By the time my commentary goes out Friday morning, several economic data points will have been released, including the University of Michigan’s U.S. Consumer Sentiment Index for December, and the Core PCE (personal consumption expenditure) price index for September.

Economists expect both to move very little in either direction, a good news, bad news report if you’re an investor. While it’s nice to see consumer sentiment improve, albeit slightly, inflation remains an issue despite tariffs causing less of a problem than initially predicted.

Investors most likely are looking ahead to next week and a possible rate cut. The Dec. 10 Federal Reserve meeting puts the possibility of a rate cut at over 80%. That’s good news for stocks. We’ll see soon enough.

In yesterday’s options trading, there were approximately 1,341 calls and puts that were unusually active, with DTEs (days to expiration) of seven days or more.

With share prices relatively inflated -- the Shiller P/E ratio is above 40, the highest level since 1999 -- my focus today is on potential cash-secured puts to sell to generate income while getting better entry points for stocks worth owning for the long haul.

Here are three possibilities from yesterday’s unusually active put options.

Have an excellent weekend.

Netflix (NFLX)

Before I get into Netflix’s (NFLX) unusually active put option from yesterday that caught my attention, I have to admit that I’ve been writing about options for nearly four years at Barchart. I still can’t figure out how specific options end up on the daily list. Here’s what I mean.

According to the Barchart’s Unusual Options Activity page, there were 11 Netflix put options, with strike prices ranging from $218 to $70. All of these have Vol/OI (volume-to-open interest) ratios of 1.45 or higher.

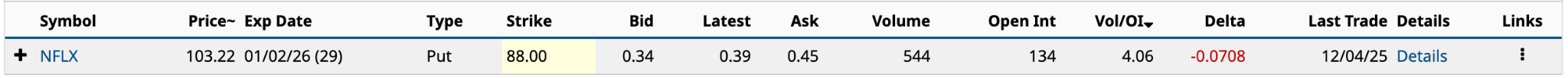

One of the 11 is the Jan. 2/2026 $88 put. It had a Vol/OI ratio of 4.01.

As this relates to selling a cash-secured put, it’s 14.75% OTM (out of the money), with a 4.9% annualized return from the $34 in premium income. The profit probability -- the probability of Netflix’s share price trading above the $87.66 breakeven price -- is a high 92.24%.

As this relates to selling a cash-secured put, it’s 14.75% OTM (out of the money), with a 4.9% annualized return from the $34 in premium income. The profit probability -- the probability of Netflix’s share price trading above the $87.66 breakeven price -- is a high 92.24%.

While you’re not going to get rich from the put’s annualized return, it does provide a slim possibility that you can buy 100 NFLX shares in 29 days for $87.66. That’s a better entry point. It is the first step in executing the “wheel” strategy, which involves selling cash-secured puts until you buy shares through assignment, and then doing a covered call on the shares you own.

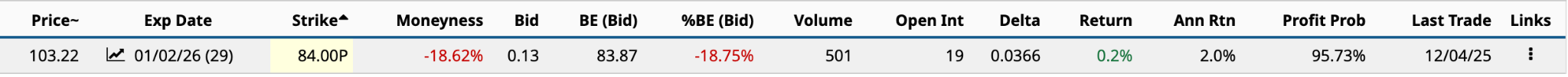

However, I did an options screen for puts with high Vol/OI ratios, and one of the Netflix puts that showed up was the $84 strike with the same Jan. 2 expiration. The put’s Vol/OI ratio was 26.37, nearly seven times higher than the $88 strike.

While the annualized return is half and the profit probability is even higher, it’s OTM by nearly 20%, which is what I look for when selling cash-secured puts. Netflix stock hasn’t traded at the $83.87 breakeven since early January.

While the annualized return is half and the profit probability is even higher, it’s OTM by nearly 20%, which is what I look for when selling cash-secured puts. Netflix stock hasn’t traded at the $83.87 breakeven since early January.

Netflix is an excellent business. Full stop. The news that it is buying Warner Bros. Discovery (WBD) for $72 billion in cash and stock could lead to near-term volatility. In the long run, whether the federal government approves the deal or not, it will remain a stock worth owning.

Using the $84 put to make this happen is a good way to ensure you can buy at the lower price with a little income for your troubles.

ON Semiconductor (ON)

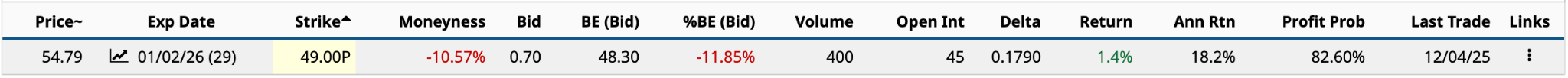

While I generally don’t write about semiconductor companies, or many tech stocks for that matter, ON Semiconductor’s (ON) Jan. 2/2026 $49 put caught my eye. It had a Vol/OI ratio of 8.89.

