Workforce housing company Target Hospitality (NASDAQ: TH) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 4.4% year on year to $99.36 million. The company expects the full year’s revenue to be around $315 million, close to analysts’ estimates. Its GAAP loss of $0.01 per share was $0.03 above analysts’ consensus estimates.

Is now the time to buy Target Hospitality? Find out by accessing our full research report, it’s free for active Edge members.

Target Hospitality (TH) Q3 CY2025 Highlights:

- Revenue: $99.36 million vs analyst estimates of $85.3 million (4.4% year-on-year growth, 16.5% beat)

- EPS (GAAP): -$0.01 vs analyst estimates of -$0.04 ($0.03 beat)

- Adjusted EBITDA: $21.55 million vs analyst estimates of $15.83 million (21.7% margin, 36.1% beat)

- The company reconfirmed its revenue guidance for the full year of $315 million at the midpoint

- EBITDA guidance for the full year is $55 million at the midpoint, below analyst estimates of $57.77 million

- Operating Margin: 0.1%, down from 29.4% in the same quarter last year

- Free Cash Flow Margin: 71.1%, up from 24.9% in the same quarter last year

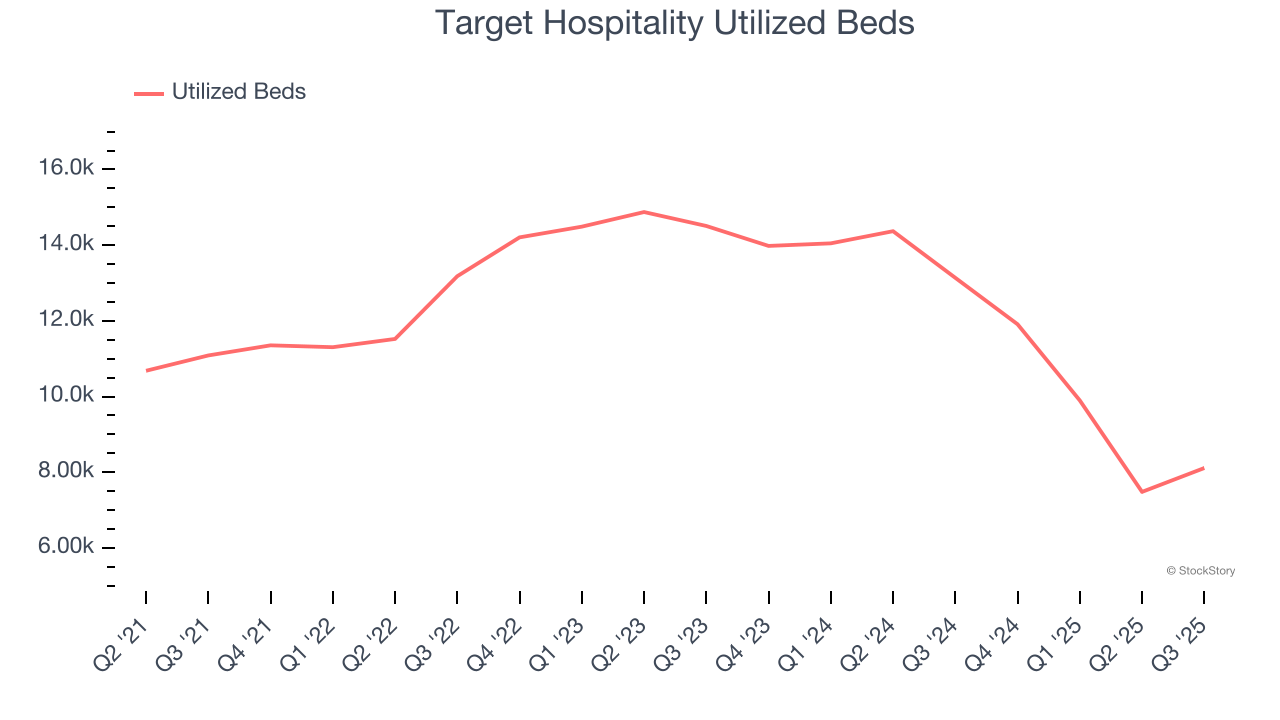

- Utilized Beds: 8,112, down 5,026 year on year

- Market Capitalization: $770.3 million

"We continue to build on the progress we have made toward key strategic growth initiatives, focusing on expanding and diversifying Target's business portfolio. Since the second quarter of 2025, we have added over $55 million in multi-year committed revenue contracts, bringing the total value of new multi-year contract awards announced in 2025 to over $455 million," stated Brad Archer, President and Chief Executive Officer.

