plc (ACN) is a global outsourcing company that provides strategy and consulting, interactive, and technology and operations services. The company offers its professional services and specialized skills across more than 40 countries spread across more than 120 countries. It has an ISS Governance QualityScore of 1, indicating low governance risk.

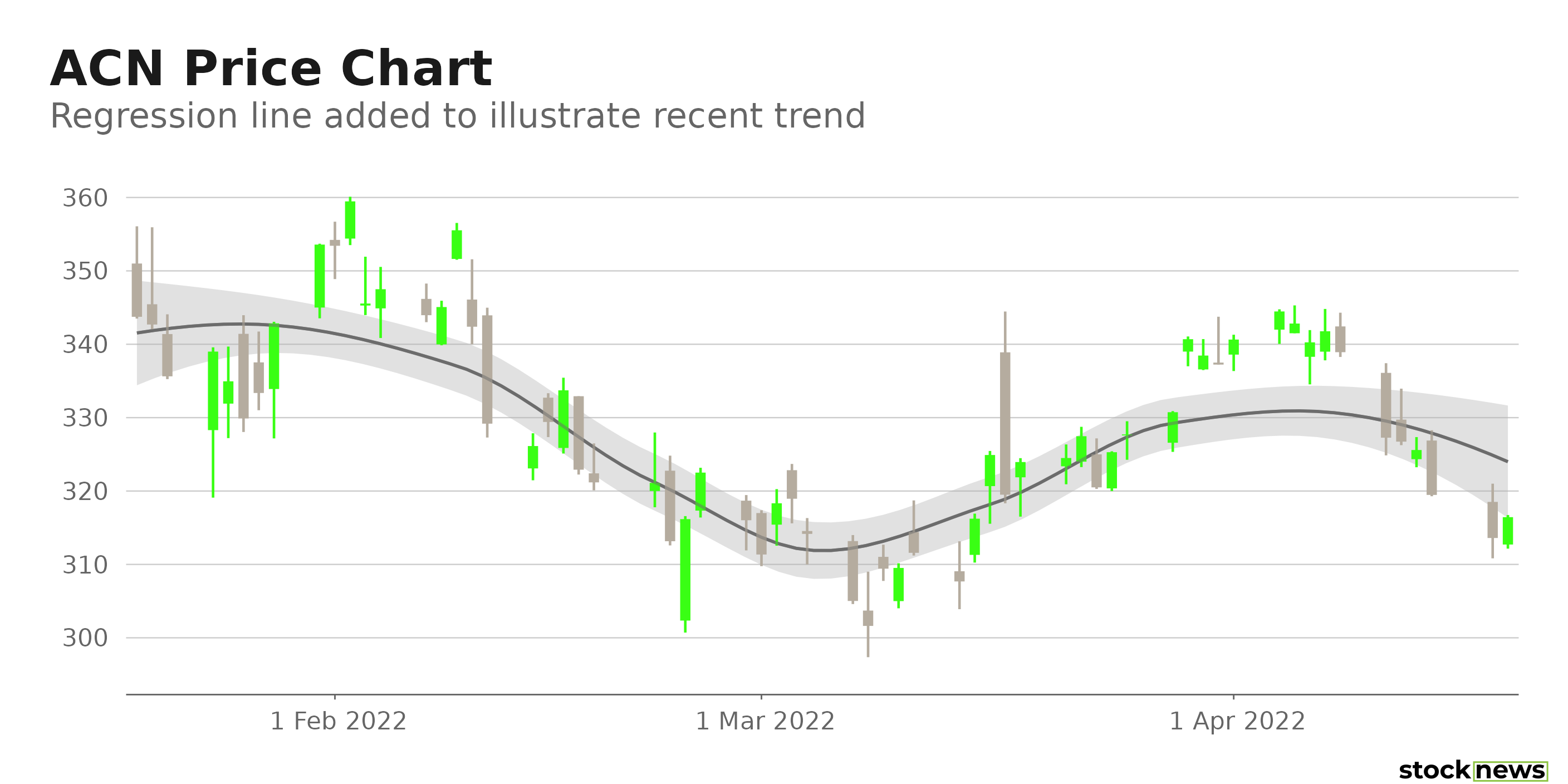

With $56.69 billion in revenues, ACN is one of the largest outsourcing companies globally. Shares of ACN have gained 9.3% in price over the past year, surpassing the benchmark tech-heavy Nasdaq Composite index's negative 5.1% returns over this period. However, the stock’s price has plummeted more than 24% year-to-date, driven by the tech rout and corresponding market correction earlier this year.

