Online health insurance comparison site eHealth (NASDAQ: EHTH) reported Q3 CY2025 results topping the market’s revenue expectations, but sales fell by 7.8% year on year to $53.87 million. The company expects the full year’s revenue to be around $545 million, close to analysts’ estimates. Its GAAP loss of $1.46 per share was 19.2% above analysts’ consensus estimates.

Is now the time to buy eHealth? Find out by accessing our full research report, it’s free for active Edge members.

eHealth (EHTH) Q3 CY2025 Highlights:

- Revenue: $53.87 million vs analyst estimates of $51.69 million (7.8% year-on-year decline, 4.2% beat)

- EPS (GAAP): -$1.46 vs analyst estimates of -$1.81 (19.2% beat)

- Adjusted EBITDA: -$34.01 million vs analyst estimates of -$41.07 million (-63.1% margin, 17.2% beat)

- The company reconfirmed its revenue guidance for the full year of $545 million at the midpoint

- EBITDA guidance for the full year is $70 million at the midpoint, above analyst estimates of $66.81 million

- Operating Margin: -77.1%, down from -74% in the same quarter last year

- Free Cash Flow was -$28.94 million compared to -$47.05 million in the previous quarter

- Estimated Membership: 1.12 million, down 40,901 year on year

- Market Capitalization: $150.6 million

Company Overview

Aiming to address a high-stakes and often confusing decision, eHealth (NASDAQ: EHTH) guides consumers through health insurance enrollment and related topics.

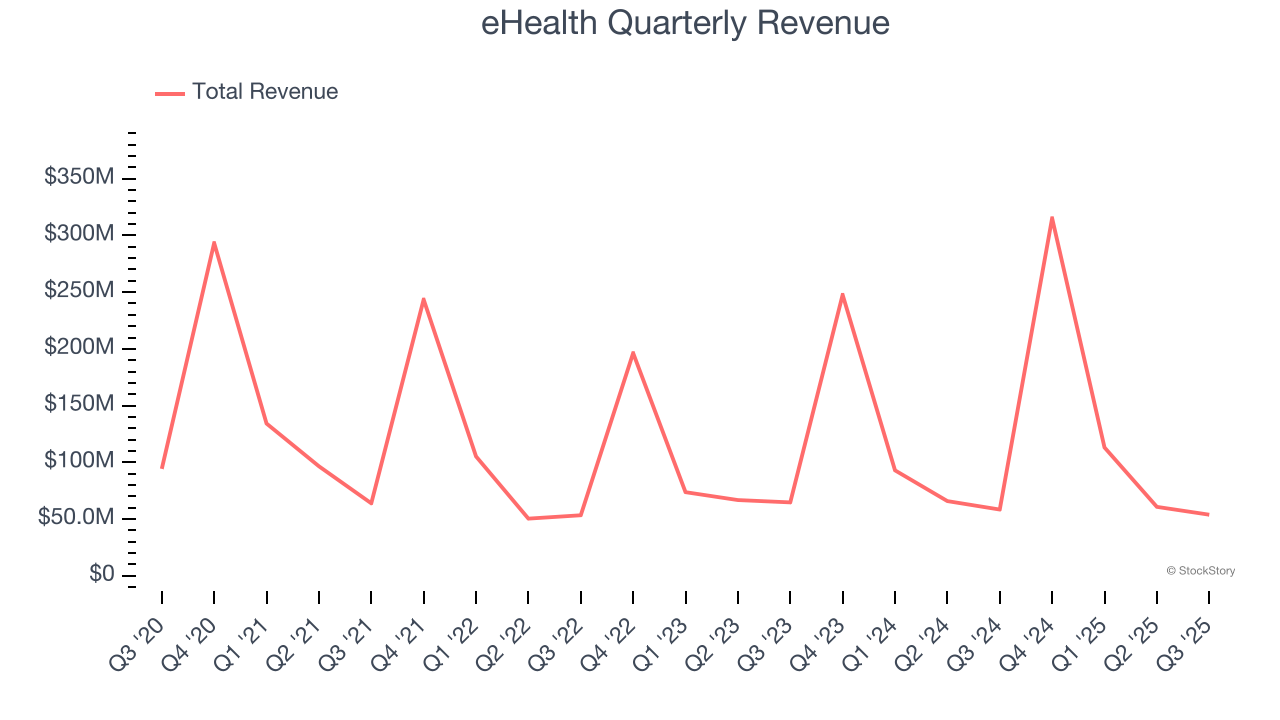

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, eHealth’s sales grew at a tepid 6.3% compounded annual growth rate over the last three years. This fell short of our benchmark for the consumer internet sector and is a poor baseline for our analysis.

