All News about Swiss Franc Trust Currencyshares

Via Talk Markets

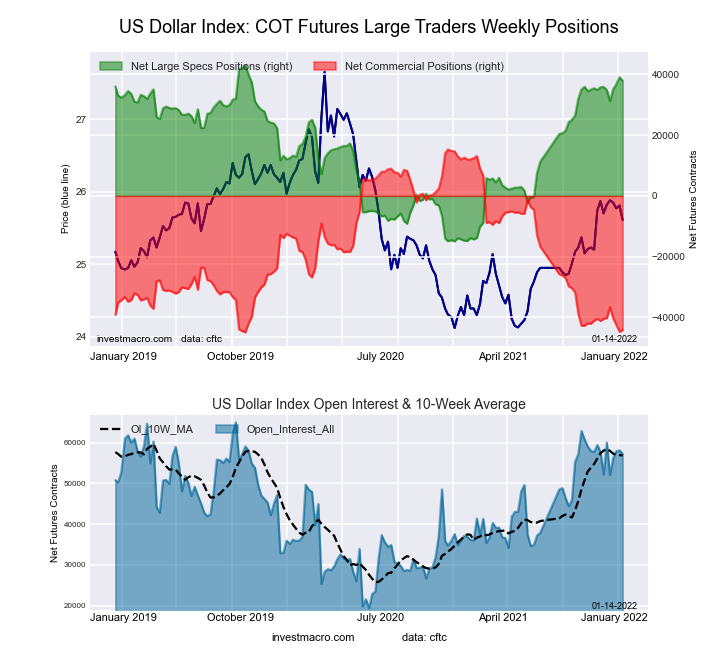

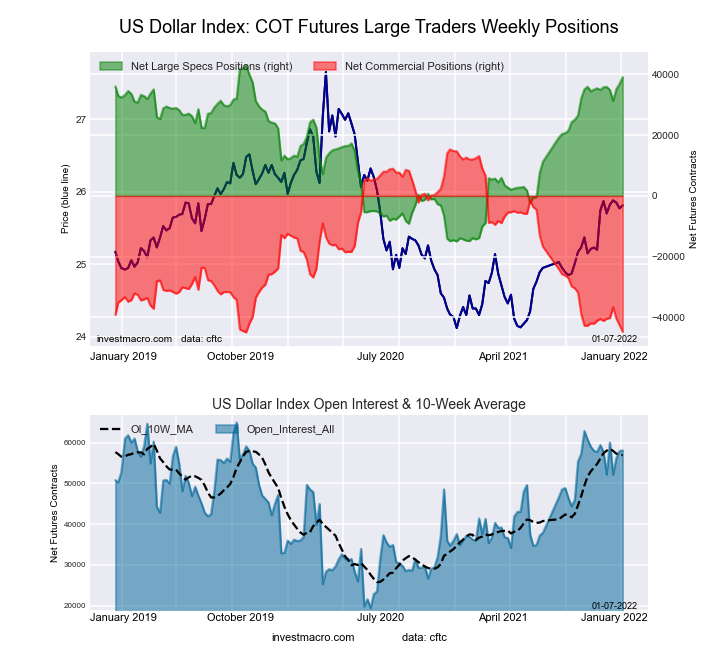

FX Positioning: More USD Long Squeeze Before Fed-Induced Rally

January 31, 2022

Via Talk Markets

Via Talk Markets

Via Talk Markets

Via Talk Markets

Via Talk Markets

Leading Banks Forecast For 2022: JPY, GBP, CAD, AUD, CHF, SEK, CNH

January 02, 2022

Via Talk Markets

JPY Q1 2022 Fundamental Forecast: USD/JPY, Fed, Labor Market Eyed

December 26, 2021

Via Talk Markets

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.