Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at Insperity (NYSE: NSP) and its peers.

The Professional Staffing & HR Solutions subsector within Business Services is set to benefit from evolving workforce trends, including the rise of remote work and the gig economy. With companies casting a wider net to find talent due to remote work, the expertise of staffing and recruiting companies is even more valuable. For those who invest wisely, the use of predictive AI in recruitment and screening as well as automation in HR workflows can enhance efficiency and scalability. On the other hand, digitization means that talent discovery is less of a manual process, opening the door for tech-first platforms. Additionally, regulatory scrutiny around data privacy in HR is evolving and may require companies in this sector to change their go-to-market strategies over time.

The 7 professional staffing & hr solutions stocks we track reported a mixed Q3. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 7.5% since the latest earnings results.

Weakest Q3: Insperity (NYSE: NSP)

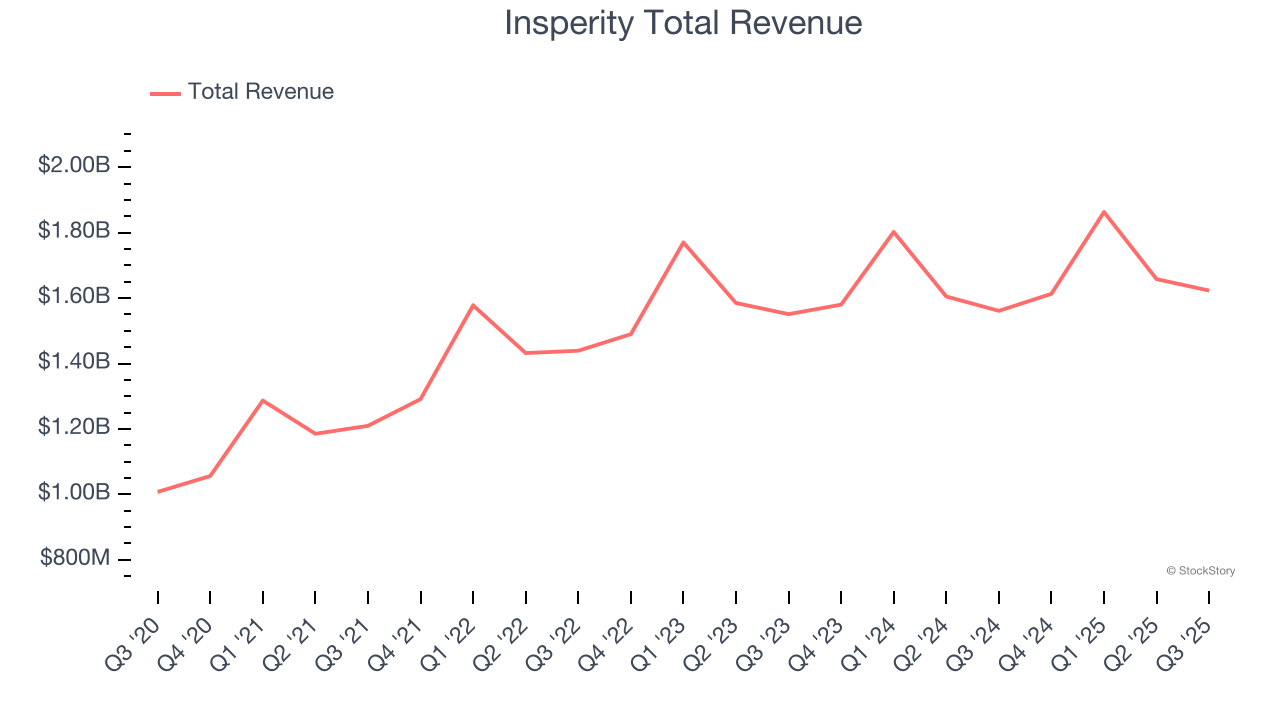

Pioneering the professional employer organization (PEO) industry it helped establish, Insperity (NYSE: NSP) provides human resources outsourcing services to small and medium-sized businesses, handling payroll, benefits, compliance, and HR administration.

Insperity reported revenues of $1.62 billion, up 4% year on year. This print was in line with analysts’ expectations, but overall, it was a disappointing quarter for the company with a significant miss of analysts’ full-year EPS guidance estimates.

“We are actively working to position Insperity for sustainable profitability at normal historical levels as we execute on our plan in response to unexpected, elevated healthcare cost trend. We are simultaneously taking assertive actions, including through the new contract with UnitedHealthcare, and will continue to focus on attracting and retaining the right clients at the right price and prudently managing expenses,” said Paul J. Sarvadi, Insperity chairman and chief executive officer.

Unsurprisingly, the stock is down 21.7% since reporting and currently trades at $35.32.

Read our full report on Insperity here, it’s free for active Edge members.

