Financial News

Three Reasons Why TRN is Risky and One Stock to Buy Instead

Trinity’s 23.1% return over the past six months has outpaced the S&P 500 by 10.1%, and its stock price has climbed to $37.87 per share. This performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Trinity, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.Despite the momentum, we're sitting this one out for now. Here are three reasons why TRN doesn't excite us and a stock we'd rather own.

Why Is Trinity Not Exciting?

Operating under the trade name TrinityRail, Trinity (NYSE:TRN) is a provider of railcar products and services in North America.

1. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Sell-side analysts expect Trinity’s revenue to decline by 13.8% over the next 12 months, a deceleration versus its 32.2% annualized growth rate for the last two years. This projection is underwhelming and implies its products and services will see some demand headwinds.

2. Low Gross Margin Reveals Weak Structural Profitability

Cost of sales for an industrials business is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics.

Trinity has poor unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 21.8% gross margin over the last five years. Said differently, Trinity had to pay a chunky $78.20 to its suppliers for every $100 in revenue.

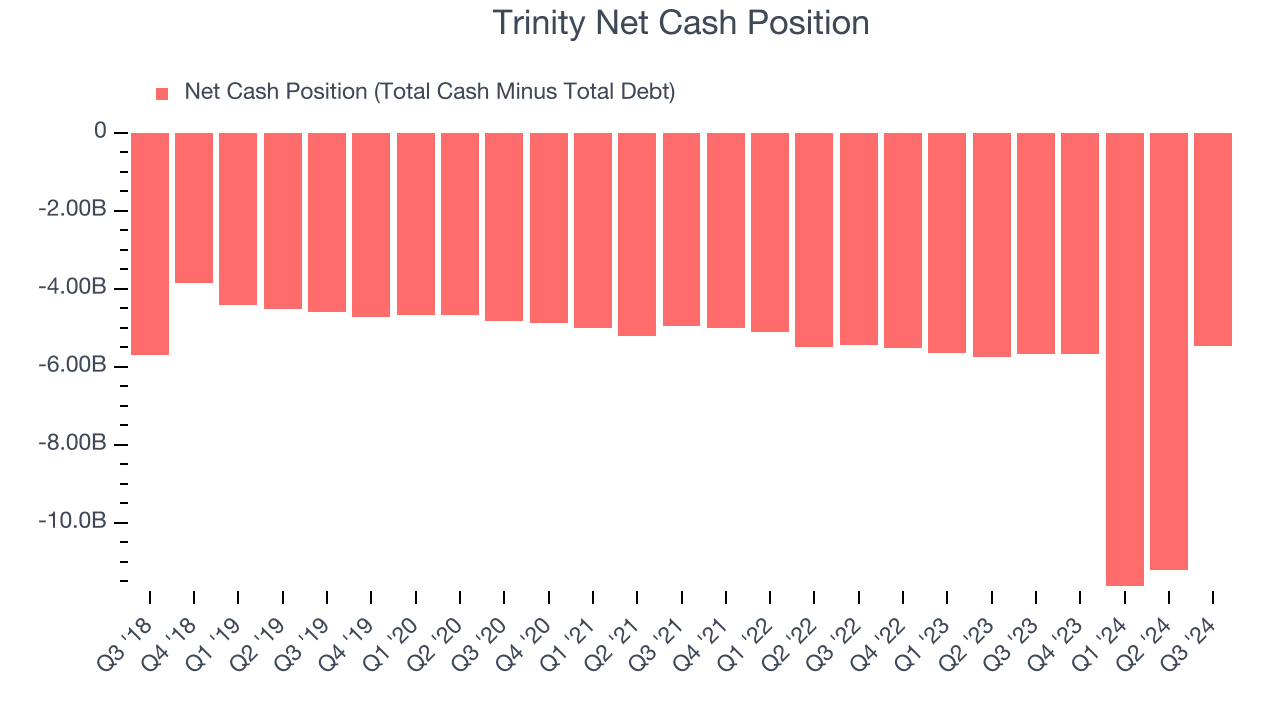

3. High Debt Levels Increase Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Trinity’s $5.7 billion of debt exceeds the $222.4 million of cash on its balance sheet. Furthermore, its 7x net-debt-to-EBITDA ratio (based on its EBITDA of $837.2 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Trinity could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Trinity can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

Trinity’s business quality ultimately falls short of our standards. With its shares topping the market in recent months, the stock trades at 24x forward price-to-earnings (or $37.87 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are superior stocks to buy right now. Let us point you toward Google, whose cloud computing and YouTube divisions are firing on all cylinders.

Stocks We Like More Than Trinity

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.