As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the electronic components & manufacturing industry, including Plexus (NASDAQ: PLXS) and its peers.

The sector could see higher demand as the prevalence of advanced electronics increases in industries such as automotive, healthcare, aerospace, and computing. The high-performance components and contract manufacturing expertise required for autonomous vehicles and cloud computing datacenters, for instance, will benefit companies in the space. However, headwinds include geopolitical risks, particularly U.S.-China trade tensions that could disrupt component sourcing and production as the Trump administration takes an increasingly antagonizing stance on foreign relations. Additionally, stringent environmental regulations on e-waste and emissions could force the industry to pivot in potentially costly ways.

The 10 electronic components & manufacturing stocks we track reported a very strong Q3. As a group, revenues beat analysts’ consensus estimates by 4.7% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 1.8% on average since the latest earnings results.

Plexus (NASDAQ: PLXS)

With over 20,000 team members across 26 global facilities, Plexus (NASDAQ: PLXS) designs, manufactures, and services complex electronic products for companies in aerospace/defense, healthcare, and industrial sectors.

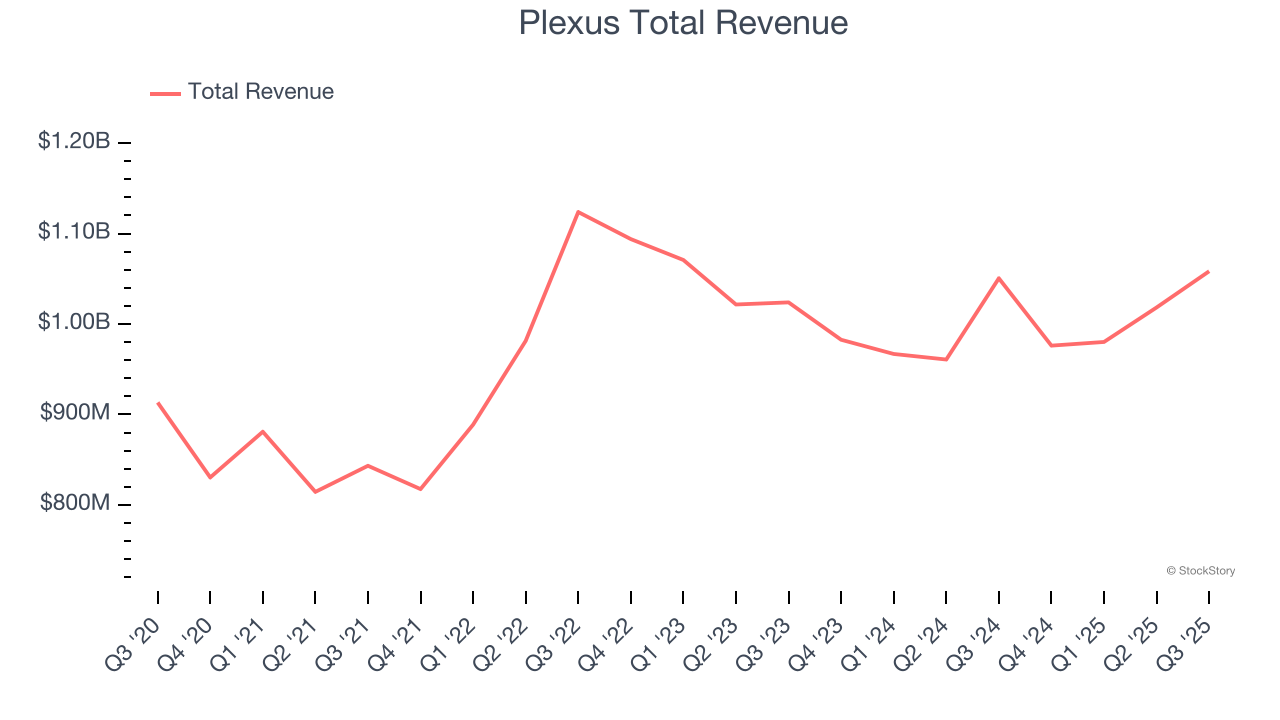

Plexus reported revenues of $1.06 billion, flat year on year. This print exceeded analysts’ expectations by 1.1%. Overall, it was a strong quarter for the company with a beat of analysts’ EPS estimates and revenue guidance for next quarter beating analysts’ expectations.

Todd Kelsey, President and Chief Executive Officer, commented, “The Plexus team continues to deliver a differentiated value proposition for our customers, and generated strong fiscal fourth quarter results. I am particularly pleased with our non-GAAP EPS of $2.14, which exceeded guidance, and our free cash flow, which again exceeded projections.”

Plexus delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. Unsurprisingly, the stock is down 2.5% since reporting and currently trades at $142.45.

Is now the time to buy Plexus? Access our full analysis of the earnings results here, it’s free for active Edge members.

