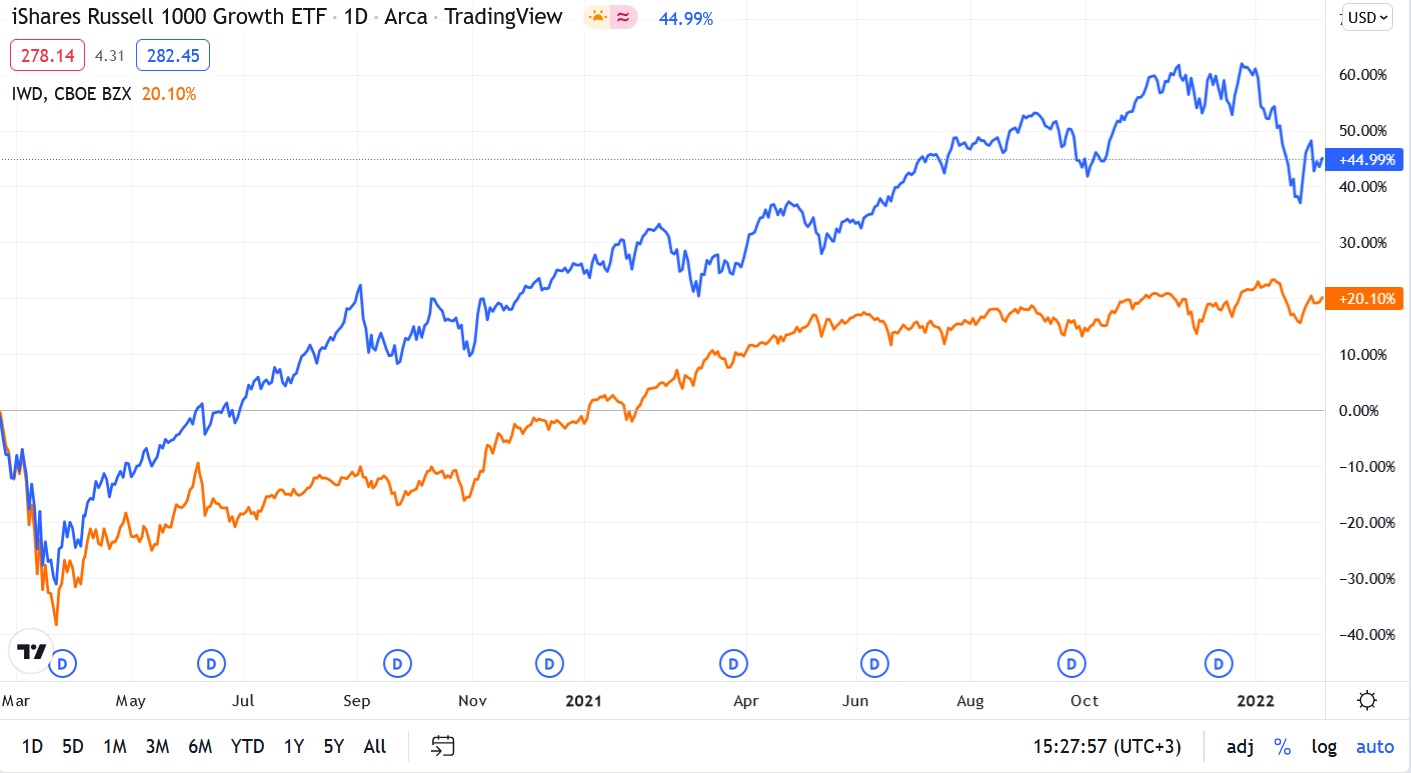

Russell 1000 Value Ishares ETF (NY: IWD )

194.33

+4.77

(+2.52%)

Streaming Delayed Price

Updated: 12:56 PM EST, Nov 6, 2024

Add to My Watchlist

All News about Russell 1000 Value Ishares ETF

AI Stock Forecast: Fighting The Irrational Crowd By Investing Through AI

December 18, 2022

Via Talk Markets

Opportunities In Large Cap Growth And Small Cap

October 20, 2022

Via Talk Markets

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.