Encourages all Shareholders to read letter posted on CoveStreetCapital.com highlighting the disingenuous behavior of the Board which has compounded the impact of the disastrous management of the Company for 20 Years.

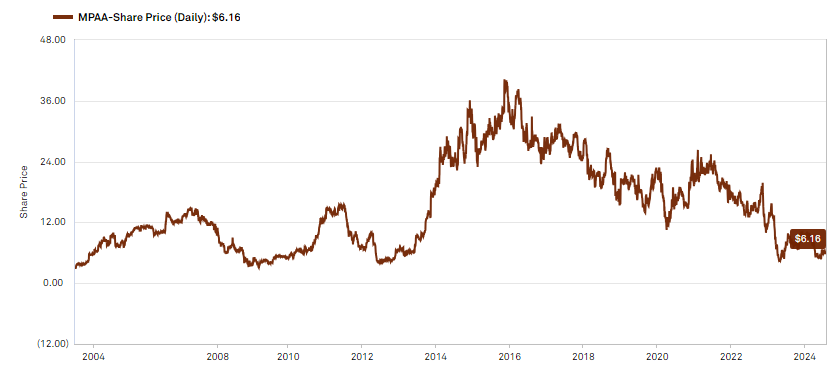

EL SEGUNDO, CA / ACCESSWIRE / August 5, 2024 / Cove Street Capital, LLC, on behalf of its clients and related entities, issued a public letter to the shareholders of Motorcar Parts of America, Inc (Nasdaq:MPAA) announcing it has voted NO with respect to all "legacy" nominations to the Board of Directors (the "Board") in order to highlight the company's awful performance and governance for 20 years.

The full text of the letter can be read at: https://covestreetcapital.com/for-whom-the-bell-tolls-motorparts-of-america

CEO Selwyn Joffe has had a value-destructive run, effectively overseeing the company as a non-profit for the benefit of customers and employees for the last 10 years, an epic failure as a public company.

Cove Street has engaged with management and the Board since February 2024 in an effort to constructively work toward long overdue material change at the Board level to assist in a rigorous overview of uneconomic company behavior.

While we were successful in convincing the company to start the process of Board refreshment by nominating two new Board members this year, the path toward this outcome needs to be aired. Proper management and governance of a public company, in our opinion, is crucial to reaching appropriate outcomes for shareholders. We would suggest the unveiling of how the process was conducted is relevant for investors to consider in making their own decisions with respect to this company and its leadership.

-

We have voted NO with respect to the following Directors:

Selwyn Joffe (served since 1994)

David Bryan (served since 2016)

Joseph Ferguson (served since 2016)

Philip Gay (served since 2004)

Jeffrey Mirvis (served since 2009)

Patricia Warfield (served since 2022)

Barbara Whittaker (served since 2017)

We are supporting the nominations of Doug Trussler, Anil Shrivastava and F. Jack Leibau, Jr.

Our research suggests the stock is woefully undervalued, which we attribute primarily to the considerable governance risks imposed by this long-time underperforming Board.

Our motivations are simple: partner with people we respect and make money for all shareholders. But in the words of John Stuart Mill:

"Let not anyone pacify his conscience by the delusion that he can do no harm if he takes no part, and forms no opinion. Bad men need nothing more to compass their ends, than that good men should look on and do nothing. He is not a good man who, without a protest, allows wrong to be committed in his name, and with the means which he helps to supply, because he will not trouble himself to use his mind on the subject."

About Cove Street Capital

Cove Street Capital is an El Segundo, California based investment manager founded in 2011. We are classic value investors in the tradition of Ben Graham and Warren Buffett, seeking superior long-term performance through the purchase of securities selling prices materially below our estimate of intrinsic value. We are strong believers in the partnership between the Board and Management of a public company and its shareholders and operate under the belief that private conversations with incentivized parties working together for the benefit of all shareholders will produce the best outcome. Learn more at CoveStreetCapital.com

Contacts

Cove Street Capital, LLC

Client Relations

424-221-5897

ClientService@CoveStreetCapital.com

SOURCE: Cove Street Capital, LLC

View the original press release on accesswire.com