Company Overview

Building mini-communities at places such as oil drilling sites, Target Hospitality (NASDAQ: TH) is a provider of specialty workforce lodging accommodations and services.

Revenue Growth

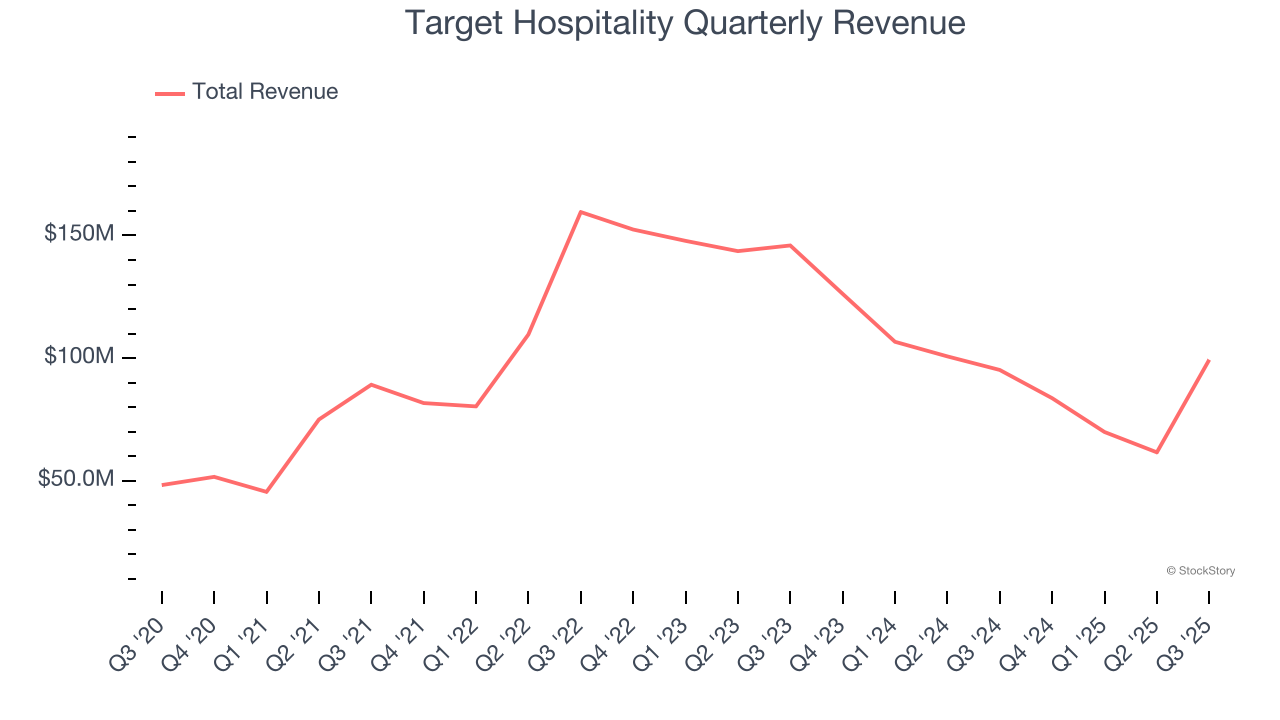

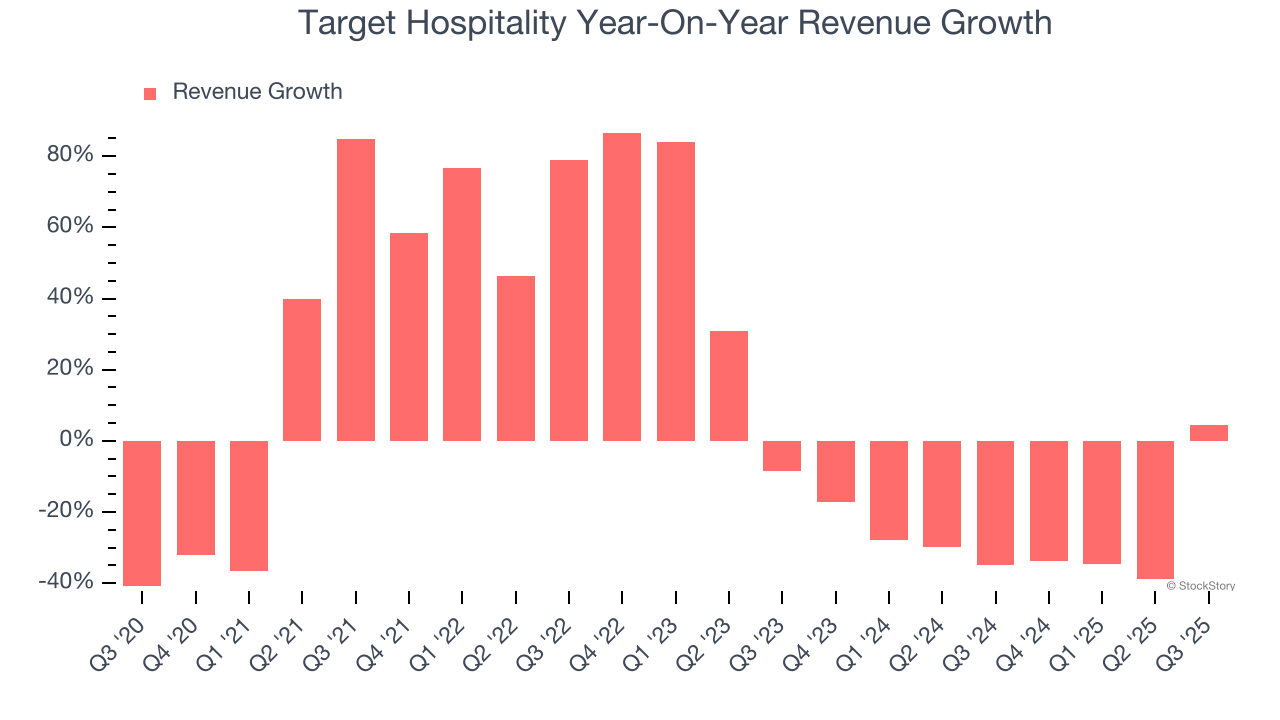

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Target Hospitality grew its sales at a sluggish 4.7% compounded annual growth rate. This wasn’t a great result compared to the rest of the consumer discretionary sector, but there are still things to like about Target Hospitality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Target Hospitality’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 27% annually.

Target Hospitality also discloses its number of utilized beds, which reached 8,112 in the latest quarter. Over the last two years, Target Hospitality’s utilized beds averaged 18.5% year-on-year declines. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Target Hospitality reported modest year-on-year revenue growth of 4.4% but beat Wall Street’s estimates by 16.5%.

Looking ahead, sell-side analysts expect revenue to decline by 5.7% over the next 12 months. While this projection is better than its two-year trend, it’s hard to get excited about a company that is struggling with demand. At least Target Hospitality is tracking well in other measures of financial health.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