Admittedly, both this put and the Netflix put previously had low volume. The highest Vol/OI ratio for puts yesterday was the Hertz (HTZ) Jan. 16/2026 $9 put at 165.13, with 103,536 contracts traded.

The $49 strike is 10.57% OTM, with a $48.30 breakeven, and an annualized return of 18.2% on the $70 premium. From where I sit, that is attractive to anyone interested in generating income while obtaining a better entry point to go long ON.

According to the company’s 2025 proxy, Texas Instruments (TXN) and Analog Devices (ADI) are among its largest competitors. Over the past five years, ON stock has gained 86%, about 10 percentage points lower than ADI but considerably higher than TXN, which is up just 9.4% over the same period.

As for analysts, Wall Street is lukewarm about the company. Of the 33 analysts rating ON stock, only 14 give it a Buy rating (3.73 out of 5), with a 12-month target price of $58.78, just 6% above its current share price.

Less than 30 months ago, ON traded near $120. Its shares now trade for less than half that.

That explains why the company announced a $6 billion share repurchase plan over the next 36 months on Nov. 18. The company’s previous three-year repurchase plan saw it buy back $2.1 billion out of the $3 billion authorization. In the first nine months of 2025, the company spent nearly 100% of its $933.2 million in free cash flow on share repurchases.

If you’re a contrarian investor, ON could be worth a closer look.

Tesla (TSLA)

Once upon a time, I was a big Tesla (TSLA) bull. Then Elon Musk strayed from his day job, and I lost interest. His potential trillion-dollar pay package doesn’t help. Take a zero off that number, and it’s still obscene.

Nonetheless, investors continue to follow Elon Musk’s every move, looking for the next great product to boost Tesla’s sales. Given that its EV revenues in both China and Europe have slowed, Barron’s recent discussion about the promise of the company’s Optimus humanoid robots suggests that the 59% gain in Tesla’s share price in the past six months could be the start of an extended move higher.

Barchart contributor Aditya Raghunath wrote about Optimus yesterday, pointing out that Ark Invest’s Cathie Wood believes humanoid robots are “potentially the most significant opportunity in artificial intelligence.”

With so many potential irons in the fire beyond EVs, Investors can't ignore Tesla stock.

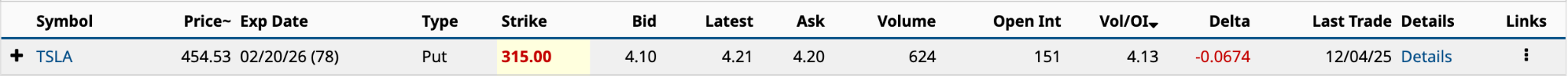

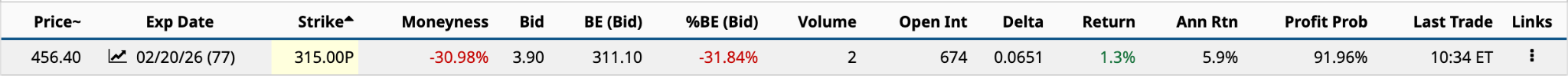

In yesterday’s unusual options activity, Tesla’s Feb. 20/2026 $315 put stands out to me. Deep OTM (30.7%), Tesla last traded around $315 in August.

Looking at the $315 put trading on Friday as I write this, while the volume is low, the 5.9% annualized return is an attractive income for patient investors willing to generate income in the near term to buy TSLA stock at a better price than currently exists.

Normally, I wouldn’t recommend a DTE of more than 60 days. However, Tesla’s quite volatile, so it’s always possible the $315 strike price could come into play over the next 77 days, although the probability of its share price trading below the $311.10 breakeven is only 8.04%.

Normally, I wouldn’t recommend a DTE of more than 60 days. However, Tesla’s quite volatile, so it’s always possible the $315 strike price could come into play over the next 77 days, although the probability of its share price trading below the $311.10 breakeven is only 8.04%.

Further, as the DTE shrinks, so too does the annualized return. The Jan. 16/2026 $315 has a current bid price of $1.45 and an annualized return of 4.0%.

However, the objective of selling these cash-secured puts is to obtain a better entry point for Tesla shares, not to generate income. The 49-day DTE reduces the possibility that the shares are assigned.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- SoFi Stock Breaks Below Key Moving Averages on $1.5B Offering. Should You Buy the Dip?

- Netflix Is Buying Warner Bros. Discovery. Should You Buy NFLX Stock?

- Amazon Just Released Its Graviton5 CPU. Should You Buy, Sell, or Hold AMZN Stock Here?

- Tesla, Netflix, and ON Semiconductor: 3 Unusually Active Cash-Secured Put Options to Sell Now