Fountain’s latest report highlights key trends and insights for recruiting workers at scale

Fountain, the leading platform for frontline workers that helps employers around the world hire 3 million people per year, today released “The State of Frontline Hiring: 2023 Annual Benchmarking Report,” revealing key findings from the current state of frontline hiring.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20231025495585/en/

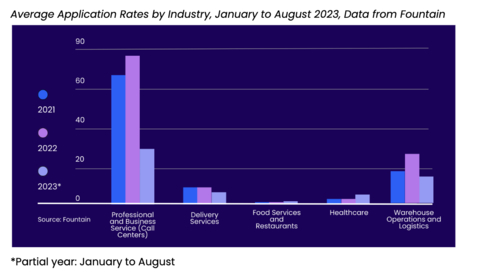

Average Application Rates by Industry, January to August 2023, Data from Fountain

The insights come from Fountain’s proprietary data covering more than 4 million applications and thousands of job openings from high volume employers who hire upwards of 1,000 applicants per year. Industries represented include Professional and Business Services (Call Centers), Delivery Services, Food Services and Restaurants, Healthcare, and Warehouse Operations and Logistics, with a granular dive into metrics from applications per open role to conversion rates, illuminating how the hiring market for these workers has changed. The report found that while there was tremendous demand for frontline workers during the pandemic, the market has since shifted as unemployment has stabilized and an additional “catch-up” bump in hiring between February and August of 2023 has also better prepared employers for the 2023 holiday season.

The frontline workforce makes up 70% of U.S. jobs, according to McKinsey. For office-based industries, hires, openings, and quits have returned to their pre-pandemic levels according to the U.S. Bureau of Labor Statistics. But for frontline industries, there were 25% more job openings in July 2023, compared to July 2019, and quit rates are at their highest levels since the pandemic.

So far this year, peak hiring started in February when the percentage of total applicants hired reached 15% before declining to below 10% by August. What had been a 10-month window of elevated hiring prior to the pandemic was shortened by three months, indicating employers may be scaling back labor costs due to recession fears and the impact of inflation on consumer spending.

“Frontline employers were forced to lay off and then rehire their workers in a short span of time following lockdowns and government stipends, combined with rapid business closings and reopenings. The speed to hire and the rate at which this changes has only recently begun to reset,“ said Sean Behr, CEO of Fountain. “The American frontline worker has also changed—what we are witnessing as we vet and hire millions of workers each year is that these workers have more options, more flexibility, and are treated better. With more opportunities available, they have more power and ability to effect change at their current companies, which we are seeing playing out across industries, and employers should take notice.”

Top Findings:

- Frontline Jobs Demand: Call Centers (under Business and Professional Services) are seeing the highest application rates of the sectors studied, but there has been a 58% decline in average weekly applications per job postings this year so far compared to 2021. Delivery Services applications have fallen 11% in 2023, with hiring remaining relatively steady.

- Warehousing Still a Standout: The Warehouse Operations and Logistics sector continues to show strength, with 28% of applicants hired in 2023 and compensation at $19 per hour, despite average weekly application rates dropping only 5%, from 19 per role in 2021 to 18 per role in 2023. Hiring slowed after a boom year in 2022, indicating employers will likely have fewer openings this holiday season as consumers pare back spending.

- Where Pay is Up but Hiring is Down: Healthcare’s average hiring rate peaked at 17% in 2022 but has since cooled, falling to 12% in 2023. This is inverse to a recent spike in application rates, which is likely related to rising pay. Advertised healthcare wages clocked in at the highest of the industries covered, at an average $34 per hour in 2023.

- Rise of Video Interviews: Video interviews have been a value add for Food Services and Restaurants; companies that offered the option for candidates to record video interviews saw conversion rates of more than 60%, compared to the conversion rates of roughly 45% for phone and in-person interview formats. This indicates employers in this sector should consider adding video interviews to their hiring process to increase their conversion rates.

- The Dotted Line: So far in 2023, all industries in 2023 have seen contract signing rates above 90% for jobs offered, with the exception of Warehouse Operations and Logistics: The rate of applicants who sign contracts and complete onboarding paperwork for this industry has declined to 82%, which may hint toward unattractive pay or hours that lead applicants to look elsewhere.

- Holiday Outlook: Overall application rates for frontline workers in these sectors have been declining since August 2022, and are now at roughly the same level seen throughout 2019. This indicates employers are showing less of an appetite for hiring as we head into the 2023 holiday season.

*Methodology: For this report, Fountain examined proprietary and anonymized data from thousands of job applications and openings in the U.S., covering a time period between March 2021 and August 2023. Categories included Application Rate, Applicant-to-Hire Ratio or “Hire Rate,” Average Pay Per Hour, and Stage Conversion Rate. In addition to raw values, application and hire rates are also presented as three-month rolling averages to smooth the data and assist with trend identification. Total applications can be impacted by variables not directly examined in this report including hours, pay, benefits offered, location, job advertisement spend, and brand awareness. Application and hire rates are also shown on a normalized scale of 0 to 100, with the minimum rate for each within the time frame represented as 0 and the maximum rate for each represented as 100. Normalization of the data shows how two different measures interact when applied to the same scale but is not the actual observed value.

About Fountain

Fountain is the leading comprehensive platform for hiring and onboarding the frontline workforce. Fountain delivers a streamlined hiring process for employers to find more qualified candidates, faster–with a tech-driven efficiency that gets people to jobs in days, not weeks. The platform creates a seamless experience for hiring teams and applicants, with mobile-first technology that meets candidates where they are and saves employers time and resources, processing more than 30 million applications per year. With a focus on AI-powered technology and exceptional customer service, Fountain helps companies across all industries transform their frontline recruiting, onboarding, and retention processes to build a better workforce. For more information, visit https://www.fountain.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20231025495585/en/

Contacts

Chelsea Allison

chelsea@cmand.co