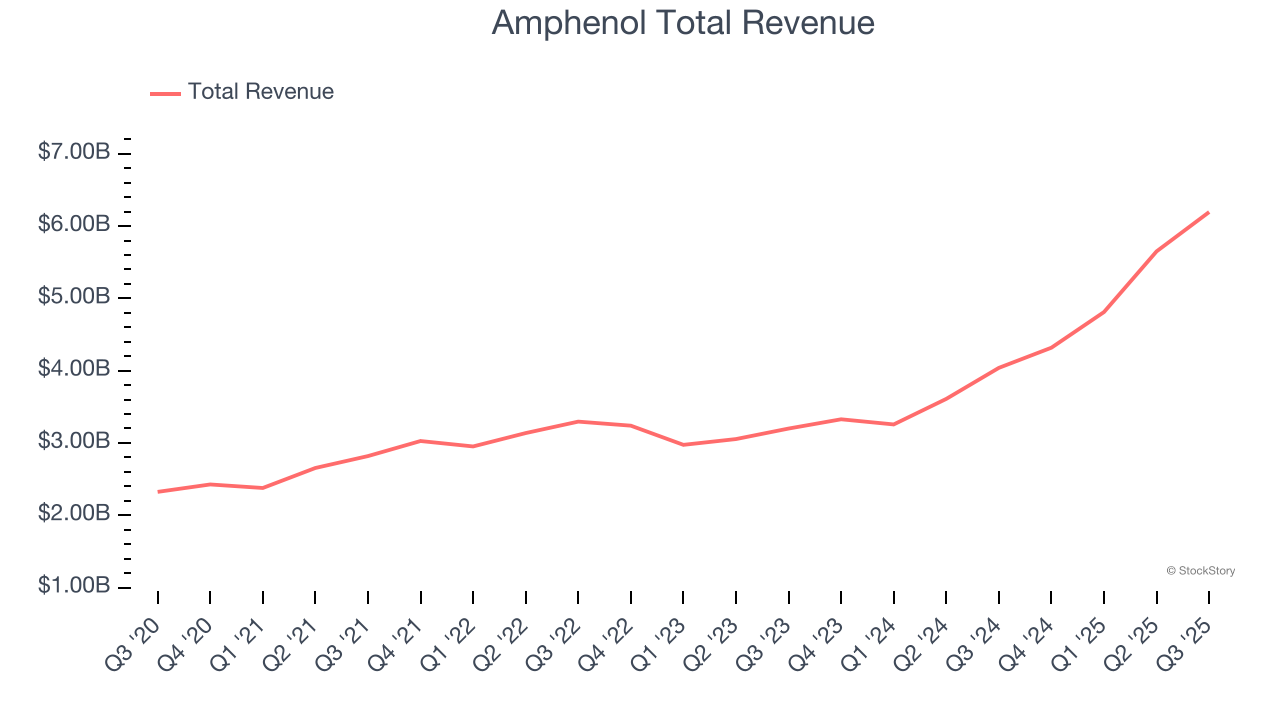

Best Q3: Amphenol (NYSE: APH)

With over 90 years of connecting the world's technologies, Amphenol (NYSE: APH) designs and manufactures connectors, cables, sensors, and interconnect systems that enable electrical and electronic connections across virtually every industry.

Amphenol reported revenues of $6.19 billion, up 53.4% year on year, outperforming analysts’ expectations by 10.9%. The business had an incredible quarter with a beat of analysts’ EPS estimates and a solid beat of analysts’ EPS guidance for next quarter estimates.

Amphenol scored the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 12.2% since reporting. It currently trades at $139.68.

Is now the time to buy Amphenol? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: CTS (NYSE: CTS)

With roots dating back to 1896 and a global manufacturing footprint, CTS (NYSE: CTS) designs and manufactures sensors, connectivity components, and actuators for aerospace, defense, industrial, medical, and transportation markets.

CTS reported revenues of $143 million, up 8% year on year, exceeding analysts’ expectations by 4.8%. It was a satisfactory quarter as it also posted an impressive beat of analysts’ revenue estimates but a significant miss of analysts’ EPS estimates.

The stock is flat since the results and currently trades at $42.50.

Read our full analysis of CTS’s results here.

Jabil (NYSE: JBL)

With manufacturing facilities spanning the globe from China to Mexico to the United States, Jabil (NYSE: JBL) provides electronics design, manufacturing, and supply chain solutions to companies across various industries, from healthcare to automotive to cloud computing.

Jabil reported revenues of $8.25 billion, up 18.5% year on year. This print beat analysts’ expectations by 9.5%. It was an exceptional quarter as it also logged a solid beat of analysts’ EPS guidance for next quarter estimates and an impressive beat of analysts’ revenue estimates.

Jabil had the weakest full-year guidance update among its peers. The stock is down 6.7% since reporting and currently trades at $210.16.

Read our full, actionable report on Jabil here, it’s free for active Edge members.

Rogers (NYSE: ROG)

With roots dating back to 1832, making it one of America's oldest continuously operating companies, Rogers (NYSE: ROG) designs and manufactures specialized engineered materials and components used in electric vehicles, telecommunications, renewable energy, and other high-performance applications.

Rogers reported revenues of $216 million, up 2.7% year on year. This number surpassed analysts’ expectations by 4.1%. Overall, it was a stunning quarter as it also put up a beat of analysts’ EPS estimates and an impressive beat of analysts’ EPS guidance for next quarter estimates.

The stock is up 1.1% since reporting and currently trades at $84.49.

Read our full, actionable report on Rogers here, it’s free for active Edge members.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.