Despite the broader market weakness, ACN's revenues increased 24% year-over-year to $15 billion in its fiscal 2022 second quarter ended February 28. Its operating income and EPS rose 25% and 14%, respectively, from the same period last year to $2.06 billion and $2.54. Regarding this, ACN's Chair and CEO Julie Sweet said, "Our outstanding second-quarter financial performance demonstrates continued strong, broad-based demand across all our markets, services and industries. We continue to take significant market share as clients increasingly turn to Accenture as the partner uniquely positioned to help them navigate today's accelerating pace of change. Our core strength is the diversity of our business that enables us to digitally transform across the enterprise through the depth and breadth of our services."

Here is what could shape ACN's performance in the near term:

Consistent Earnings Growth History

ACN's revenues have improved at a 10.9% CAGR over the past five years. The company's EBITDA has improved at an 11.8% CAGR over the past five years and at a rate of 12.5% over the past three years. Its net income and EPS have increased at CAGRs of 12.7% and 13%, respectively, over the past three years, and at CAGRs of 10.9% and 10.6% over the past five years. Also, ACN's tangible book value improved at a 16.8% rate per annum over the past five years.

The company's trailing-12-month revenues rose 24.1% year-over-year, while its EBIT improved 26.1% from the same period last year. ACN's trailing-12-month net income increased 17.1% from the same period in the previous year, while EPS rose 17.4% over this period.

Impressive Profitability

ACN's 11.27% trailing-12-month net income margin is 106.8% higher than the 5.45% industry average . Its trailing-12-month EBITDA margin and asset turnover ratio of 16.78% and 14.42%, respectively, are significantly higher than the 13.69% and 0.63% industry averages.

In addition, ACN's 32.89%, 22.79%, and 14.42% respective ROE, ROTC, and ROA compare with the 7.28%, 4.78%, and 3.4% industry averages.

Bullish Growth Prospects

Analysts expect ACN's revenues to rise 20.9% year-over-year to $16.04 billion in its fiscal year 2022 third-quarter, ending May 31, 2022. The $2.84 consensus EPS estimate for the current quarter indicates an 18.3% improvement from the same period last year. In addition, the Street expects the company's revenues and EPS to rise 18.4% and 19.6%, respectively, year-over-year to $15.88 billion and $2.63 in the next quarter.

Furthermore, ACN's revenue is expected to improve 22.3% year-over-year in its fiscal 2022 and 9.8% from the same period last year in fiscal 2023. Its EPS is expected to rise 22.6% from its year-ago value in the current year and 12% next year.

Consensus Rating and Price Target Indicate Potential Upside

Among the 14 Wall Street analysts that rated ACN, nine rated it Buy, while five rated it Hold. The 12-month median price target of $402.57 indicates a 28.4% potential upside from yesterday's closing price of $313.60. The price targets range from a low of $350.00 to a high of $480.00.

Favorable POWR Ratings

ACN has an overall B rating, which equates to Buy in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

ACN has a B grade for Quality and Sentiment. The company's higher-than-industry profit margins justify the Quality grade, while bullish analyst sentiment matches the Sentiment grade.

Among the 10 stocks in the A-rated Outsourcing – Tech Services industry, ACN is ranked #3.

Beyond what I have stated above, view ACN ratings for Growth, Momentum, Value, and Stability here.

Note that ACN is one of the few stocks handpicked currently in the Reitmeister Total Return portfolio. Learn more here.

Bottom Line

ACN has been scaling its business expansion through acquisitions of late. This month, the company acquired an independent networking services company, AFD.TECH, and has entered into an acquisition agreement with leading U.K. sustainability consultancy Avieco. Furthermore, so far this year ACN has invested in several other tech-based companies through its wholly-owned subsidiary Accenture Ventures. So, we think the stock is an ideal investment bet on the dip, given its impressive growth prospects.

How Does Accenture (ACN) Stack Up Against its Peers?

While ACN has a B rating in our proprietary rating system, one might want to consider looking at its industry peer, Hackett Group Inc. (HCKT), which has an A (Strong Buy) rating.

Want More Great Investing Ideas?

ACN shares were trading at $316.29 per share on Tuesday morning, up $2.69 (+0.86%). Year-to-date, ACN has declined -23.28%, versus a -6.62% rise in the benchmark S&P 500 index during the same period.

About the Author: Aditi Ganguly

Aditi is an experienced content developer and financial writer who is passionate about helping investors understand the do’s and don'ts of investing. She has a keen interest in the stock market and has a fundamental approach when analyzing equities.

The post Accenture: A High-Quality Stock with Consistent Earnings Growth appeared first on StockNews.com