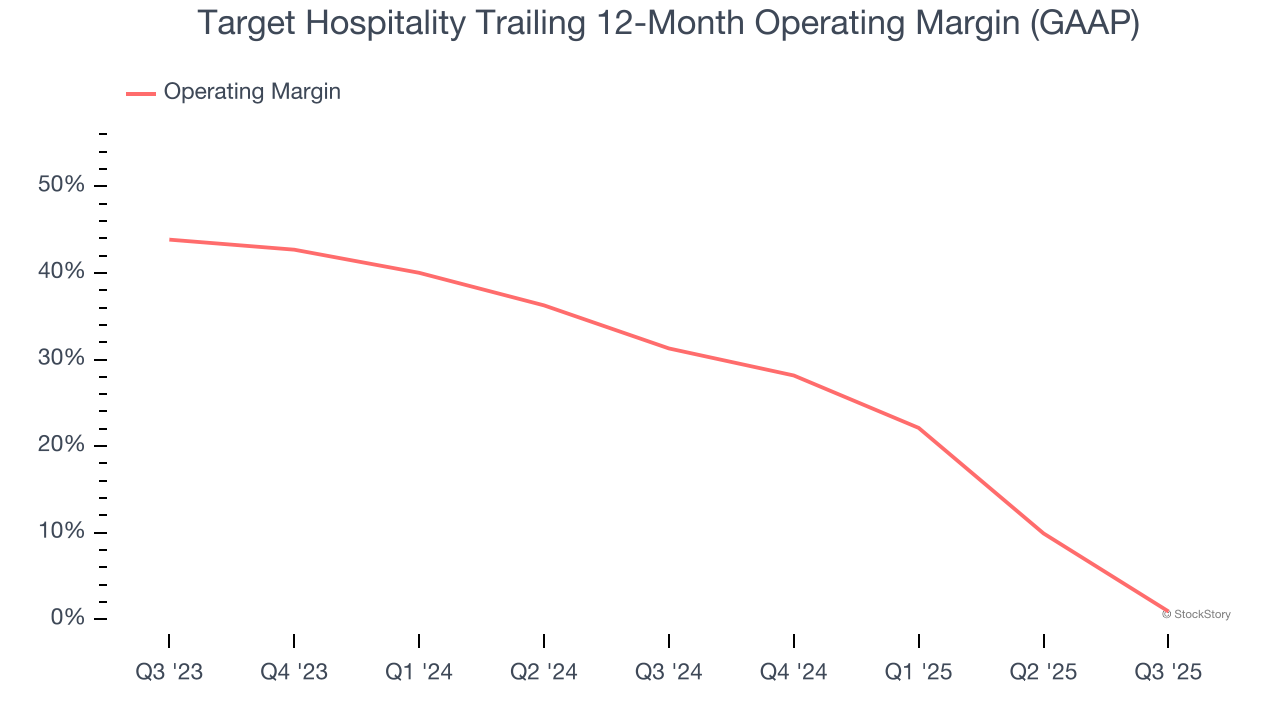

Operating Margin

Target Hospitality’s operating margin has shrunk over the last 12 months, but it still averaged 18.4% over the last two years, top-notch for a consumer discretionary business. This shows it’s an efficient company that manages its expenses effectively.

In Q3, Target Hospitality’s breakeven margin was down 29.3 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

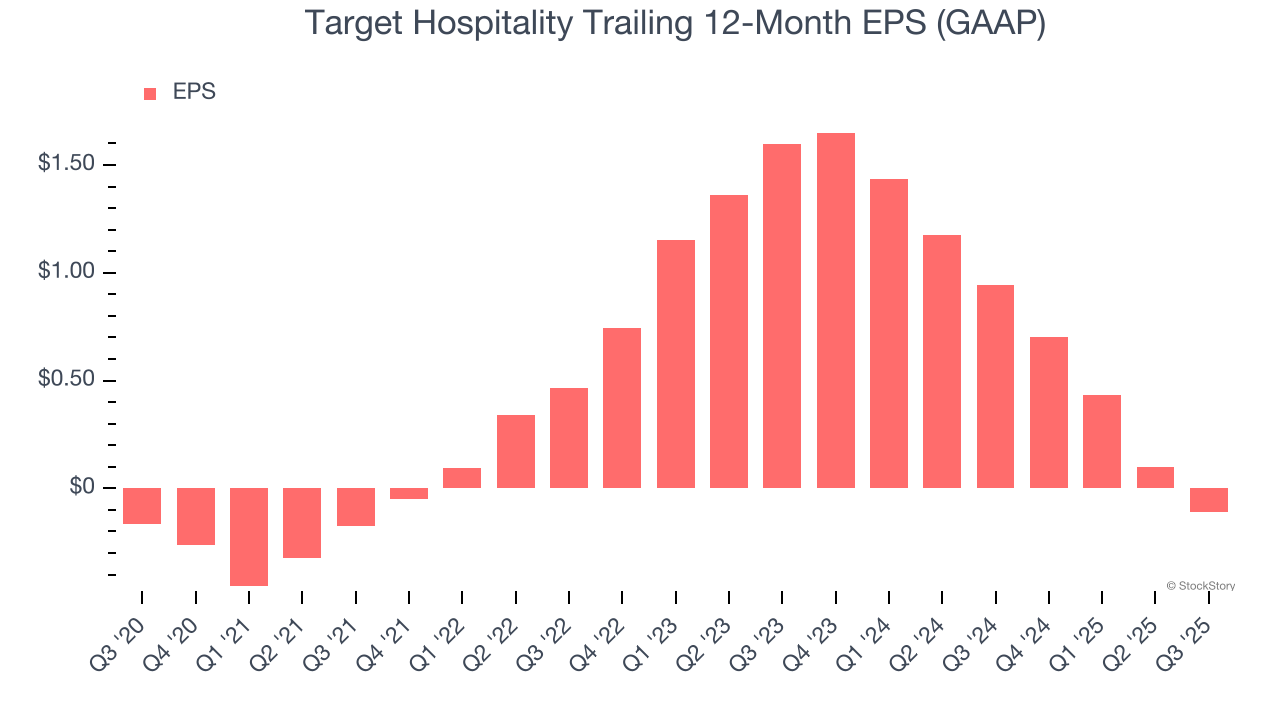

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although Target Hospitality’s full-year earnings are still negative, it reduced its losses and improved its EPS by 7.7% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

In Q3, Target Hospitality reported EPS of negative $0.01, down from $0.20 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Target Hospitality’s Q3 Results

It was good to see Target Hospitality beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its full-year EBITDA guidance missed. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 3.6% to $8 immediately following the results.

Target Hospitality had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.