As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the travel and vacation providers industry, including Target Hospitality (NASDAQ: TH) and its peers.

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

The 17 travel and vacation providers stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 1.2% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 8.4% since the latest earnings results.

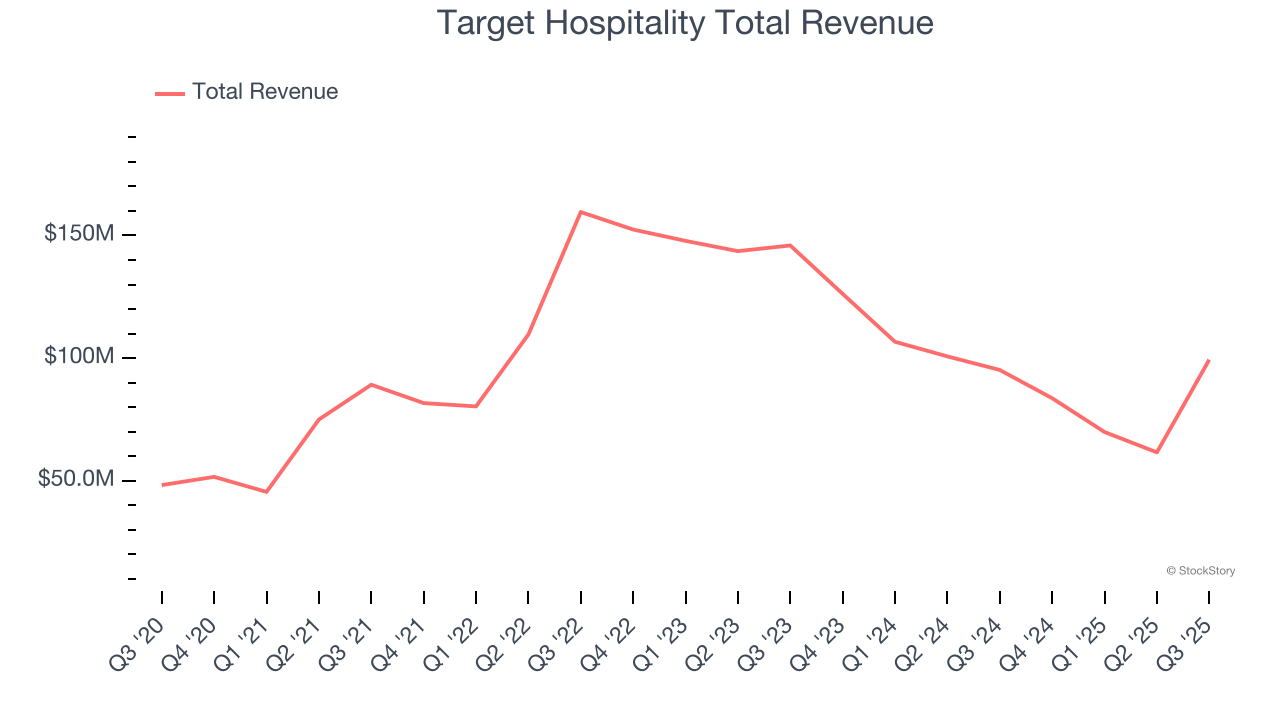

Target Hospitality (NASDAQ: TH)

Building mini-communities at places such as oil drilling sites, Target Hospitality (NASDAQ: TH) is a provider of specialty workforce lodging accommodations and services.

Target Hospitality reported revenues of $99.36 million, up 4.4% year on year. This print exceeded analysts’ expectations by 16.5%. Overall, it was a very strong quarter for the company with a beat of analysts’ EPS and EBITDA estimates.

"We continue to build on the progress we have made toward key strategic growth initiatives, focusing on expanding and diversifying Target's business portfolio. Since the second quarter of 2025, we have added over $55 million in multi-year committed revenue contracts, bringing the total value of new multi-year contract awards announced in 2025 to over $455 million," stated Brad Archer, President and Chief Executive Officer.

Target Hospitality achieved the biggest analyst estimates beat and highest full-year guidance raise of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 15.9% since reporting and currently trades at $6.49.

Is now the time to buy Target Hospitality? Access our full analysis of the earnings results here, it’s free for active Edge members.