Best Q3: Kforce (NYSE: KFRC)

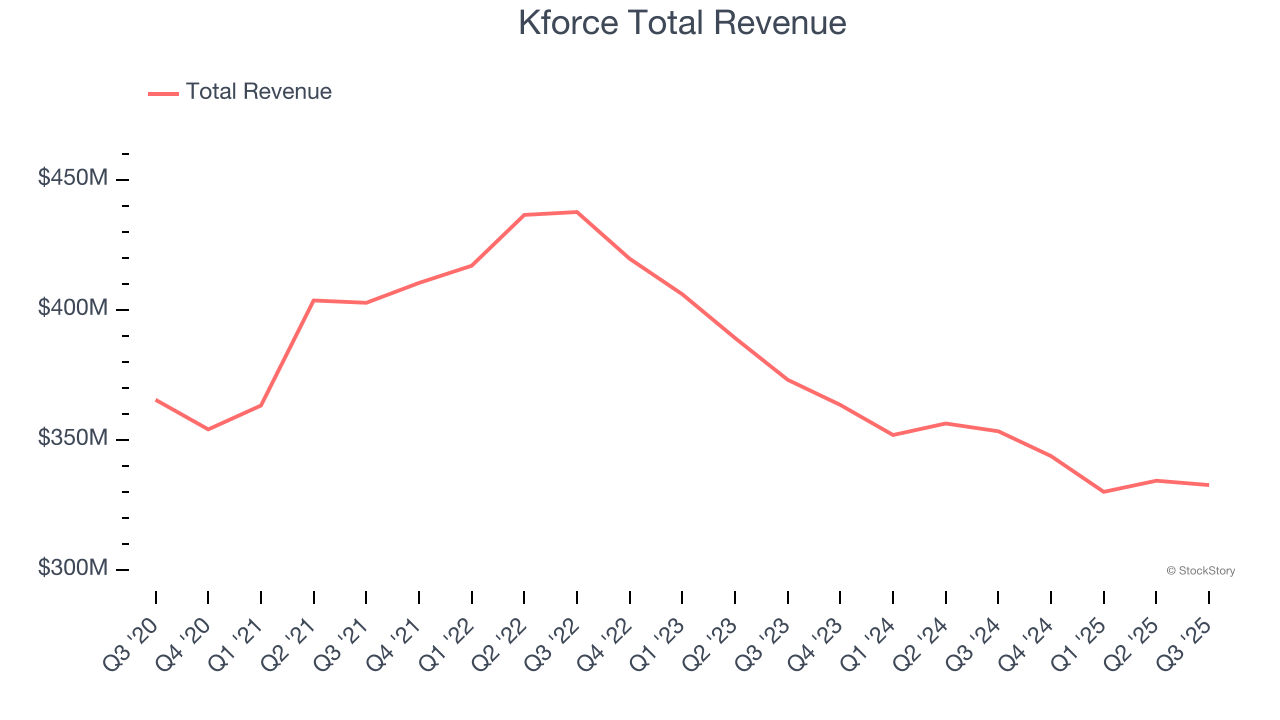

With nearly 60 years of matching skilled professionals with the right opportunities, Kforce (NYSE: KFRC) is a professional staffing company that specializes in placing technology and finance experts with businesses on both temporary and permanent bases.

Kforce reported revenues of $332.6 million, down 5.9% year on year, outperforming analysts’ expectations by 1.5%. The business had an exceptional quarter with revenue guidance for next quarter exceeding analysts’ expectations and a beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 22.5% since reporting. It currently trades at $30.06.

Is now the time to buy Kforce? Access our full analysis of the earnings results here, it’s free for active Edge members.

Alight (NYSE: ALIT)

Born from a corporate spinoff in 2017 to focus on employee experience technology, Alight (NYSE: ALIT) provides human capital management solutions that help companies administer employee benefits, payroll, and workforce management systems.

Alight reported revenues of $533 million, down 4% year on year, falling short of analysts’ expectations by 0.7%. It was a disappointing quarter as it posted a significant miss of analysts’ full-year EPS guidance estimates and EPS in line with analysts’ estimates.

Alight delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. As expected, the stock is down 13.9% since the results and currently trades at $2.36.

Read our full analysis of Alight’s results here.

Robert Half (NYSE: RHI)

With roots dating back to 1948 as the first specialized recruiting firm for accounting and finance professionals, Robert Half (NYSE: RHI) provides specialized talent solutions and business consulting services, connecting skilled professionals with companies across various fields.

Robert Half reported revenues of $1.35 billion, down 7.5% year on year. This number met analysts’ expectations. More broadly, it was a mixed quarter as it also produced EPS in line with analysts’ estimates but revenue in line with analysts’ estimates.

Robert Half had the slowest revenue growth among its peers. The stock is down 7.4% since reporting and currently trades at $27.45.

Read our full, actionable report on Robert Half here, it’s free for active Edge members.

First Advantage (NASDAQ: FA)

Processing approximately 100 million background checks annually across more than 200 countries and territories, First Advantage (NASDAQ: FA) provides employment background screening, identity verification, and compliance solutions to help companies manage hiring risks.

First Advantage reported revenues of $409.2 million, up 105% year on year. This print topped analysts’ expectations by 1.6%. Overall, it was a strong quarter as it also recorded an impressive beat of analysts’ full-year EPS guidance estimates and a beat of analysts’ EPS estimates.

First Advantage scored the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The stock is up 8% since reporting and currently trades at $13.97.

Read our full, actionable report on First Advantage here, it’s free for active Edge members.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.