This quarter, eHealth’s revenue fell by 7.8% year on year to $53.87 million but beat Wall Street’s estimates by 4.2%.

Looking ahead, sell-side analysts expect revenue to decline by 1.3% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and implies its products and services will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Estimated Membership

User Growth

As an online marketplace, eHealth generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

eHealth struggled with new customer acquisition over the last two years as its estimated membership have declined by 2.7% annually to 1.12 million in the latest quarter. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If eHealth wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

In Q3, eHealth’s estimated membership once again decreased by 40,901, a 3.5% drop since last year. The quarterly print isn’t too different from its two-year result, suggesting its new initiatives aren’t accelerating user growth just yet.

Revenue Per User

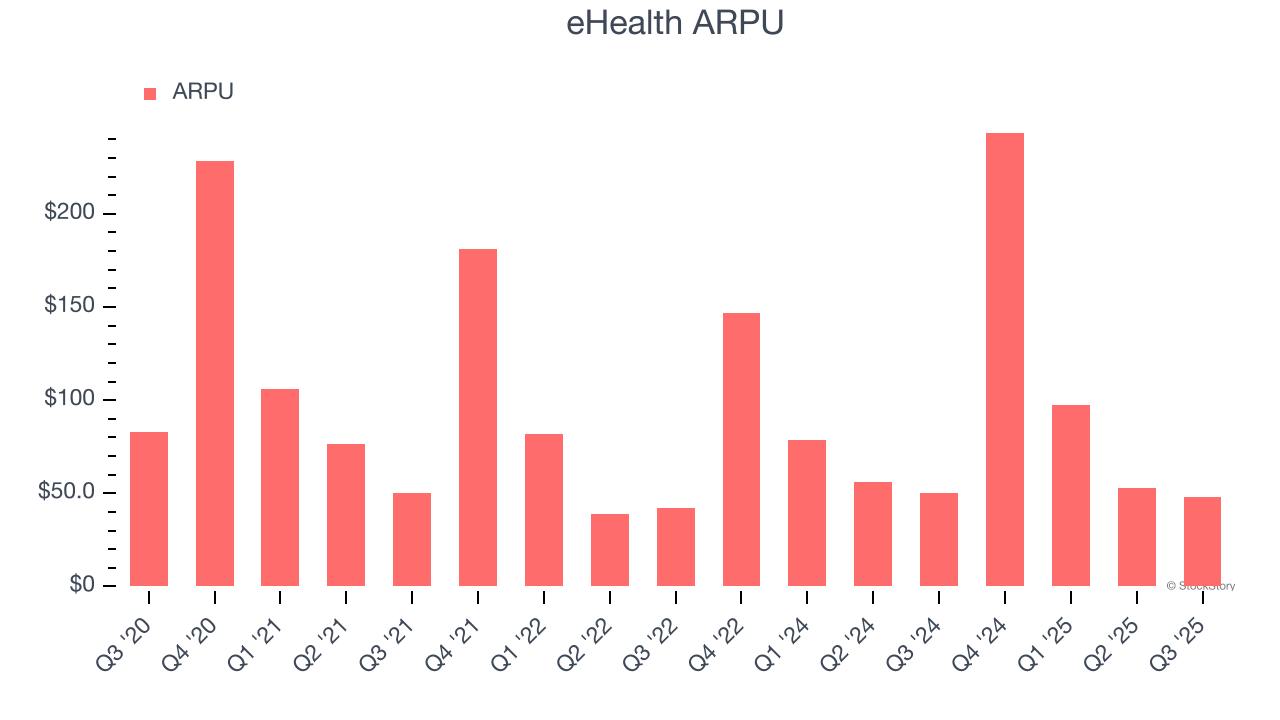

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns in transaction fees from each user. ARPU also gives us unique insights into a user’s average order size and eHealth’s take rate, or "cut", on each order.

eHealth’s ARPU growth has been mediocre over the last two years, averaging 4.8%. This raises questions about its platform’s health when paired with its declining estimated membership. If eHealth wants to grow its users, it must either develop new features or lower its monetization of existing ones.

This quarter, eHealth’s ARPU clocked in at $48.16. It declined 4.4% year on year, mirroring the performance of its estimated membership.

Key Takeaways from eHealth’s Q3 Results

We were impressed by how significantly eHealth blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year EBITDA guidance trumped Wall Street’s estimates. On the other hand, its number of users declined and its full-year revenue guidance was in line with Wall Street’s estimates. Overall, we think this was mixed quarter. The stock traded down 1.4% to $4.84 immediately after reporting.

Big picture, is eHealth a buy here and now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.