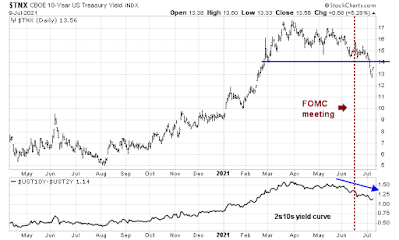

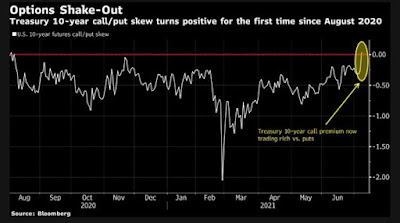

In late May, I forecasted bond market price strength and called for a counter-trend rally in growth stocks (see What a bond market rally could mean for your investments) but the latest move in both yields and growth appear exhaustive. As evidence of the change in psychology, Bloomberg reported that put option premiums over calls on the 10-Year Treasury Note have vanished. Traders are now paying more for call options than put options.

Here are seven reasons why investors should fade the growth scare.

The full post can be found here.