Wrapping up Q2 earnings, we look at the numbers and key takeaways for the apparel retailer stocks, including Urban Outfitters (NASDAQ: URBN) and its peers.

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

The 9 apparel retailer stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 1.1% while next quarter’s revenue guidance was in line.

While some apparel retailer stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.3% since the latest earnings results.

Urban Outfitters (NASDAQ: URBN)

Founded as a purveyor of vintage items, Urban Outfitters (NASDAQ: URBN) now largely sells new apparel and accessories to teens and young adults seeking on-trend fashion.

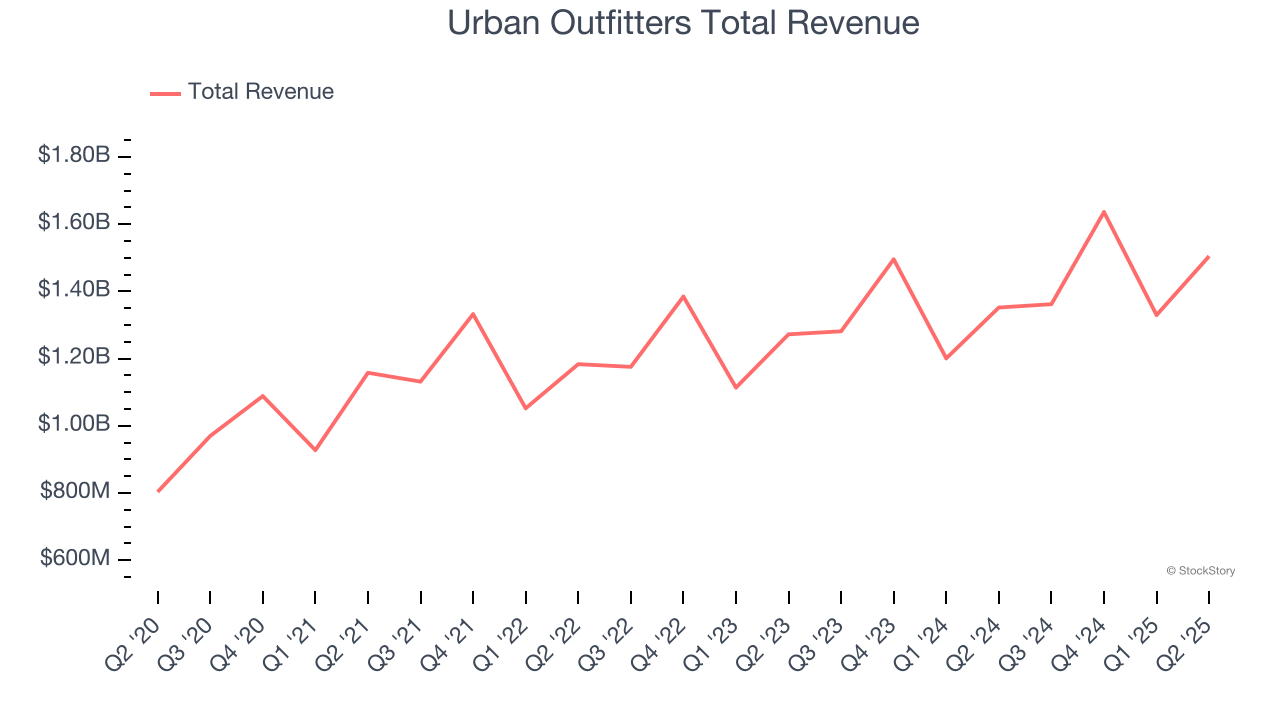

Urban Outfitters reported revenues of $1.50 billion, up 11.3% year on year. This print exceeded analysts’ expectations by 1.9%. Overall, it was a strong quarter for the company with a solid beat of analysts’ revenue estimates and a beat of analysts’ EPS estimates.

“We are proud to announce record revenues, profits, and earnings per share for the quarter,” said Richard A. Hayne, Chief Executive Officer.

Urban Outfitters achieved the fastest revenue growth of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 11.5% since reporting and currently trades at $69.17.

Best Q2: American Eagle (NYSE: AEO)

With a heavy focus on denim, American Eagle Outfitters (NYSE: AEO) is a specialty retailer offering an assortment of apparel and accessories to young adults.