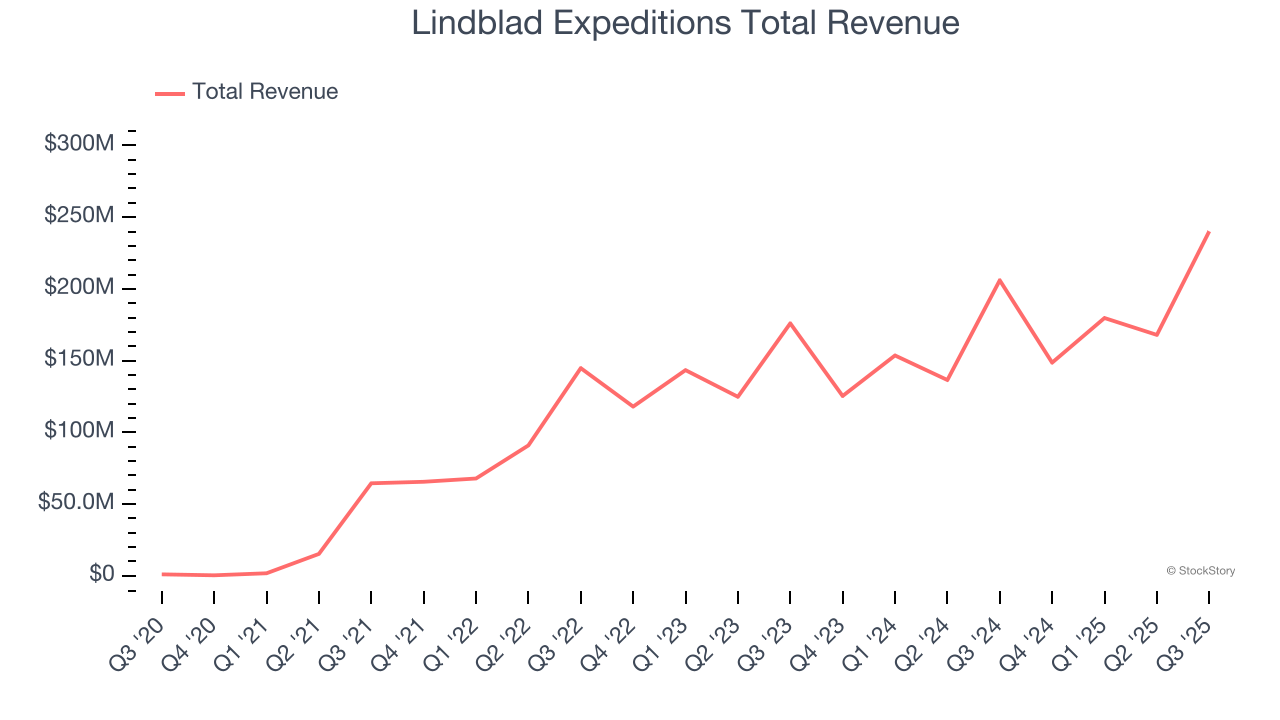

Best Q3: Lindblad Expeditions (NASDAQ: LIND)

Founded by explorer Sven-Olof Lindblad in 1979, Lindblad Expeditions (NASDAQ: LIND) offers cruising experiences to remote destinations in partnership with National Geographic.

Lindblad Expeditions reported revenues of $240.2 million, up 16.6% year on year, outperforming analysts’ expectations by 4.6%. The business had a very strong quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Lindblad Expeditions achieved the fastest revenue growth among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 4.8% since reporting. It currently trades at $11.62.

Is now the time to buy Lindblad Expeditions? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Hilton Grand Vacations (NYSE: HGV)

Spun off from Hilton Worldwide in 2017, Hilton Grand Vacations (NYSE: HGV) is a global timeshare company that provides travel experiences for its customers through its timeshare resorts and club membership programs.

Hilton Grand Vacations reported revenues of $1.3 billion, flat year on year, falling short of analysts’ expectations by 5%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue and adjusted operating income estimates.

Hilton Grand Vacations delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 15.4% since the results and currently trades at $37.36.

Read our full analysis of Hilton Grand Vacations’s results here.

Travel + Leisure (NYSE: TNL)

Formerly known as Wyndham Destinations, Travel + Leisure (NYSE: TNL) is a global vacation company that provides travelers with vacation ownership, exchange, and travel services.

Travel + Leisure reported revenues of $1.04 billion, up 5.1% year on year. This number beat analysts’ expectations by 1%. Aside from that, it was a satisfactory quarter as it also logged a decent beat of analysts’ adjusted operating income estimates but a miss of analysts’ tours conducted estimates.

The stock is up 1.9% since reporting and currently trades at $61.84.

Read our full, actionable report on Travel + Leisure here, it’s free for active Edge members.

Hilton (NYSE: HLT)

Founded in 1919, Hilton Worldwide (NYSE: HLT) is a global hospitality company with a portfolio of hotel brands.

Hilton reported revenues of $3.12 billion, up 8.8% year on year. This result topped analysts’ expectations by 3.7%. More broadly, it was a satisfactory quarter as it also recorded an impressive beat of analysts’ revenue estimates but EBITDA guidance for next quarter meeting analysts’ expectations.

The stock is flat since reporting and currently trades at $267.89.

Read our full, actionable report on Hilton here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.