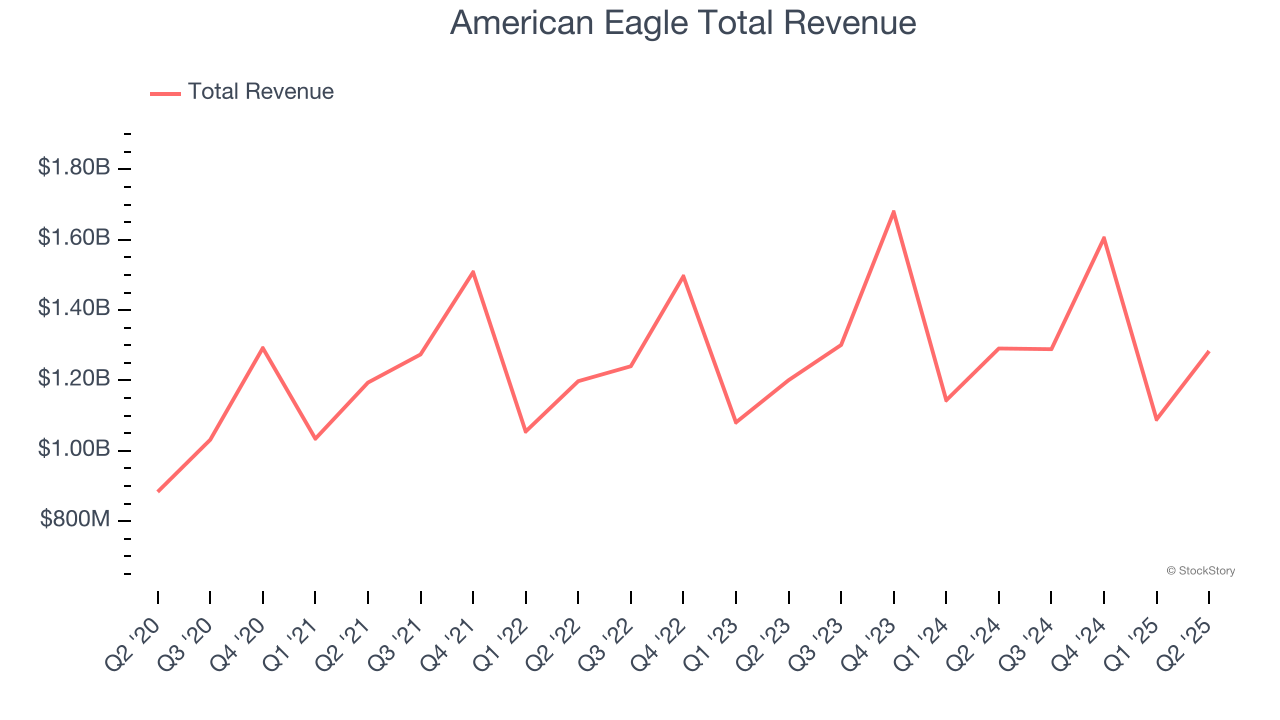

American Eagle reported revenues of $1.28 billion, flat year on year, outperforming analysts’ expectations by 4%. The business had an incredible quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ gross margin estimates.

The market seems happy with the results as the stock is up 22.9% since reporting. It currently trades at $16.76.

Is now the time to buy American Eagle? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: Torrid (NYSE: CURV)

Promoting a message of body positivity and inclusiveness, Torrid Holdings (NYSE: CURV) is a plus-size women’s apparel and accessories retailer.

Torrid reported revenues of $262.8 million, down 7.7% year on year, exceeding analysts’ expectations by 0.9%. Still, it was a disappointing quarter as it posted full-year EBITDA guidance missing analysts’ expectations and revenue guidance for next quarter missing analysts’ expectations.

Torrid delivered the highest full-year guidance raise but had the slowest revenue growth in the group. As expected, the stock is down 41.4% since the results and currently trades at $1.40.

Read our full analysis of Torrid’s results here.

Zumiez (NASDAQ: ZUMZ)

With store associates called “Zumiez Stash Members”, Zumiez (NASDAQ: ZUMZ) is a specialty retailer of street and skate apparel, footwear, and accessories.

Zumiez reported revenues of $214.3 million, up 1.9% year on year. This number topped analysts’ expectations by 1.4%. It was a stunning quarter as it also recorded EPS guidance for next quarter exceeding analysts’ expectations and a beat of analysts’ EPS estimates.

The stock is up 22.7% since reporting and currently trades at $22.63.

Read our full, actionable report on Zumiez here, it’s free for active Edge members.

Victoria's Secret (NYSE: VSCO)

Spun off from L Brands in 2020, Victoria’s Secret (NYSE: VSCO) is an intimate clothing and beauty retailer that sells its own brands of lingerie, undergarments, and personal fragrances.

Victoria's Secret reported revenues of $1.46 billion, up 3% year on year. This result beat analysts’ expectations by 4%. Overall, it was a very strong quarter as it also logged a beat of analysts’ EPS and EBITDA estimates.

Victoria's Secret scored the biggest analyst estimates beat among its peers. The stock is up 45.9% since reporting and currently trades at $33.20.

Read our full, actionable report on Victoria's Secret here, it’s free for active Edge members.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.